Pakistani-American economist Atif Mian has recently analyzed Pakistan's economy in a series of tweets. He has said "Pakistan's economy is not in a good place", adding that the nation's "per capita income has not risen in 3 years (in fact down slightly)". He has particularly mentioned the country's "exaggerated external demand driven by its rentier economy", "flawed energy policy" and "a broken economic decision system" among the main causes for poor economic performance. Is Atif Mian's diagnosis correct? Is the official reported data Atif Mian using accurate? What is the current PTI government doing or not doing to correct the problems identified by Mr. Mian? Let's try and assess the situation.

|

| Economist Atif Mian's Tweet on Pakistan Economy |

Per Capita Income:

Pakistan's officially reported GDP and per capita incomes are grossly understated. These are based on the last economic census that was done from April 2003 to December 2003 and published in 2005. The last agriculture census was in 2010, and livestock census in 2006, according to Dr. Ishrat Husain, former governor of The State Bank of Pakistan. The country's economy has changed significantly since then, adding several new economic activities while others have become less important. For example, the Quantum Index of Large Scale Manufacturing (QIM) with 2005-06 base year gives a weight to textiles of 20.9% (Yarn 13.7 and cloth 7.2). But the textile industry has moved up to higher value added products as reflected in its exports. The value added textiles (non-yarn and non-cloth) now make almost 80% of the total textile exports. These changes are not reflected in current GDP calculations.

In its 2014 annual report, the State Bank of Pakistan talked about a number of new sectors that are either under-reported or not covered at all: "In terms of LSM growth, a number of sectors that are showing strong performance; (for example, fast moving consumer goods (FMCG) sector; plastic products; buses and trucks; and even textiles), are either under reported, or not even covered. The omission of such important sectors from official data coverage, probably explains the apparent disconnect between overall economic activity in the country and the hard numbers in LSM."

Bangladesh just rebased its GDP in 2020-21 to 2015-16. This has boosted its per capita income by double digits for every year since 2015-16. Bangladesh's per capita income for the 2015-16 fiscal year has now gone up to $1,737 from $1,465 in the old calculation. For the 2019-2020 fiscal, the per capita income has gone up to $2,335 from $2,024. The new GDP estimate covers 21 sectors, up from 15 sectors previously. India last rebased its GDP in 2015, a change that bumped up its per capita GDP by double digits. Nigeria's last rebasing in 2012 increased the size of its economy (GDP) by nearly 90%. Pakistan's current base year is 2005-6. Rebasing which is now long overdue will almost certainly increase Pakistan's per capita income by double digits.

In this age of big data, it is important for Pakistan to ensure that its bureaucracy at Pakistan Bureau of Statistics (PBS) keeps the national economic data as current as possible. PBS should release the results of the Census of Manufacturing Industries CMI 2015-16 and the finance ministry should rebase Pakistan's economy to year 2015-16 to better reflect the current economic realities. This data is extremely important for businesses, investors, lenders and policymakers.

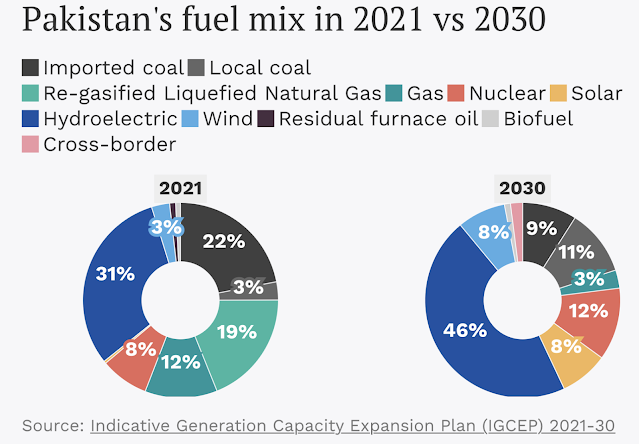

Energy Mix:

|

| Pakistan Power Generation Fuel Mix. Source: Third Pole |

Hydroelectric dams contributed 37,689 GWH of electricity or 27.6% of the total power generated, making hydropower the biggest contributor to power generated in the country. It is followed by coal (20%), LNG (19%) and nuclear (11.4%).

|

| Cost Per Unit of Electricity in Pakistan. Source: Arif Habib |

Nuclear offers the lowest cost of fuel for electricity (one rupee per KWH) while furnace oil is the most expensive (Rs. 22.2 per KWH).

|

| Pakistan Exports Trend 2011-21. Courtesy of Ali Khizer |

|

| Pakistan Textile Exports Trend 2011-21. Courtesy of Ali Khizer |

| |

|

|

| Pakistan's Current Account Balance vs International Oil Prices. Source: Arif Habib |

Recent history shows that Pakistan's current account deficits vary with international oil prices. Pakistan's trade deficits balloon with rising imported energy prices. One of the keys to managing external account balances lies in reducing the country's dependence on foreign oil and gas.

Related Links:

Haq's Musings

South Asia Investor Review

Pakistan Among World's Largest Food Producers

Food in Pakistan 2nd Cheapest in the World

Indian Economy Grew Just 0.2% Annually in Last Two Years

Pakistan to Become World's 6th Largest Cement Producer by 2030

Has Bangladesh Surged Past India and Pakistan in Per Capita Income?

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid19 Crisis

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Incomes of Poorest Pakistanis Growing Faster Than Their Richest Counterparts

Can Pakistan Effectively Respond to Coronavirus Outbreak?

How Grim is Pakistan's Social Sector Progress?

Double Digit Growth in Pakistan's Energy Consumption Confirms Economic Recovery

Trump Picks Muslim-American to Lead Vaccine Effort

COVID Lockdown Decimates India's Middle Class

Pakistan to be World's 7th Largest Consumer Market by 2030

Pakistan's Balance of Payments Crisis

How Has India Built Large Forex Reserves Despite Perennial Trade Deficits

Conspiracy Theories About Pakistan Elections"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

39 comments:

How can statistical data of GDP,be taken as base,when the informal GDP is 30-50% of the official GDP - and then be used,to make surmises,on Per capita ?

In such nations - per capita GDP,means nothing !

Here we need to calculate per capita expenditure,over time - and if it is rising,on certain components - it is a proxy to,per capita income.

If in 20 years,ECO-NO-MISTS say that the Per capita is the same (almost) - that is obviously bunkum - as oil and food costs,have risen by at least 2-300%,and so,incomes would have risen by 100% - as THEY ARE STILL ALIVE.

The problem is not statistics - it is the ECO-NO-MIST !

If Pakistan opens its doors to PRC Nuclear,Solar and Wind-On and Offshore,oil imports by Pakistan could be cut - drastically.

Such obvious facts are known to all - but geopolitics,has made it imperative - and that takes out the political risk,from this matrix - and that means that,the TUNNEL WILL BE FULL OF LIGHT !

EVEN PERSIAN HYDRO AND THERMAL POWER,FROM THE PERSIAN GRID,CAN CUT PAKISTAN OIL IMPORTS TO MIL.HERE AGAIN,ONCE PAKISTAN REALISES THAT, IT HAS NO FUTURE WITH THE US - THE PATH TO SALVATION WILL BE CLEAR ! REALISATION TAKES TIME !

JIYE JIYE PAKISTAN !

Atiaf sahab is right

Pakistan per capital and growth have remained stagrant due to

1- lack of investment, poor savings and lack of external flows due to its juck credit rating due to multiple near defaults/IMF loans due to poor external sector(CAD)

And

2- lack of revenue mobilization due to inabaility to effectively tax and document most of the economy due to political and technical reasons

I dont see any of the above changing especially since these are widely unpopular and a new populist govt in 2023 will roll back any reforms that were tried (& mostly failed in execution) by the current govt

This is why despite huge potential foreign investors stay away from countries like pakistan & nigeria and are heading to vietnam, india and bemgaldesh

They know that public support is with elite corruption and fixing this is unlikely

Tax collection and digitalization of economy must be the top priority of every government.

Government approved POS system has to installed in every big and small retailers and all shops in the malls.

Government must engage district government to introduce a system to monitor basic commodities prices.

New startup initiative by current government will slowly improve economy.

New improve and robust judicial system has to be introduced to resolve cases within a month instead of years and decades.

Government must work with tourists industry/local tourists organizations to sell tour packages (transportation, room and boarding and tour guide) to foreign tourists.

Pakistan introducing PR scheme will bring investment to Pakistan.

What are the benefit of digitalization?

It will make it easy to collect tax when the whole economy is digitalized.

If the whole economy become digitalized, it will be almost impossible to do the money laundering.

It will improve our business transactions and banking sector.

Pakistan should digitalize all land record to prevent land grabbers and Kabza mafia from taking over other land.

It will make it easy to do land reform when land records are digitalized.

Buying and selling of vehicles will be easy when the ownership record is digitalized.

Easy for government to hire if the background check process is digitalized.

If the Criminal record is digitalized then it will be easy to find criminals.

Gloom is a matter of spin/perception. I read his twitter thread and felt it was objective. What he wrote about the fundementals of our economy is correct.

The Pakistani economy can be seen as glass half full or glass half empty, it's a matter of perception. As mentioned by @RiazHaq there is loads of potential and the data is flawed too.

It's the responsbility of govt to correct data and to maximise potential.

A personal pet peave of mine is our energy policy. We are hugely wasteful in terms of energy use. We should be focused massively on renewable energy, it should be the backbone of our energy requirements and fossil fuels ought to supplement the shortfall. That is the energy policy we NEED to move to NOW.

The Mian is prophetic !

Pakistan is not in "AS GOOD A PLACE" as it should be,due to ECO-NO-MISTS !

Pakistan should NOT be a GOOD PLACE,for ECO-NO-MISTS !

The only Good place,for Pakistan ECO-NO-MISTS,is the IMF and World Bank

Economics is based on TRANSPARENT ACCOUNTING,and MACRO LEVEL thinking,and SIMPLISTIC inferences on MASS PSYCHOLOGY ! dindooohindoo

PAKISTAN HAS GREATLY SUFFERED,due to the hallucinations of Economists ! It is time to embrace,Islamic economics !

Country registered 14-year high GDP growth in 2021 despite COVID-19: Asad Umar

https://www.geo.tv/latest/394351-asad-umar-claims-record-economic-growth-despite-being-hit-by-covid-19

Last fiscal year, country’s economic growth rate recorded an all-time high in 14 years at 5.7%, minister says.

Says major industries also succeed in maintaining the growth rate at 15% which is more than average.

In last two weeks, Opposition came up with two failed narratives, PTI leader says.

FAISALABAD: Federal Minister for Planning, Development, and Special Initiatives Asad Umar claimed on Thursday that despite being hit by COVID-19, Pakistan’s economy witnessed record development under the leadership of Imran Khan, Geo News reported.

Coronavirus had badly affected the world’s economy, but last year, Pakistan’s economic growth shot up as compared to the last 14 years, he said.

Talking to journalists in Faisalabad, the PTI leader shed light on the economy and said that during the last fiscal year, the country’s economic growth rate was forecast at 3.4% but it recorded an all-time high in 14 years at 5.7%.

Coronavirus has battered the world’s economy, but under the leadership of Imran Khan Pakistan’s economy is progressing toward development, he added.

The federal minister further said that the last year, the growth of industries recorded a 15-year high, while major industries also succeed in maintaining the growth rate at 15% which is more than average.

Historic increases in the production of wheat were recorded while potato, tomato, onion, and natural gas and crude oil production also shot up.

Umar also lashed out at the Opposition, saying that in the last two weeks, it came up with two failed narratives.

"I pity for them (the Opposition) as the government vanquished them in National Assembly after passing bills with a majority," he said.

Pakistan Quantum Index of Manufacturing (QIM) rebased

https://www.brecorder.com/news/40148481

ISLAMABAD: The government has rebased Quantum Index of Large Scale Manufacturing Industries (LSMI) from 2005-06 to 2015-16 with increasing the total 112 items with cumulative weight of 70.3 percent for computation to 123 items having total weight of 78.4 percent, where, the Ministry of Industries and Production weight has been decreased from 49.556 percent in the QIM 2005-06 to 40.54 percent in QIM 2015-16.

The Pakistan Bureau of Statistics (PBS) has released a report on the rebasing of Quantum Index of Large Scale Manufacturing Industries (QIM) from 2005-06 to 2015-16, which stated that the weights presently used for the QIM were derived from the Census of Manufacturing Industries (CMI) 2005-2006. Total 112 items with cumulative weight of 70.3 percent are being used for computation of QIM.

The production data is collected from Oil Companies Advisory Council (OCAC), Ministry of Industries and Production (MOIP) and Provincial Bureaus of Statistics (BOS).

Moreover, to keep QIM more reliable, update and to overcome the challenges, the current QIM is rebased on the basis of results of CMI 2015-16. The rebased QIM has been computed with 123 items having total weight of 78.4 percent derived from the CMI 2015-16 with all existing data sources with addition of the PBS internal data source.

It further stated that new weights have been derived at two stages, the weight at industry level have been derived on the basis of gross value added (GVA) of Large Scale Manufacturing Industries (LSMI) at the basic prices.

The total GVA for the LSMI is taken as 100 and percentage contribution of each industry has been considered as the weight of that industry.

Arif Habib Limited

@ArifHabibLtd

The NAC, in its 104th meeting, reviewed the change of base of National Accounts from FY06 to FY16. With this revision, the final estimates of GDPg of FY21 came out to be 5.57%.

Full report

https://arifhabib.com/r/GDPg.pdf

Muzzammil Aslam

@MuzzammilAslam3

پاکستان کی تاریخ کی بلند ترین مشینری میں سرمایہ کاری 2021 . مسلم لیگ ن کے پہلے تین سال اور پی ٹی آئ کی پہلے تین سال سرمایہ کاری میں واضع فرق۰ الحمد اللہ!

Translated from Urdu by

Investment in the highest machinery in the history of Pakistan 2021. There is a clear difference between the first three years of PML-N and the first three years of PTI. Praise be to Allah!

https://twitter.com/MuzzammilAslam3/status/1485163856636911617?s=20

Riaz Haq

@haqsmusings

Replying to

@kaiserbengali

@Asad_Umar

is right! #Pakistan must grow its #exports to deal with its current account imbalances. Meanwhile, please note that Pakistan #textile exports are rapidly changing from yarn and cloth to higher value-added #garments. Also growing #tech #exports by double digits.

https://twitter.com/haqsmusings/status/1485278540568268801?s=20

Riaz Haq

@haqsmusings

#Pakistan PM #imrankhanPTI says #poverty has been reduced & #farmers #income are up 73%, while Pak #GDP rose by 5.37%. High global #energy & #food prices have fueled #inflation & bumped up Pak current account deficit to $20 billion. #economy #COVID19 https://dunyanews.tv/en/Pakistan/638009-I-consider-Shahbaz-Sharif-not-a-leader-of-opposition-but-a-national-crim

https://twitter.com/haqsmusings/status/1485358780766294018?s=20

ISLAMABAD (Dunya News) - Addressing the country during the Aap Ka Wazir-e-Azam - Ap Kay Saath programme on Sunday, the Prime Minister (PM) of Pakistan Imran Khan said that if he leaves the government, he will be more dangerous. If he come to the streets, his opponents will not find a way to escape. He added that it is said daily that a deal has been struck. The opposition say that they want to save the people. People of the country will not come out at their request. The government will complete its term and the next turn also belongs to it.

he does not consider President Pakistan Muslim League - Nawaz (PML-N) Shehbaz Sharif as leader of the opposition but as a national criminal.

He added that the inflation is a problem not only of Pakistan but of the whole world. Those who are asking for National Reconciliation Ordinance (NRO) make noise in Parliament, they do not let me speak. So I try to hold the sessions and interact with people of the country every month.

Prime Minister (PM) Imran Khan said that we have nothing to do with the robbers; I wanted to answer in front of people every month. In principle, questions should be answered in Parliament, but the opposition members make noise and do not allow me to speak. The Islamic welfare state is our manifesto. When it came to power, the country was on the verge of default.

PM Imran Khan said that the poverty has been reduced in during Pakistan Tehreek -e-Insaaf s (PTI) tenure. Farmers income increased by 73%, while the GDP increased by 5.37%.

Addressing the question on the culminating inflation, the premier said that inflation is not just a problem of Pakistan. Corona has hit the world economy hard. Unfortunately, we have a current account deficit of 20 billion.

With the depreciation of the Rupee, the things that are imported become more expensive. The country spent Rs 8 Billion on the people during Corona.

When the country s problems were solved, Corona came, which affected the salaried class the most. The world is in crisis because of Corona.

He further added that we will get rid of the problem of inflation very soon. I will collect Rs 8,000 Billion in taxes in Pakistan. Palm oil has become expensive all over the world.

PM Imran Khan said that the salaried class is in trouble, he will call the industrialists and ask them to increase the salaries of the salaried class, people have been given Rs 40 Billion to build houses. The government has removed the obstacles in the construction sector, 3 Million houses are being built. A record production of cotton, sugarcane, maize, rice and wheat has been done.

Earlier today, Prime Minister Imran Khan started receiving direct phone calls from general public during a programme "Aap Ka Wazir-e-Azam - Aap Kay Saath".

According to details, the Prime Minister was listening to the complaints and opinions of people and inform them about different initiatives taken by government.

People could contact with Prime Minister on telephone number 051-9224900.

Prime Minister Imran Khan has so far held four public sessions in which he responded to 86 questions asked by the public.

Out of the total 86 queries, 74 questions were asked through phone calls, while 12 queries were received on social media.

Public participation in the Aap Ka Wazir-e-Azam - Aap Kay Saath programme was categorized as Punjab 47 percent, Islamabad 15 percent, overseas 11 percent, Sindh and Khyber Pakhtunkhwa seven percent each, Azad Kashmir and Gilgit-Baltistan 2.4 percent each and Balochistan 2.8 percent.

While jumping 29 percent to $251 million in December, IT exports surged 36 percent to $1.3 billion in the first half of this fiscal year, mostly riding a massive stream of investment pouring into Pakistan’s technology sector, data showed on Saturday.

https://www.thenews.com.pk/print/927335-it-exports-surge-36pc-in-first-half-of-fy2022

Technology exports amounted to $667 million in the second quarter. Pakistan’s total IT exports stood at $1.44 billion in FY2020, which increased to $2.1 billion in FY2021.

According to Khurram Schehzad, CEO of Alpha Beta Core, this growth will gather more momentum down the line.

“Increased investment in the startup ecosystem is helping Pakistan develop technology infrastructure, which will in turn increase IT exports growth,” Schehzad said.

However, the recent increase in foreign investments in Pakistan, especially in tech based startups doesn’t reflect in the IT exports.

But Schehzad says it has been helping develop technology infrastructure and increase job opportunities in tech-based companies, which will eventually help increase IT exports further.

“I see IT exports recording a historic high of $2.8 billion to $3 billion in the fiscal year 2022,” an IT sector analyst said.

“But it depends on if the government is willing to incentivise the sector.”

He said the government also needed to establish tech zones to help the sector grow more.

He said around 15,000 IT companies were being established and hiring fresh employees, adding, expansion of the technology sector would subsequently fuel IT exports growth.

Wajid Rizvi, Head of Strategy and Economy at JS Global, expects IT exports to grow to $2.6 billion by the end of FY2022.

“The market-based exchange rate and devaluation of rupee has also enhanced the potential of technology sector exports as the companies/individuals associated with the sector receive their payments mostly in dollars,” Rizvi said.

He added that Pakistan was a net exporter of IT services and the sector had a great potential to grow, evident from a rising trend of software and other IT exports.

@haqsmusings

·

13h

Unfortunately,

@AtifRMian

only sees #Pakistan’s glass half empty. He refuses to even acknowledge the country’s progress on growing #export & change in #energy mix to lower imports.He ignores transitory high #energy prices causing current account deficits. https://southasiainvestor.com/2022/01/pakistan-economy-not-in-good-place-atif.html

Omer Zeshan Khan

@OmerZeshanKhan

·

8h

Export growth is low end and for limited time (a bonus). Previous Govt did a few things for localisation (car/mobile/edible oil). Haven’t seen these guys doing anything. They are just sitting and talking. Pakistan’s economy is robust enough to feed people while Govt waits.

Omer Zeshan Khan

@OmerZeshanKhan

·

·

Riaz Haq

@haqsmusings

·

3h

#ImranKhan’s #NayaPakistan housing program is a good idea, especially the incentives for small & medium mortgages for the lower middle class. It’s boosting #employment in #Construction & #manufacturing sectors as well as the housing stock http://riazhaq.com/2020/07/naya-pakistan-low-cost-home-loans-and.html

Omer Zeshan Khan

@OmerZeshanKhan

·

2h

Can you name one project under Naya Pakistan Housing?

Riaz Haq

@haqsmusings

Replying to

@OmerZeshanKhan

@Muslims4USA

and

@AtifRMian

#Housing #Mortgage financing in #Pakistan jumped 85% last year, according to the State Bank. “Financing under MPMG picked up momentum in 2021 as approvals for financing by banks grew from near zero to Rs117 billion in 2021”

https://twitter.com/haqsmusings/status/1488166329769070596?s=20&t=6qD3vPwWBkwSxAhRdxw3Tg

https://www.thenews.com.pk/amp/923033-banks-disburse-rs355bln-housing-loans-in-2021

KARACHI: Credit to the housing and construction sector increased by record Rs163 billion or 85 percent in 2021, mainly driven by the central bank’s rules to encourage mortgages and incentives and penalties for lenders with respect to achieving or failing housing finance targets.

Banks disbursed Rs355 billion housing loans in 2021, compared with Rs192 billion in the previous year, the State Bank of Pakistan said in a statement on Thursday.

Disbursement of low-cost housing loans under the Government Markup Subsidy scheme, also known as Mera Pakistan Mera Ghar (MPMG), reached Rs38 billion last year. In December, banks extended Rs9.3 billion loans to the borrowers; highest monthly disbursement since January 2021.

Analysts said tighter monetary conditions usually affect mortgages as the SBP has jacked up interest rates by 275 basis points in three moves since September. Currently, the policy rate hovers at 9.75 percent.

However, the government’s mark-up subsidy scheme looks to remain protected from an upward move in interest rates as the government is providing subsidy to the mortgage clients for the first 10 years.

Habib Bank, Meezan Bank and Bank Al Habib were the top three contributors, said the SBP.

Banks also made significant progress in the provision of financing under MPMG scheme, introduced in 2020, it added.

“Financing under MPMG picked up momentum in 2021 as approvals for financing by banks grew from near zero to Rs117 billion in 2021. The banks have received requests of financing of Rs276 billion from potential customers, which indicates that approvals and disbursements will keep growing in coming months.”

Bank Alfalah emerged as the leading bank with highest disbursement of Rs3.3 billion followed by nine banks with disbursements of over Rs2 billion each. These include Meezan Bank, Bank Islami, National Bank, Standard Chartered Bank, HBFCL, United Bank, MCB Bank, Bank of Punjab and Habib Bank, said the statement.

Financing for housing and construction and particularly under MPMG witnessed impressive growth on the back of many enabling regulatory environments introduced after extensive consultation with stakeholders, the SBP noted.

Further, the SBP said it advised the banks to increase their housing and construction finance portfolios to at least 5 percent of their domestic private sector advances till December 2021, introducing a set of incentives and penalties to ensure compliance.

Arif Habib Limited

@ArifHabibLtd

Oil marketing industry sales surged by 18.9% YoY during Jan’22 to 1.80mn tons (7MFY22: 12.91mn tons, +14.5% YoY).

https://twitter.com/ArifHabibLtd/status/1488511560565854222?s=20&t=ifmoAqCf2BMw2onQ92fGFg

-------------

https://tribune.com.pk/story/2341510/oil-sales-surge-20-to-18m-tons-in-january-2022

KARACHI:

The demand for petroleum oil products remained robust despite the uptrend in prices, as wheat harvesting, power generation through oil-fired plants and building of domestic reserves in anticipation of a further hike in international prices generated strong demand in January.

Besides, healthy industrial activities and growing car numbers on roads also contributed to the rising momentum in sales of petroleum products. Overall oil sales surged almost 20% to 1.8 million tons in January 2022 compared to 1.51 million tons in the previous month of December 2021, Arif Habib Limited (AHL) reported on Tuesday. “(High-speed) diesel had a major increase in demand among petroleum products in the wake of wheat harvesting in the country,” AHL Head of Research Tahir Abbas said while talking to The Express Tribune.

Secondly, three major power plants, located in Punjab, ran on diesel due to the widening gas shortfall during winter months. Besides, some other plants ran on furnace oil and its demand picked up as well. Thirdly, oil marketing companies (OMCs) and their dealers (petrol pumps) built inventories during the month in anticipation of a hike in prices of petroleum products in the global as well as domestic markets.

The building of reserves was aimed at making additional profits on likely increase in prices in the domestic market with effect from February 1, 2022. The government, however, decided to keep oil prices unchanged, which “had earlier been expected to increase by Rs12-15 per litre,” he said. The demand for petrol also remained robust in the backdrop of a significant growth in sales of cars and SUVs.

Car sales slowed down, but still remained significant despite the fact that the government took measures to cut imports of luxury cars and restricted bank financing for cars to control the current account deficit (CAD). Sales of diesel increased 20% to 0.74 million tons in January compared to 0.62 million tons in December.

Sales of petrol rose 6.2% to 0.74 million tons in the month under review compared to 0.70 million tons in the previous month. Sales of furnace oil surged 103% to 0.26 million tons in January compared to 0.13 million tons in December 2021. Cumulatively, in the first seven months (July-January) of the current fiscal year 2021- 22, oil sales increased 14.5% to 12.91 million tons compared to 11.27 million tons in the same period of previous year. The growth in demand is mostly seasonal given that wheat harvesting takes place

#Pakistan to end reliance on #IMF by boosting #exports, cutting #deficits & tapping #capital markets. #Textile exports are poised to surge 40% to a record $21 billion this year & further to $26 billion next year. Pak also incentivizing #tech exports boom.

https://www.bloomberg.com/news/articles/2022-02-02/pakistan-seeks-to-end-50-years-of-imf-debt-with-esg-bond-trade

Pakistan, which has sought almost 20 bailouts from the International Monetary Fund over half a century, wants to end its reliance on the multilateral lender by shrinking its deficits and tapping the capital markets.

Finance Minister Shaukat Tarin, who has negotiated the last leg of a current $6 billion IMF loan, plans to raise $1 billion via an ESG-compliant Eurobond in March after issuing a similar amount of Sukuk last week. He also targets to shrink the budget shortfall to 5%-5.25% of gross domestic product in the year starting July 1 from 6.1% the previous period and spur growth to 6% from 5%.

“I think this program should be enough,” Tarin, 68, said in an interview in Islamabad. “If we start generating 5%-6% balanced growth, which means sustainable growth, then I don’t think we need another IMF program.”

Prime Minister Imran Khan has been a vocal critic of IMF bailouts, saying “the begging bowl needed to be broken” if Pakistan must command respect in the world. He joins nations, including South Asian peer Sri Lanka, that prefer to maneuver with bilateral loans or commercial borrowings rather than adopt the austerity that accompanies an IMF agreement.

The first part of Tarin’s plan to halt Pakistan’s boom-bust cycle involves boosting exports. The central bank offered cheap loans to manufacturers and energy tariffs were brought in line with the region. Textile shipments -- more than half of total exports -- are poised to surge 40% to a record $21 billion in the year through June and further to $26 billion next year, according to Khan’s commerce adviser.

Pakistan also plans to extend similar incentives to the technology sector as it seeks to ride a wave of global venture-capital interest in startups. The policies could be unveiled in about a month, Tarin said.

Tarin was appointed in April 2021 and has since renegotiated some of the IMF’s financial conditions, including a smaller increase in utility prices and lower mop up in taxes than the lender had earlier insisted on.

He has adopted some of the structural conditions, which include increasing autonomy for the central bank and putting an end to deficit monetization. Like predecessors, he hasn’t been able to significantly broaden Pakistan’s tax base or sell loss-making state-run firms.

Previous governments accepted IMF conditions in the short term and, when the program ends, policy makers revert to profligate spending, Tarin said. Instead, he vowed to “control our expenses” in the upcoming budget.

“We are trying to now take those steps, which are going to put this economy on an inclusive and sustainable growth path,” said Tarin. “Once it gathers momentum and is sustainable, then I think we will probably see 20-30 years of growth.”

A British investor group CDC & Gul Ahmed Metro (GAM) group JV to add 500MW of #renewable power in #Pakistan with significant minority stake in Metro #Wind Power. CDC and GAM are also co-investors in Zephyr Power Limited, an operating 50MW #windfarm. https://www.cdcgroup.com/en/news-insight/news/were-partnering-with-gul-ahmed-metro-group-to-scale-renewable-power-in-pakistan/

The Metro-BII Renewables joint venture aims to add 500 megawatts (MW) low-cost renewable power to Pakistan in the medium term, increasing jobs and expanding economic opportunities

The joint venture will mitigate Pakistan’s carbon emissions, cutting 728,000 tonnes of carbon dioxide per year for the planet

Investment aligns with CDC’s ambition to invest over £3 billion of climate finance over the next five years

CDC Group (soon to become British International Investment – BII) and Gul Ahmed Metro Group (GAM), are today announcing their partnership to form the Metro-BII Renewables joint venture. The new joint venture builds on the existing partnership between the UK’s development finance institution and GAM, a Pakistani family-owned business with expertise in Pakistan’s power sector, and it will aim to develop and operate up to 500MW of renewable energy assets in Pakistan.

Metro-BII Renewables aims to add up to 500 Megawatts (MW) of primarily greenfield low-cost renewable power to Pakistan’s grid over the medium term, and has a current generation capacity of 110MW. The JV will boost clean power generation, providing electricity to over 850, 000 consumers in Pakistan. Moreover, up to 17,000 jobs will be supported across the country, as a result of the increased power capacity. In addition, Metro-BII Renewables will help the country decarbonise as the joint venture’s target capacity size will help avoid an estimated 728, 000 tonnes of carbon dioxide per year, for the planet.

This new joint venture will strengthen collaboration between CDC, which will be renamed British International Investment (BII) in April, and GAM and foster knowledge sharing from both firms’ experience within the local and regional power sector.

Under the terms of the joint venture, CDC will acquire a significant minority stake in Metro Wind Power Limited (MWPL), an under-construction 60MW windfarm project, developed by GAM, the acquisition remains subject to lender and regulatory approval. CDC and GAM are also co-investors in Zephyr Power Limited, an operating 50MW windfarm.

CDC’s capital will provide much-needed equity finance that will support the development of a clean energy platform that is bespoke to Pakistan’s needs, helping to scale power capacity in the country. The deepened partnership will help accelerate greater investments into the renewable power sector in Pakistan. This partnership further underlines CDC’s focus on the renewable sector in Pakistan, where CDC has made over US $160 million in equity and debt investments, over the past five years.

#CPEC II: #Pakistan, #China ink industrial cooperation agreement in #Beijing. It will increase labor #productivity, enhance #industrial competitiveness, grow exports, sustain diversification in #exports basket. #economy #Beijing2022

https://www.app.com.pk/global/pakistan-china-ink-framework-agreement-on-industrial-cooperation-under-cpec/ via @appcsocialmedia

ISLAMABAD/BEIJING (China), Feb 4 (APP): Pakistan and China on Friday inked the Framework Agreement on Industrial Cooperation under China Pakistan Economic Corridor (CPEC).

The prime minister arrived in Beijing on Thursday to attend the opening ceremony of Winter Olympics and meet the Chinese leadership.

State Minister and Chairman BoI Muhammad Azfar Ahsan and Chairman National Development & Reform Commission (NRDC) He Lifeng signed the accord.

The objective of the Joint Working Group (JWG) on Industrial Cooperation is to attract Foreign Direct Investment (FDI), promote industrialization and development of economic zones, and initiate, plan, execute, and monitor projects, both in public as well as private sector.

The engagement with China under JWG is envisaged to increase labour productivity in Pakistan, enhance industrial competitiveness, increase exports, and sustain diversification in exports basket.

During the 8th Joint Cooperation Committee (JCC) meeting of CPEC held in 2018, both sides had signed a Memorandum of Understanding that formed the basis for future engagements between the parties under the ambit of Industrial Cooperation.

As CPEC entered its second phase which primarily revolves around Special Economic Zones (SEZs) development and industrialization, the need for a comprehensive Framework Agreement became imperative.

Similar agreements have also been signed for Early Harvest CPEC Projects on energy and infrastructure.

With continuous efforts of BOI, both sides reached the consensus to elevate the existing MoU into a Framework Agreement in 2020.

After extensive stakeholder consultations and with the approval of the Prime Minister, BOI shared the Draft Framework with NDRC in November 2020, which has been formulated keeping in consideration the needs of CPEC Phase II.

The signing ceremony of the framework agreement is a significant outcome of the prime minister’s visit and a top agenda from the Chinese side as a testimony to their interest in CPEC.

Narratives Magazine

@NarrativesM

Veteran economist Dr. #SalmanShah challenges the perceptions that #PakistanEconomy has gone from bad to worse under the #PTIGovt, arguing that after many tough decisions, it is now on the road to recovery. #NarrativesMagazine

https://twitter.com/NarrativesM/status/1490710786204999688?s=20&t=BwFyKByaqAcuhcHFNQjiCw

On the Road to Recovery

Dr. Salman Shah

https://narratives.com.pk/thinktank/on-the-road-to-recovery/

For the record, it is instructive to note that within a few months after the ending of the last programme in September 2016, the IMF was sounding the alarm bells and cautioning the government to take actions to stop the rapid deterioration in critical economic indicators. These warnings were clearly reflected in the July 2017, Article IV, IMF consultation report that inter-alia included the following critical observations:

Exhorted the PML-N government to safeguard the macroeconomic gains of the completed programme through continued implementation of sound policies, and to continue with structural reforms to achieve higher and more inclusive growth.

Warned that foreign exchange reserves have declined since the end of the EFF-supported programme and remain below comfortable levels.

Cautioned that on the structural front, progress in electricity sector reforms has been mixed, with a renewed build-up in circular debt.

Pointed out that massive financial losses of ailing public sector enterprises (PSEs) have continued.

------------------

The banking sector under the leadership of the State Bank of Pakistan is opening up inclusive financing in new areas such as mortgage finance, agriculture finance and SME finance. The State Bank of Pakistan’s Roshan Digital Accounts are facilitating investment by overseas Pakistanis in a big way. The FDI is expected to jump manifold due to launch of phase-II of the CPEC; Chinese corporate sector investment is expected to boom. The board of Investment has been tasked to populate SEZs at a rapid pace. All impediments in the way of the FDI are being proactively reduced.

By the grace of God, Pakistan is now on the road to recovery and growth. The issuance of a global Sukuk Bonds within days of the revival of the IMF programme was well received in the international markets. Heavily oversubscribed, it is already trading at a premium. This indicates the confidence of the international financial markets in the emerging story of Pakistan; its potential and the commitment of its leadership to reform. Barring another black swan event or further escalation of global oil prices, Pakistan’s best days are here to stay. The beginnings of the long-awaited investment surge is taking shape, the stock market is poised to see the return of the foreign portfolio investor, successful completion of a few large ticket privatization transactions will catalyze direct foreign investment towards new highs. For the first time in 40 years we are enjoying relative peace on the borders and peace within. If we are able to persistently build on this momentum, the sixth largest and most youthful country in the world can rapidly progress on the road of development, lift its masses out of poverty and enable it to join the ranks of the prosperous.

At just 30%, #Pakistan has among world's lowest #trade-to-#GDP ratios, leaving lots of room for growth. Most of its export are textiles Pak #exports are relatively more diversified compared to #Bangladesh and #Cambodia, but less diversified than #India's https://www.adb.org/sites/default/files/publication/768386/pakistan-economy-trade-global-value-chains.pdf

https://twitter.com/haqsmusings/status/1493052397496594432?s=20&t=4tOefQ2CRak0Efy2TL9rGA

https://www.dawn.com/news/1674830

Pakistan exhibits one of the lowest trade-to-GDP ratios in the world showing at just 30 per cent. However, it is not all doom and gloom and the country has a lot of room for improvement, according to the Asian Development Bank (ADB).

One viable strategy that Pakistan can adopt to boost its growth is to further open its economy to trade. At just 30pc, Pakistan exhibits one of the lowest trade-to-GDP ratios in the world, even when taking its size into account, the ADB says in its report titled ‘Pakistan’s Economy and Trade in the Age of Global Value Chains’.

This indicates great potential for improvement. Studies have affirmed numerous benefits to economic openness, including opportunities for specialisation, access to wider markets, the inflow of know-how, and the formalisation of the economy.

Existing patterns indicate that Pakistan’s trade is currently oriented to the United States, Europe, and China. It specialises in textiles, though some of its agricultural products are sold to the Middle East. Interestingly, it does not have a significant trading relationship with its proximate neighbours in South Asia. The only economy for which it is a major market is its northern neighbour Afghanistan, the report points out.

While the vast majority of its export products fall under the textiles grouping, formal measures of export concentration suggest that Pakistan’s exports basket is relatively more diversified, especially compared with other major textile exporters like Bangladesh and Cambodia. However, its exports are less diversified than India.

The report used statistics from 2019 since 2020 was an unusual year [owing to Covid-19] portraying a snapshot of economic openness across various levels of GDP for 166 countries and economies with available data, and for economic openness of Pakistan, it says it is less open than India and Bangladesh. It is only more open than Ethiopia, Brazil and Sudan.

The ADB says Pakistan is a relatively large country, however its trade openness remains remarkably low. Citing example, it says countries that have GDPs comparable to that of Pakistan but with much higher trade-to-GDP include the Philippines, the Netherlands, and Viet Nam. India’s GDP is almost 10 times larger than Pakistan’s, yet trade plays a greater role in its economy, according to the report.

Pakistan has historically experienced uneven growth and remains among the least open economies in the world, even after taking its relatively large size into account.

What it does export is dominated by textile products and rice, though a formal measure of concentration suggests that its exports basket is on the whole quite diversified.

The dominance of textile products in Pakistan’s exports raises the issue of diversification — or potentially the lack of it. Concentrating too much on only a few sectors or products poses risks to an economy since shocks to the dominant sector can more easily cause an economy-wide recession.

Pakistan can adopt to boost its growth to further open its economy to trade. Benefits to economic openness include opportunities for specialisation, access to wider markets, and the inflow of investments, technology, and know-how. There is also evidence that trade promotes the reallocation of labour from the informal to the formal sector.

In a major development for the power sector, the Senate passed on Thursday the Weighted Average Cost of Gas (WACOG) bill.

The development was announced by Federal Minister for Energy Hammad Azhar who said the bill is a "historic reform", which will ensure Pakistan’s energy security.

“WACOG bill has been passed today by Senate as well. It is a historic and long-pending reform that will ensure the energy security of Pakistan,” said Azhar in a tweet.

https://www.brecorder.com/news/40155128

The federal minister was of the view that the development would allow the government to embark upon the reform of the “gas pricing structure, remove anomalies and enhance supplies of imported gas”.

Azhar said that the reform is as significant as the approval a couple of months ago of Indicative Generation Capacity Expansion Plan (IGCEP) model for power purchase.

“Both historic reforms in power and petroleum sector have been carried out by PTI govt in the last six months,” he added.

What is the PPP of Pakistan?

The economy of Pakistan is the 18th largest in terms of purchasing power parity (PPP), and 43rd largest in terms of nominal gross domestic product.

...

Economy of Pakistan.

Statistics

Population 207.68 million (5th) (2017 national census)

GDP $347 billion (nominal; 2021). $1.5 trillion (PPP; Jun 2021)

Pakistan creating #export miracles under #imrankhanPTI. #Pakistan`s monthly exports soared by 51.23% in Feb 2022 compared to February 2021. Pakistan`s #exports witnessed an increase of 32.77% during the first 8 months of the current fiscal year from the same period last year.

http://en.ce.cn/Insight/202203/19/t20220319_37417208.shtml

Editor's note: Cheng Xizhong, Visiting Professor at Southwest University of Political Science and Law,Special Commentator of China Economic Net, former Defense Attache in South Asian countries. The article reflects the author's opinions and not necessarily the views of Gwadar Pro.

Pakistani Prime Minister Imran Khan's series of policies to encourage exports are now producing great achievements. Over the past year, despite the severe pandemic and the downturn of the world economy, Pakistan's exports of various commodities and services have increased significantly, which reflects the wise and correct decision-making of the Imran Khan administration.

According to the latest report of the Pakistan Bureau of Statistics (PBS), Pakistan`s exports witnessed an increase of 32.77% during the first eight months of the current fiscal year as compared to the corresponding period of the last fiscal year.

Among various export commodities and services, textile exports rose sharply by 26.08% during the first eight months of the current fiscal year as compared to the corresponding period of the last fiscal year. The exports of information technology (IT) services shot up by 32.63% during the first seven months of the current fiscal year as compared to the corresponding period of the last fiscal year, earning $1,486.89 million.

It was another miracle that last month, Pakistan`s exports soared by 51.23% as compared to February 2021.

In my point of view, in addition to the export stimulus policies, these amazing achievements are closely related to the Imran Khan administration's correct macroscopic equilibrium between pandemic prevention and control and economic development, export-oriented industry development, and continuous successful expansion of China-Pakistan Economic Corridor (CPEC) and Special Economic Zones (SEZs).

I have noted that in terms of specific measures, the Pakistani government has launched drastic reforms with the Asaan Karobar Programme as a historic and nationwide reform drive to improve the ease of doing business in Pakistan. In recent years, three rounds of reforms have been successively introduced. Around 167 reform measures have been taken up with federal and provincial departments, of which 115 reform measures have already been implemented involving 75 departments, benefitting more than 30 business sectors.

In order to constantly improve the business environment for expanding imports, the Pakistani Ministry of Commerce launched an online portal aimed at identifying and then removing regulatory obstacles and problems through active involvement of private sectors and business associations. The State Bank of Pakistan, Securities and Exchange Commission of Pakistan, and Federal Board of Revenue all coordinated their efforts in ensuring a business-friendly environment in the country.

I believe that the sustained and substantial increase in exports will enhance Pakistan's financial capacity for further promoting industrialization and modernization and improving people's livelihood.

Arif Habib Limited

@ArifHabibLtd

Cost of Power Generation down by 26.9% MoM during Feb’22

Feb’22: PKR 8.94/KWh, +89.6% YoY | -26.9% MoM

8MFY22: PKR 7.79/KWh, +77.7% YoY

https://twitter.com/ArifHabibLtd/status/1505560053415219206?s=20&t=ZjuzMeRqtMxJ5u0DZQbobA

#China, #Pakistan agree to enhance pragmatic ties in #agriculture, #economy and #trade, #finance and information #technology. Joint statement by #Chinese FM Wang Yi & Pak FM Shah Mahmood Qureshi in #Islamabad. #OICInPakistan #OIC #CPEC https://www.devdiscourse.com/article/international/1972202-china-pakistan-agree-to-enhance-pragmatic-ties-in-agriculture-economy-trade

During the meeting ahead of the Organization of Islamic Cooperation (OIC) on Tuesday, Wang said that China is willing to work with Pakistan to further synergize their development strategies, conduct systematic exchanges on governance experience and improve long-term cooperation plans. Noting that the Pakistan-China relations are at their best in history, Qureshi described that Pakistani Prime Minister Imran Khan's recent visit to China was very successful, and the leaders of the two countries have reached a large number of important consensus, Xinhua News Agency reported.

The Pakistan-China friendship is the cornerstone of Pakistan's foreign policy, he said, adding that as all-weather strategic partners, Pakistan and China have stood together through thick and thin, helped and supported each other, as well as stood firmly together at critical moments. The Pakistani side stands ready to work with China to implement the consensus reached between the leaders of the two countries, and expand practical cooperation in various fields including agriculture, economy and trade, finance and information technology, Qureshi said while calling for increased investment from China to help push Pakistan's industrialization process, Chinese news agency said.

It further reported that Wang said that the Pakistan-China All-Weather Strategic Cooperative Partnership is unique and time-tested, and the two countries have become good neighbours, good friends, good partners and good brothers who trust each other. The traditional friendship between China and Pakistan is rock-solid, which is a precious treasure for both sides, he added. China hopes that Pakistan will get more deeply involved in China's new development landscape with a further convergence of interests, Wang said.

China is willing to expand imports from Pakistan and support Chinese enterprises in investing in Pakistan, so as to help Pakistan enhance its capacity of independent development. Qureshi welcomed Wang who had come over to attend the 48th session of the Council of Foreign Ministers of the Organization of Islamic Cooperation (OIC), saying that the first time participation by a Chinese foreign minister in the meeting is of historical significance, which shows China's support for Pakistan and that China attaches great importance to Islamic countries.

As an OIC founding member, Pakistan is willing to push the OIC to deepen its friendly ties with China, he said, according to Xinhua News Agency. Wang arrived in the Pakistani capital on Monday to attend the 48th session of the Council of Foreign Ministers of the Organization of Islamic Cooperation. (ANI)

Federal Minister for Industries and Production Makhdum Khusro Bakhtyar said LSM growth grew by 8.2 percent in February 2022, mean while, it posted growth of 7.6 percent during July-Jan FY22. He added that all major industries including automobile and fertilizer industry had showed remarkable growth in this duration, said a statement issued here on Saturday.

https://dailytimes.com.pk/904514/lsm-growth-up-8-2pc-in-feb-2022-khusro/

The Minister noted that growth of LSM is imperative to enhance manufacturing base and job creation in the country.

He said recently Prime Minister of Pakistan Imran Khan announced Industrial Promotion Package which would not only revitalize industrialization in the country but also enhance our manufacturing sector. According to PBS data reported on Friday, the industry output increased by 8.2 percent during the month of January 2022 compared to the growth of January 2021 on year on year basis.

The major sectors that showed positive growth during July-January (2021-22) included textile (2.9pc), food (3.4pc), beverages (2.5pc), tobacco (21.9pc), wearing apparel (18.3pc), leather products (4.5pc), wood products (172.2pc), paper and board (8.2pc), coke and petroleum products (0.5pc), chemicals (5.4), Chemical products (15.5pc), automobiles (63.5pc), iron and steel products (17.52pc), furniture (553.pc),automobiles (63.5pc) and other manufacturing (22.2pc).

---------

LSM growth jumps 7.6 pc in 7 months

https://www.app.com.pk/business/lsm-growth-jumps-7-6-pc-in-7-months/

ISLAMABAD, Mar 18 (APP): Large Scale Manufacturing Industries (LSMI) production grew by 7.6 percent during the first seven months of the current fiscal year as compared to the corresponding period of last year, Pakistan Bureau of Statistics (PBS) reported Friday.

The LSMI Quantum Index Number (QIM) was recorded at 120 points during July-January (2021-22) against 111.5 points during July-January (2020-21), showing growth of 7.6 percent, according to latest PBS data.

The highest increase of 9.7 percent was witnessed in the indices monitored by the Provincial Board of Statistics (BOS), followed by 6.9 percent increase in indices monitored by Ministry of Industries and 0.5 percent increase in the products monitored by the Oil Companies Advisory Committee (OCAC).

On year-on-year basis (YoY), the industry rose by 8.2 percent during the month of January 2022 compared to the growth of January 2021, according to PBS latest data.

The major sectors that showed positive growth during July-January (2021-22) included textile (2.9%), food (3.4%), beverages (2.5%), tobacco (21.9%), wearing apparel (18.3%), leather products (4.5%), wood products (172.2%), paper and board (8.2%), coke and petroleum products (0.5%), chemicals (5.4), Chemical products (15.5%), automobiles (63.5%), iron and steel products (17.52%), furniture (553.%),automobiles (63.5%) and other manufacturing (22.2%).

The commodities that witnessed negative growth included pharmaceuticals (3.5%), rubber products (25.5%) and electrical equipment (1.2%).

It is pertinent to mention here that the provisional QIM is being computed on the basis of the latest production data received from sources, including OCAC, Ministry of Industries and Production (MoIP), and PBS.

Pakistan’s Political Crisis Has Been an Energy Crisis, Too

Successive governments have failed to back renewables, cutting the country off from the cheapest source of indigenous energy. The new prime minister could change all that.

https://www.bloomberg.com/opinion/articles/2022-04-17/pakistan-s-political-crisis-is-an-energy-crisis-too-wind-solar-would-help

The political crisis that pitched Pakistan’s prime minister Imran Khan from office wasn’t just about the failure of his anti-corruption agenda and mismanagement of an economy where inflation running at nearly 13% has driven months of opposition protests. It’s also, as with so many of Pakistan’s political crises, about energy and exchange rates.

For decades, heavy dependence on imported energy has constrained growth. To break out of its chronic pattern of stagnation, Pakistan needs more power for its industrial, household and transport sectors. Whenever that has happened in the past, however, a rising bill for imported fossil fuels has prompted one of its periodic balance-of-payments crises. The International Monetary Fund bailout that’s widely expected within months would be Pakistan’s 19th since the early 1970s.

Soaring prices of liquefied natural gas (LNG) and coal on the international markets have left Pakistan, the world’s fifth-most populous nation, with having to cut electricity supply to households and industry as the country in a deep political and economic crisis cannot afford to buy more of the expensive fossil fuels.

https://oilprice.com/Latest-Energy-News/World-News/High-Energy-Prices-Lead-To-Power-Cuts-In-Pakistan.html

Pakistan—whose population is the fifth largest in the world after China, India, the United States, and Indonesia—started to feel the pinch of high energy prices as early as last autumn, when it was struggling to procure imported LNG for its power plants. Pakistan’s predicament came amid a global natural gas crunch and surging prices for the fuel in Europe and Asia, months before prices shot up again as a consequence of the Russian invasion of Ukraine.

As global energy prices remain elevated and highly volatile with the Russian war in Ukraine, Pakistan—dependent on imports with relatively poor state finances—is especially hard hit.

The energy crisis, and the political crisis with last week’s ousting of Imran Khan as prime minister of the country, which has nuclear weapons, have combined to throw the Pakistani state budget and finances into disarray.

Now Pakistan cannot afford to buy more LNG and coal, on which its power plants rely to generate electricity, Bloomberg reported on Monday.

In the middle of last week, on April 13, a total of 7,140 megawatts (MW) capacity plants were shut either due to fuel shortage or technical faults, Miftah Ismail tweeted. Ismail has been picked to serve as a finance minister by new Prime Minister-designate Shehbaz Sharif.

According to Bilal Kayani, Assistant Secretary General at the Pakistani party PMLN, foreign exchange reserves at the State Bank of Pakistan (SBP) amounted to just $10.8 billion on 8 April, a day before Imran Khan was ousted through the vote of no confidence. That’s less than 2 months of import cover. Reserves declined rapidly by $5.4 billion in just 5 weeks, Kayani said.

Pakistan: Experts stress shifting to coal for energy needs

https://tribune.com.pk/story/2353970/experts-stress-shifting-to-coal-for-energy-needs

Power sector experts have emphasised upon Pakistan to push harder for utilisation of lignite - an economical alternative to imported furnace oil and RLNG (re-gasified liquefied natural gas) - as it is crucial for the country’s ambition to achieve higher economic growth through industrialisation.

Besides industrialisation, provision of electricity to domestic consumers by using local coal reserves could serve the purpose of generating cheap electricity and curbing the ever increasing circular debt in the power sector, they added. They were of the view that the incumbent coalition government, led by Prime Minister Shehbaz Sharif, inherited fiscally unsustainable circular debt of nearly Rs2.5 trillion and lofty subsidies on energy prices, as well as re-surging blackouts despite surplus generation capacity. Electricity at current price is not affordable for businesses and residential consumers.

According to the government, the electricity generation cost rose by over 66% in March compared to a year ago because of the surging global energy prices.

The generation cost has surged 66.2% to Rs9.22 kWh in March this year from Rs5.55 kWh a year ago owing to spike in imported fossil fuel prices.

“Pakistan should now focus on local coal reserves for power generation as an alternate to imported fuel and coal given that its cost is much cheaper than the imported coal,” emphasised Sino-Sindh Resources Deputy CEO Chaudhary Abdul Qayyum.

Talking to The Express Tribune, Qayyum said that the local coal prices were not sensitive to international price fluctuations.

“Local coal at Thar is available for as low as $40 per ton and with rise in mine scaling, its prices will fall further to $30 a ton,” he pointed out.

“The best thing is that the government has to pay the price in local currency.”

Currently, around 16 million tons of coal is being imported by Pakistan to operate four power plants, Qayyum said adding that if these plants had been running on local coal, massive amounts of foreign exchange could have been saved by the country besides generation of cheap electricity.

He underlined that the recent commodity cycle had witnessed imported coal prices going up to $420-470 a ton from $100-120 a ton, making imported coal even more expensive than residual fuel oil (RFO) for power production.

Sindh govt plans to launch floating solar power project on Keenjhar Lake

Solar panels to generate 500MW of electricity after two years

https://tribune.com.pk/story/2365112/sindh-govt-plans-to-launch-floating-solar-power-project

"Work on the feasibility report of the project is in full swing and it is hoped that the project will start generating electricity in two years time after going through the approval stages," said Sindh Energy Minister Imtiaz Ahmed Shaikh, adding that Go Company, which was working on the project, was expected to invest US$400 million in the project.

The energy minister’s statement came during his talk with officials from power companies.

He said that this was a unique floating solar power plant project for Pakistan which would not only provide 500 MW of environmentally friendly electricity but would also create employment opportunities in the province.

"Keenjhar Lake will promote tourism and help in controlling load shedding," he added.

Imtiaz Shaikh said that the 500 MW eco-friendly power project was another milestone of the achievements of the Sindh government.

In recent months, Pakistan has seen efforts to increase the instalment and use of solar panels. The government worked towards a comprehensive solar energy package comprising tax waivers and concessionary loans for consumers in a bid to overcome the prolonged power outages that have stalled life in the country.

The solar package would include a short-term plan for shifting government offices to solar energy. It involves the preparation of a plan for helping small consumers to switch over to solar energy with the help of subsidies or concessionary loans.

The government is also planning to waive the general sales tax on all the components used in generating solar energy.

The energy task force, chaired by Shahid Khaqan Abbasi, reviewed the solar power plan in a recent meeting. The prime minister constituted the task force on solar energy initiatives with a vision to promote sustainable and green energy.

Solar plant to replace 300MW Gwadar coal power project

The project was conceived under the CPEC and approved in 2016

https://www.thenews.com.pk/print/976586-solar-plant-to-replace-300mw-gwadar-coal-power-project

The Power Division has decided to abandon the 300MW imported coal-based power plant at Gwadar and replace it with a solar plant.

The project was conceived under the CPEC and approved in 2016, but its formal construction had not started. Now the government wants China to install a solar power plant of the same capacity after the government decided not to install any new power plant based on imported fuel in the future.

“We have decided to abandon the project, but we will have to take up the issue at various CPEC forums with our Chinese counterparts. CPEC projects have sensitivity and importance which is why the Power Division’s decision to replace the imported coal-based project at Gwadar with a solar plant is being kept at a low profile,” an official said.

Federal Minister for Power Division Khurram Dastgir Khan also hinted the government wanted the Chinese power plant at Gwadar to be replaced with a solar power plant of 300MW. Talking to The News, he also added that the government had decided to ban new power plants based on imported fuel and would add new capacity to electricity generation based on local fuel, such as Thar coal, wind, solar, and hydel. “However, the government will continue the policy to install more nuclear power plants,” he added.

More importantly, the minister said, the government has also decided to convert the existing imported coal-based power plants of 3,960MW, including the Port Qasim plant, Sahiwal power plant and China Hub plant, each having the capacity to generate 1,320MW of electricity, to local coal. The fuel import bill had eaten up almost $20 billion in the first 11 months of the last fiscal 2021-22. The initiative is being taken to scale down the fuel import bill and reduce reliance on imported fuel for power generation. The minister said the process to convert the three projects to local coal would take investment and time as boilers of the plants would need some specific changes for calibration with Thar coal.

The Joint Cooperation Committee (JCC) for the CPEC had decided in its 6th meeting held in Beijing in December 2016 that a 300MW imported coal-fired power project must be developed on a fast-track basis at Gwadar. The tariff of the project was determined in September 2019, land for the project was acquired in February 2020 and the project management was signed on April 8, 2021. The Nepra also issued a generation licence to the project management. However, the financial close of the project has not yet been completed as it is still under process. The project is still on the list of under-construction CPEC projects. However, its construction has not started yet. That is why top officials of the Power Division have decided to abandon the project and replace it with a solar power plant under its new policy not to install a new power plant base on imported coal in future.

Pakistan is currently importing 30 to 70MW of electricity from Iran under an agreement of 110MW. Sometimes, Pakistan has some fluctuation in electricity import because of demand in Iran. Pakistan had inked a new agreement of importing 100MW electricity for which a transmission line would be laid from Polan (Iran) to Gwadar by the end of 2022, or the start of 2023. The government has also increased its emphasis on laying its own infrastructure in Balochistan and the NTDC will lay a high transmission line of 500kv from Makran coast to Gwadar.

Answering Pakistan’s Burning Question: How To Ignite Lignite?

Amy Kover

https://www.ge.com/news/reports/answering-pakistans-burning-question-ignite-lignite

Buried 1,000 feet below the parched Thar Desert in Pakistan lies more fuel energy than all the known oil in Iran and Saudi Arabia combined. Just a small fraction of this 175-billion-ton lignite coal reserve is plentiful enough to supply one-fifth of Pakistan’s current energy levels for 50 years. This would significantly bolster the energy supply to Pakistan’s 200 million residents, who per capita have access to roughly just 3 percent of the electricity a typical American consumes. As a local resource, it would also lower hefty bills for imported oil and coal, diminishing Pakistan’s reliance on outside sources for energy.

The problem is that lignite is about as combustible as soggy logs in a fireplace. Composed of more than 50 percent water, as well as other impurities, lignite is known as low-caloric fuel — an ideal description for diet products, but not so much for an electricity resource. That’s partly why Thar’s reserve has gone largely untapped since its accidental discovery in 1992 by geologists searching for drinkable water. Even nine years ago, when the private-public partnership Sindh Engro Coal Mining Company purchased 1 percent of the reserve for mining, one question continued to confound power plant operators: How to ignite lignite?

Last month, an answer arrived. GE Power — which has experience burning a similar form of lignite coal in Europe and the U.S. — will bring its boiler and steam turbine technology to Pakistan. Chinese contractor SEPCOIII announced plans, in June, to use GE Power’s systems as part of its new power plant near Karachi. Known as “Qasim-Lucky,” the plant will generate 660 megawatts of electricity to power 1.3 million Pakistani homes and businesses when Lucky Power begins commercial operations in 2021. “As the first lignite-fueled ultra-supercritical power plant across the Middle East, North Africa and Turkey region, the project will help to set new industry benchmarks in Pakistan,” Qin Xubao, project director at SEPCOIII, said recently.

An “ultra supercritical” steam turbine at the RDK8 power plant in Germany. The water pressure inside reaches 4,000 pounds per square inch, more than what’s exerted when a bullet strikes a solid object. The water, which exists in a “supercritical state,” is heated to 1,112 degrees Fahrenheit (600 degrees Celsius). Top: The boilers of an ultra-supercritical power plant in Neurath, Germany. Images credit: GE Steam Power.

When it comes to combusting lignite, size matters. Every square centimeter of the boiler must fill evenly with gas. Since different fuels burn at different temperatures, GE designs its boilers with Goldilocks dimensions: neither so small that the fuel overheats nor so big that it won’t combust. Just as crucial is the positioning of each component in the boiler. “The way you inject the air into the flame, the way you manage the size of the flame and positioning of the flame, it all impacts how the lignite will react and burn,” explains Sacha Parneix, commercial general manager for GE’s Steam Power business in the Middle East, North Africa and Turkey (MENAT). “We have a lot of design features to make sure that we manage to truly burn this fuel that does not want to completely burn easily.”

Answering Pakistan’s Burning Question: How To Ignite Lignite?

Amy Kover

https://www.ge.com/news/reports/answering-pakistans-burning-question-ignite-lignite

Flue gas then travels up to the steam boiler, where its heat transforms water stored in tubes into steam power. The steam’s mechanical energy spins enormous turbines to power electricity generators. It’s also when another kind of engineering magic — GE Power’s steam turbine — kicks in. GE’s ultra-supercritical science puts steam under pressure of roughly 4,000 pounds per square inch — the same impact as a bullet striking a solid object — and heats to 1,112 degrees Fahrenheit (600 degrees Celsius). The heat and pressure turn steam into a supercritical fluid, a phenomenon where a substance no longer has specific liquid and gas phases but exhibits properties of both at the same time. In this state, the steam can get turbines spinning faster than any other system in operation, more than 20 percent above the world-average net thermal-efficiency rate of coal-fired power plants — a measure of how well the plant converts fuel into heat. That kind of efficiency gobbles up less fuel, reducing both operating expenses and carbon dioxide emissions per kilowatt-hour generated.

Though Lucky Power plans to rely on lignite mined from Thar (with some exports for backup), the plant itself is situated 276 miles (445 kilometers) away in the outskirts of densely populated Karachi. That’s a significant boon to Qasim. “On top of being designed for local Pakistani Thar coal, the project’s location ensures easy connectivity to the national grid and very low transmission and distribution losses in supplying affordable power to the major load center of the city of Karachi,” Parneix says.

All of this further augments GE Power’s work to help Pakistan diversify its power grid. Last May, the company achieved commercial operation for two HA gas turbines for the Bhikki combined-cycle plant in Lahore to power up to 2.4 million homes. GE’s HA gas turbines are planned for operation at two other power plants in Pakistan: Balloki, near Chunian, and Haveli Bahadur Shah, in Jhang. The Haveli Bahadur Shah plant alone is expected to add the electricity capacity needed for another 2.5 million homes. GE also worked with Hawa Energy to launch a 50-megawatt wind farm along the Gharo-Keti Bandar wind corridor in Jhimpir. So far, a quarter of Pakistan’s electricity flows through fuel-agnostic GE-built technologies, supporting Pakistan’s fuel-diversification power-generation strategy.

If things go as planned at Qasim, Thar-mined lignite will get to play a starring role in this story of “How Pakistan Got Its Electric Groove On.”

The National Transmission and Dispatch Company (NTDC) connected the fourth 330MWs mine-mouth power plant built under China-Pakistan Economic Corridor (CPEC) initiative at Thar coal Block II with the national grid.

https://pakobserver.net/ntdc-connects-330mws-thal-nova-plant-with-national-grid/

“We successfully provided back feed supply/seller’s interconnection facility for Thal Nova power plant through 500kV Thal Nova-Matiari transmission line,” NTDC said according to a report published by Gwadar Pro on Friday. The back feed supply energized the power plant for testing its electrical equipment, the statement added. After completion of the testing, the power plant will start contributing cheaper electricity to the national grid, NTDC said.

#Pakistan #Hydro #power: 1530MW #Tarbela 5th Extension Project to start power generation in 2025. It's financed by World Bank ($390 million) and Asian Infrastructure Investment Bank ($300 million). #RenewableEnergy #electricity https://www.nation.com.pk/20-May-2023/1530mw-tarbela-5th-extension-project-to-start-power-generation-in-2025 via @the_nation

Tarbela 5th Extension Hydropower Project, having a cumulative generation capacity of 1530MW, will start power generation in 2025.

While briefing Chairman WAPDA Engr Lt Gen (r) Sajjad Ghani during his visit to Tarbela 5th Extension Hydropower Project, it was informed that electricity generation from the project would start in 2025. Masood Ahmed from World Bank also accompanied the chairman. GM Tarbela Dam Zakir Ateeq, PD Tarbela 5th Extension Hydropower Project and representatives of the consultants and the contractor, made detailed presentation on progress of the project. It was briefed that construction activities are underway on five sites. Recovery plan to match the completion schedule of the project was also discussed in detail during the briefing.

Earlier, the chairman witnessed construction work on various sites including intake, penstock and outlet, power house, tailrace culvert and switch yard. Member (Power) WAPDA Jamil Akhtar, GM (Power) Tarbela Nasrum Minallah, GM (HRD) Brig Hamid Raza (Retd) and GM (Security) Brig Muhammad Tufail (Retd) were also present on the occasion.

During his interaction with the project management, the chairman said that green, clean and affordable hydel electricity is all the more important to rationalise the tariff and stabilise the economy. This necessitates timely completion of hydropower projects, he added. The Chairman urged the project management to gear up their efforts and complete Tarbela 5th Extension Hydropower Project in accordance with the schedule.

WAPDA is constructing Tarbela 5th Extension Hydropower Project on Tunnel No. 5 of Tarbela Dam. World Bank and Asian Infrastructure Investment Bank (AIIB) are providing financial assistance for the project to the tune of $390 million and $300 million respectively. Cumulative generation capacity of the project stands at 1530MW with three generating units of 510MW each. The project will provide 1.347 billion units of environment friendly and low-cost hydel electricity to the national grid on the average every year. With completion of Tarbela 5th Extension Project, installed capacity at Tarbela Dam will increase from 4888 MW to 6418 MW. Chairman WAPDA also visited intake structure of Tarbela 4th Extension Hydel Power Station and discussed operation and maintenance (O&M) activities of the power station. Commissioned in 2018 with funding of the World Bank, the 1410 MW-Tarbela 4th Extension Hydel Power Station has so far provided 18.67 billion units of electricity to the national grid.

CPEC Suki Kinari project nears completion | The Manila Times

https://www.manilatimes.net/2023/06/12/business/foreign-business/cpec-suki-kinari-project-nears-completion/1895652

The Suki Kinari Hydropower project in northwest Pakistan achieved the hoisting of a core component on Saturday, as a 413-ton rotor, crucial to turning water into electricity, was smoothly installed on the last of four generating units.

The successful hoisting of the last rotor will help advance the construction progress of the power station under the China-Pakistan Economic Corridor (CPEC), located in the Mansehra district of the South Asian country's Khyber Pakhtunkhwa province.

Noting the hoisting of the last rotor as a key milestone of the 884-megawatt hydropower project, Yu Zhiliang, assistant general manager of the Suki Kinari Hydropower project of the Overseas Investment Co. of China Gezhouba Group, which invests in and implements the project, said that it marks the installation of the unit body of the hydropower station is coming to an end.

It is also a solid step for the waterless commissioning of four generating units in the coming six months, said Yu.

The hydropower project started construction in January 2017. Once getting functional, the CPEC project will annually generate some 3.21 billion kilowatt-hours of clean electricity, replacing 1.28 million tons of coal and reducing 2.52 million tons of carbon dioxide emissions per year, said Yu.

It will significantly optimize Pakistan's energy structure, boosting the country's economic and social development, he added.

Launched in 2013, the CPEC is a corridor linking Pakistan's Gwadar port with Kashgar in northwest China's Xinjiang Uygur Autonomous Region, highlighting energy, transport and industrial cooperation.