Pakistan has received nearly $30 billion in worker remittances in fiscal year 2020-21, according to the State Bank of Pakistan. This is a new record representing about 10% of the country's gross domestic product (GDP). This money helps the nation cope with its perennial current account deficits. It also provides a lifeline for millions of Pakistani families who use the money to pay for food, education, healthcare and housing. This results in an increase in stimulus spending that has a multiplier effect in terms of employment in service industries ranging from retail sales to restaurants and entertainment.

|

| Overseas Pakistani Workers' Remittances. Source: Arif Habib |

Pakistan's share of working age population (15-64 years) is growing as the country's birth rate declines, a phenomenon called demographic dividend. This dividend is manifesting itself in high levels of worker exports and record remittances pouring into the country. Saudi Arabia and the United Arab Emirates(UAE) are the top two sources of remittances but the biggest increase (58%) in remittances is seen this year from Pakistanis in the next two sources: the United Kingdom and the United States.

|

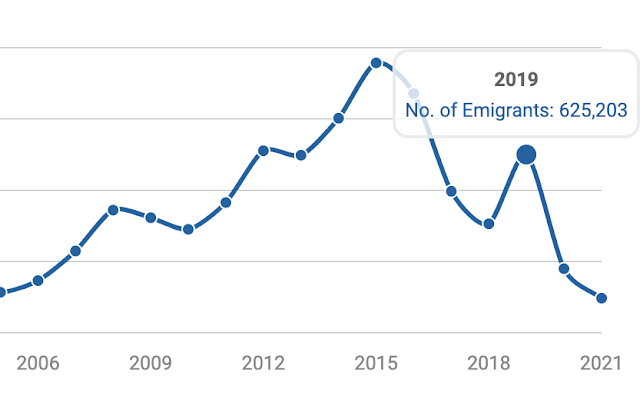

| Pakistani Workers Going Overseas. Source: Bureau of Emigration |

|

| Projected Population Decline in Emerging Economies. Source: Nikkei Asia |

Haq's Musings

South Asia Investor Review

Pakistan is the 7th Largest Source of Migrants in OECD Nations

Pakistani-Americans: Young, Well-educated and Prosperous

Inspirational Story of Karachi Rickshaw Driver's Daughters

Pakistan Remittance Soar 21X

Pakistan's Growing Human Capital

Two Million Pakistanis Entering Job Market Every Year

Pakistan Most Urbanized in South Asia

Hindu Population Growth Rate in Pakistan

Do South Asian Slums Offer Hope?

38 comments:

Whats the reason for the largest growth of remittance from USA & uk?

Not sure but I do know the education, skill levels and earnings of Pakistanis in the US are higher than their counterparts in the Middle East.

https://www.riazhaq.com/2021/06/us-census-pakistani-americans-are-young.html

Six reasons why remittances soared in South Asia during COVID-19

https://blogs.worldbank.org/endpovertyinsouthasia/six-reasons-why-remittances-soared-south-asia-during-covid-19

Tax incentives. Increasingly, policymakers want to encourage greater formal remittances. Pakistan and Bangladesh, which (along with Mexico) saw the highest surge in remittances in a sample of 45 developing countries, had recently introduced new remittance tax incentives. This one-off change may explain the high growth rate in 2020.

---------

Remittance flows are a major source of income for all countries in South Asia, larger than all other capital inflows combined. In 2019, India received more remittances than any other country in dollar terms, and Nepal ranked third in the world in terms of remittances to GDP at 27 percent. Remittances seem to have been even more essential during the COVID-19 pandemic, increasing by 5.2 percent in 2020 in South Asia. But this was somewhat surprising because household surveys globally showed remittances falling, especially in the second quarter of 2020.

So, what happened in South Asia? Many studies indicate that remittances tend to increase when receiving households experience disasters or recessions. However, since the COVID-19 shock was global in nature, both home (recipient) and foreign (sender) countries were impacted. Migrant workers, many of whom- in North America, the EU, and the Middle East- are employed mostly in contact-intensive services sectors were particularly hard hit by COVID-19.

---------

Our analysis in the World Bank’s latest South Asia Economic Focus shows that several factors help explain the large increase in remittances in 2020. Some also suggest there are great opportunities for policy interventions.

Savings repatriation. A portion of the recorded rise in remittances could represent repatriated savings of emigrants returning home after losing their jobs or not finding new opportunities. One example: Saudi Arabia granted less than 10,000 work visas per quarter in the first and third quarters of 2020, compared to an average approval rate of over 40,000.

Better capturing of remittance statistics. Remittances could have shifted from informal (unrecorded) to formal (recorded) channels. Part of the increase was just recording of flows unnoticed in the past in official statistics, not an actual increase . Before COVID-related travel restrictions, a significant share of remittances may have arrived through trips home by migrants or their trusted friends with cash in hand, gifts, etc. This was no longer an option during the pandemic.

Generosity. Dire economic conditions in South Asia could have encouraged greater giving by migrants’ close-knit family and community ties. South Asian countries rank high compared to other middle-income countries on a measure of altruism based on FINDEX . Current giving campaigns by diaspora amid the health crisis in India suggest this altruism is alive and well in 2021!

Financial innovation. The shift to more formal channels was facilitated by the accelerated development of Fintech and digital transfer apps such as G-pay and Alipay, which have made the digital transfer of funds more accessible and cheaper per transaction, leading to an overall increase in remittances.

Tax incentives. Increasingly, policymakers want to encourage greater formal remittances. Pakistan and Bangladesh, which (along with Mexico) saw the highest surge in remittances in a sample of 45 developing countries, had recently introduced new remittance tax incentives. This one-off change may explain the high growth rate in 2020.

Host country transfers. Some migrants were able to access cash transfers offered by host country governments, which would allow then to send home higher amounts than normal (e.g., stimulus payments in the United States).

India received over USD83 billion in remittances in 2020, a drop of just 0.2 per cent from the previous year, despite a pandemic that devastated the world economy, according to a World Bank report.

https://indianexpress.com/article/business/economy/india-received-83-billion-in-remittances-in-2020-world-bank-report-7313003/

China, which received USD 59.5 billion in remittances in 2020 against USD 68.3 billion the previous year, is a distant second in terms of global remittances for the year gone by, as per the latest World Bank data released on Wednesday.

In 2019, India had received USD83.3 billion in remittances.

The report said India’s remittances fell by just 0.2 per cent in 2020, with much of the decline due to a 17 per cent drop in remittances from the United Arab Emirates, which offset resilient flows from the United States and other host countries.

In 2019, India had received USD83.3 billion in remittances.

India received over USD83 billion in remittances in 2020, a drop of just 0.2 per cent from the previous year, despite a pandemic that devastated the world economy, according to a World Bank report.

×

China, which received USD 59.5 billion in remittances in 2020 against USD 68.3 billion the previous year, is a distant second in terms of global remittances for the year gone by, as per the latest World Bank data released on Wednesday.

In 2019, India had received USD83.3 billion in remittances.

The report said India’s remittances fell by just 0.2 per cent in 2020, with much of the decline due to a 17 per cent drop in remittances from the United Arab Emirates, which offset resilient flows from the United States and other host countries.

India and China are followed by Mexico (USD42.8 billion), the Philippines (USD34.9 billion), Egypt (USD29.6 billion), Pakistan (USD26 billion), France (USD24.4 billion) and Bangladesh (USD21 billion), it showed.

In neighbouring Pakistan, remittances rose by about 17 per cent, with the biggest growth coming from Saudi Arabia, followed by the European Union countries and the United Arab Emirates.

In Bangladesh, remittances also showed a brisk uptick in 2020 (18.4 per cent), and Sri Lanka witnessed remittance growth of 5.8 per cent.

In contrast, remittances to Nepal fell by about two per cent, reflecting a 17 per cent decline in the first quarter of 2020.

The World Bank, in its latest Migration and Development Brief, said despite COVID-19, remittance flows remained resilient in 2020, registering a smaller decline than previously projected.

Officially recorded remittance flows to low- and middle-income countries reached USD540 billion in 2020, just 1.6 per cent below the 2019 total of USD548 billion.

“As COVID-19 still devastates families around the world, remittances continue to provide a critical lifeline for the poor and vulnerable,” said Michal Rutkowski, Global Director of the Social Protection and Jobs Global Practice at the World Bank.

“Supportive policy responses, together with national social protection systems, should continue to be inclusive of all communities, including migrants,” Rutkowski added.

But Pakistan have 35B USD defecit in Trade import Export.

So still 5B USD loss.

May Almighty ALLAH protect Pakistan.

Jamil: "But Pakistan have 35B USD defecit in Trade import Export"

Pakistan annual trade deficit for fy 21 was $30 billion, not $35 billion

https://www.dawn.com/news/1632649/trade-deficit-swells-to-308bn-in-fy21

Highest Levels in Country's Economic History in FY21...

1) Goods Exports =$25.26 bln

2) IT Exports=$2 bln

3) Remittances = $29.37 bln

4) Forex Reserves = $25.41 bln

5)Wheat Production=28.75mln tons

6)C/A Surplus =$153mln (11M)

https://twitter.com/Aadil_Jillani/status/1415257701509120000?s=20

In #Asia, rising #demand for fuel #oil from #Pakistan in August and September has seen higher premiums for spot HSFO cargoes loading over late-July 2021, which are typically used for blending. #energy #economy https://www.spglobal.com/platts/en/market-insights/latest-news/shipping/071921-asia-residual-fuels-key-market-indicators-for-july-19-23

ICE Brent futures September contract were trading at $72.55/b at 0145 GMT July 19, down from the $73.61/b level at 0830 GMT July 16, Intercontinental Exchange data showed.

In Asia, rising demand for fuel oil from Pakistan in August and September has seen higher premiums for spot HSFO cargoes loading over late-July, which are typically used for blending.

Singapore fuel oil traders estimate the August low sulfur fuel oil arbitrage flow of cargo from the West into the Straits at lower than July's levels of about 2.2 million mt.

** The premium for supply of Singapore ex-wharf marine fuel 0.5%S bunker on a term contract basis for August dates was heard offered at $3.50-$4.50/mt on the last trading day of the week ended July 16.

** Industry sources said that balance July dates are currently being inked at a premium of $3-$3.50/mt over Singapore Marine Fuel 0.5%S cargo assessments, compared with a premium of $1.50-$2.00/mt for offers made in June for July supply.

** In North Asia, suppliers in Zhoushan continue to compete with each other amid high inventories, market sources based there said. Low sulfur fuel oil production in China remains steady, contributing to ample supply, the sources added.

** China has eased the prevention measures for ships coming from India, but some regulations are still there in Zhoushan, capping bunker demand, industry sources said. Reflecting the weaker demand, the delivered Zhoushan 0.5%S marine fuel bunker price has fallen below the Singapore price since July 14.

** Meanwhile, Hong Kong has been seeing strong demand since the 14-day mandatory quarantine rule for crew members under COVID-19 restrictions was lifted a month ago, while supply for 0.5%S sulfur grade is likely to remain sufficient.

** The port is yet to see a full recovery in bunker demand after the 14-day mandatory quarantine was lifted, Hong Kong bunker industry sources said, attributing the slow recovery to lower bunker prices in mainland Chinese ports and shipowners' reluctance for bunker-only calls in Hong Kong amid high freight rates.

High Sulfur Fuel Oil

** According to ICE data, morning discussions for the August Singapore 380 CST/Rotterdam high sulfur fuel oil spread inched lower to $12/mt July 19, from the July 16 spread at $12.10/mt.

** After Pakistan LNG Ltd. cancelled procurement tenders for spot LNG, Pakistan State Oil has since issued seven new buy tenders for fuel oil to meet utilities demand, the first of which closes at the end of the week of July 26.

** The rise in demand for high sulfur fuel oil saw the cash differential to the FOB Singapore 180 CST HSFO assessment rise to a five-month high on July 15 at $3/mt, before falling to $1.44/mt July 16, S&P Global Platts data showed.

** Demand to meet the specifications of the cargoes sought by PSO has also seen higher prices paid for spot high sulfur fuel oil cargoes sold by India's BPCL and HPCL, market traders said.

** In North Asia, the 380 CST high sulfur bunker supply in Hong Kong is expected to remain tight for the rest of July when replacement cargo is scheduled to arrive, said a bunker supplier based there.

** Bunker suppliers hold 380 CST bunker grade only to meet demand and supply has been thin after the IMO 2020, market sources said.

** Hong Kong's 380 CST price was the highest in Asia over June 24-July 6, and has been the second highest since July 7 after Japan, reflecting the tightness, Platts data showed.

#Pakistan Commerce Chief says country aims to unlock #manufacturing & export potential. #Export-led growth & Make in Pakistan are our priorities. Exports reached a record $31.3b (goods $25.3b) & (services $6b) in fiscal 2020-21 despite #pandemic challenges https://gn24.ae/c047920aa036000

PAKISTAN EYES MASSIVE PARTICIPATION IN EXPO 2020 DUBAI

* The large-scale manufacturing sector recorded nine per cent growth during July-March 2020-21 – indicating a strong post-pandemic recovery.

* To bolster exports, the government has removed three barriers: Shift from fixed parity that artificially overvalued rupee, giving refunds to exporters and industrialists on time and exemptions on customs duties mainly on raw materials.

* The Ministry of Commerce has set its eyes on the export target of $35 billion in the next fiscal year.

As the country plans to move beyond simple manufacturing, the five key areas of focus will be: pharmaceutical, engineering, food processing, fisheries, fruits and vegetables.

* To identify new markets and boost trade ties and investments, Pakistan is eyeing massive participation at Expo 2020 Dubai.

“Make in Pakistan is our top priority now” Dawood asserted. Pakistan’s policy in the past has been to support trading rather than manufacturing which is now changing under Khan’s administration. “Manufacturing is wealth creation. It helps build industries, create more jobs” which Pakistan, a country of 220 million people, desperately needs. The large-scale manufacturing sector recorded nine per cent growth during July-March 2020-21 – indicating a strong post-pandemic recovery. Industrial support packages, incentives such as gas and electricity at regionally competitive rates for export-oriented businesses, tax exemptions for high-performing sector manufacturers helped achieve this growth.

#Malala says girls' #education 'worth fighting for'. The #GlobalEducationSummit wants to raise $5bn (£3.6bn) to support education in some of the world's poorest countries. #UK is promising £430m, #EU £595m, #US £218m, #Norway £300m & #Canada £173m https://www.bbc.com/news/education-58006728

"The world is facing a girls' education crisis," with more than 130 million girls missing out on school around the world, Malala Yousafzai has warned.

"Their futures are worth fighting for," the education campaigner told a global education summit in London.

She said the recovery from the pandemic had to mean fair access to education.

The Global Partnership for Education summit wants to raise $5bn (£3.6bn) to support education in some of the world's poorest countries.

Hosted by the UK and Kenya, it will raise funds for the next five years, creating an extra 88 million school places and supporting the learning of 175 million children.

'Biggest game-changer'

The pandemic has exacerbated the problems already facing schools in poorer countries - with warnings that children who were forced out of school because of coronavirus might never return.

School aid for Syrian children who know warplanes and not shops

PM pledges £430m for girls' education at G7

Government wins vote to cut overseas aid

The UK has promised £430m and other donor countries will be making pledges - with about $4bn (£2.9bn) of the total expected to be promised by Thursday.

The European Union promised £595m, Norway £300m, Canada £173m and the United States £218m over three years.

Julia Gillard, former Australian prime minister and chair of the Global Partnership for Education, which distributes funding from donor countries, was confident that the full $5bn would be raised, but different national budget cycles would mean it would arrive in stages.

She said the pandemic had disrupted education in all countries - but the impact of closing schools had been much worse in poorer countries where many families lacked access at home to internet connections or electricity.

Malala, a Nobel prize winner from Pakistan who has campaigned for female education, told the summit of the importance of investing in education, particularly for girls who don't have opportunities "just because of their gender".

"Too many children around the world - girls in particular - were already out of school before the pandemic," said UK Prime Minister Boris Johnson.

"Enabling them to learn and reach their full potential is the single greatest thing we can do to recover from this crisis," he said, urging the international community to contribute funding.

However, Mr Johnson has faced criticism, including from some of his own MPs, for pushing ahead with a cut in the UK's overseas aid budget.

Gabriela Bucher, executive director of Oxfam, questioned the priorities of a world in which billionaires could compete in launching private space rockets while millions of children are unable to go to school.

She also warned of the negative impact from the UK "dramatically cutting aid".

"It will especially leave girls less healthy and less safe, before they even set foot in the classroom," said the aid charity head.

Opening the event, UK Foreign Secretary Dominic Raab emphasised the value of investing in girls' education as the "engine of progress" - with better-educated mothers improving the health and wellbeing of their families.

Education for girls is the "biggest game-changer", he told the summit.

Kenya's cabinet secretary for foreign affairs Raychel Omamo warned of the disruption caused by the pandemic - but said "education is the pathway, the way forward".

Workers' #remittances from #Pakistani diaspora amount to $2.71 billion in July 2021, down 2.1% from July 2020. State Bank of #Pakistan points out that the figure has remained over $2 billion for the 14th straight month in a row. #economy https://www.brecorder.com/news/40112428

Overseas workers' remittances amounted to $2.71 billion in July 2021, a 2.1% fall year-on-year, with the country's central bank pointing out that the figure has remained over $2 billion for the 14th straight month.

Data released by the State Bank of Pakistan (SBP) on Tuesday said that inflows of $2.71 billion were recorded in July 2021. This is the second-highest ever level of remittances reported in the month of July, it added.

In terms of growth, remittances increased 0.7% over the previous month ($2.68 billion in June 2021), and showed a decline by 2.1% over the same month last year ($2.76 billion in July 2020). This marginal year on year decline was largely on account of Eid-ul-Azha, which resulted in fewer working days this July compared to last year, said the SBP.

Remittance inflows during July 2021 were mainly sourced from Saudi Arabia ($641 million), United Arab Emirates ($531 million), United Kingdom ($393 million) and the United States ($312 million).

The central bank was of the view that proactive policy measures by the government and SBP to incentivise the use of formal channels, curtailed cross-border travel in the face of COVID-19, altruistic transfers to Pakistan amid the pandemic, and orderly foreign exchange market conditions have positively contributed towards the sustained improvement in remittance inflows since last year.

Pakistan's remittances reach historic high of $29.4 billion in FY21

Remittances play an important part in Pakistan's economy that continues to battle widening trade and current account deficits. The country's trade deficit widened by 85.53% to $3.104 billion in July 2021 as compared to $1.673 billion in the corresponding month of 2020, said the Pakistan Bureau of Statistics (PBS).

According to trade data, the import bill in July this year went up 47.90% to $5.434 billion against $3.674 billion over the corresponding month last year. Meanwhile, the country’s exports witnessed an increase of 16.44% and remained $2.33 billion in July 2021 compared to $2.001 billion in July 2020.

The SBP's Third Quarterly Report on The State of Pakistan’s Economy for the fiscal year 2020-21, expected workers' remittances to remain buoyant, as the main factors (switch to formal channels, incentives for banks and MTOs, etc.) will still be in place.

The New Population Bomb

https://asia.nikkei.com/Spotlight/The-Big-Story/The-new-population-bomb

"A few years ago, we would get three times more recruits than we could accept," observed an employee with a staffing company in Vietnam that recruits workers for Japan's Technical Intern Training Program. "These days, we can barely get twice as many. Within five years, the number of people working away from home may start to drop."

Many Asian economies have experienced this phenomenon already, known in economics as the Lewis turning point, after British economist W. Arthur Lewis. Workers migrate from rural areas to cities, supporting economic growth by working for low wages. Eventually, growth stops because of rising wages and a shrinking labor force.

The answer, in many cases has been immigrants, which have contributed to growth in developed countries after population growth slowed. According to the U.N., there were 281 million international migrants in 2020, 1.6 times more than roughly 20 years earlier.

Border restrictions imposed during the COVID-19 pandemic have highlighted how dependent some countries have become on foreign workers.

Without immigration, many advanced economies already cannot sustain their labor pool. In the U.K. after Brexit, the combination of immigration restrictions and the pandemic has led to a severe labor shortage. Before the pandemic, 12% of heavy truck drivers were from the European Union. However, drivers can no longer be hired from outside the country under the U.K.'s new standards. According to the British Road Haulage Association, the country faces a shortage of more than 100,000 commercial heavy truck drivers. Logistics companies are becoming desperate, raising hourly wages by 30%.

The lack of immigration may not be a temporary phenomenon. The countries with the most outbound immigrants are seeing their young populations decline. The number of Indians between the ages of 15 and 29 will peak in 2025. In China that cohort will drop by about 20% in the next 30 years.

The Philippines, one of the biggest labor-exporting countries in the world, where about 10% of the population is thought to work abroad, is also showing signs of reversing course to focus on domestic production. The country is increasing the amount of domestic contract work, such as call centers. The incoming amount of overseas remittances grew by over 7% year-on-year in the first half of the 2010s, but that slowed to 3% in 2018.

Some countries have already started trying to secure workers. Germany increased its acceptance of non-EU workers in 2020. In 2019, Australia increased the maximum length of working holidays from two years to three, on the condition that people work for a set period of time in sectors where there is a labor shortage, such as agriculture. Japan also is bringing in more foreign workers through the "specified skilled worker" system.

Economic forces may drive a new competition among nations for immigrants. One key is to become a "country of choice." "A policy of actively accepting immigrants means it is important to expand the options for foreign workers to settle and live in a country permanently," said Keizo Yamawaki, a professor at Meiji University in Tokyo who specializes in immigration policy.

Javed Hassan

@javedhassan

“We design courses in collaboration with industry and play a very important role in terms of international linkages and accreditation in the skills area. Traditionally, these skills would include plumbing, electrical, welding, carpentry, etc; today they encompass high-tech areas”

“such as AI, coding and web design. To summarise, NAVTTC designs policy for the government, allocates resources and ensures that the standards meet the local market requirements and are internationally accepted as well.”

https://twitter.com/javedhassan/status/1450857983966130179?s=20

-------------------------------

https://aurora.dawn.com/news/1144225

MAB: How receptive is the industry to this idea?

SJH: People in the industry always maintain that training is the critical need of the country and we should be investing much more in that direction. The reality is that they look to the government to provide all the training and the facilities; they don’t want to invest time and energy in a more involved collaboration. We have tried to work with the Chambers of Commerce, but so far, we have not seen the kind of enthusiasm that is needed. However, things are changing. For example, we are working closely with the Hashoo Group to train young people in the hospitality sector. We are also working with a few manufacturing companies that are providing training on the factory floor. Pakistan’s main problem is productivity and productivity is dependent on the capability of the labour force; unless industry is prepared to invest in them, it will not have a capable labour force.

MAB: From which educational stream do most trainees come from?

SJH: When we were just offering traditional skills, we were attracting young people from the Matric or FSC level from government schools; young people who probably were unable to get into a university. As a result, there was a stigma attached to vocational training, an unfair one in my view – and people preferred not to opt for vocational training, even though there are good jobs out there and with good earning potential. Under Hunarmand Pakistan’s Kamyab Jawan Scheme, we have introduced high-end technical skills that offer entrepreneurial or digital facing opportunities, and since then we have seen a very different kind of student body coming in. Many are graduates who have not found jobs because they lack industry experience (it makes you wonder what kind of graduates we are producing that the industry is unwilling to hire them) and have taken advantage of the courses we offer and almost immediately found jobs. In the first phase, we trained about 40% of our intake in traditional skills, and according to an internal survey, almost 65% found a job. In terms of the high-end technical skills, about 80 to 85% have either started their own companies, are freelancing or are in jobs. We are now seeing young people from different social stratas taking up the trainings we offer. We cannot know everything about the market and one of the best proxies to understand the market requirements is to find out what the young themselves want to learn; they better than anyone else know what kind of jobs are out there and we have persuaded the institutes to talk to industry as well as to the young people and design the courses accordingly. As a result, applications have been much higher compared to the previous ones, when NAVTTC as well as the vocational institutes had to run after people to persuade them to enrol; in fact, this time, the courses have been oversubscribed. We should not underestimate the wisdom of young people. Most of them want to find jobs and stand on their own feet; do not force them on to a certain path; instead, ask them what path they want to follow and enable it.

Overseas worker #remittances to #Pakistan continue to remain robust, stand at $2.5b in October 2021, up 10.2% from October 2020. Remittances sent home by overseas #Pakistanis residing in the #US soared 26.4%.

https://tribune.com.pk/story/2329421/remittances-continue-to-remain-robust-stand-at-25b-in-october

The remittances sent home by overseas Pakistan surged 10.2% in October 2021 to $2.5 billion on a year-on-year basis owing to measures taken by the government and the State Bank of Pakistan to encourage the use of formal channels to send money home.

According to the data released by the State Bank of Pakistan (SBP) on Sunday, the inflow of remittances had stood at $2.3 billion in the same month last year.

“In addition to staying above $2 billion since June 2020, this is the eighth consecutive month when remittances have been close to or above $2.5 billion,” SBP said in a statement. “Proactive policy measures by the government and SBP to incentivise the use of formal channels and altruistic transfers to Pakistan amid the pandemic have positively contributed towards the sustained improvement in remittance inflows since last year.”

However, the inflows declined 5.7% on a month-on-month basis as they had amounted to $2.67 billion in September 2021.

Speaking to The Express Tribune, Ismail Iqbal Securities Head of Research Fahad Rauf said that the trend of remittances has remained robust for the past few months.

“While regional countries witnessed a drop in remittance inflows in the last few months, Pakistan recorded a sustained uptrend in receipts,” he cherished citing that the current number was encouraging for economic managers of Pakistan.

Speaking about the month-on-month decline, he pointed out that a slowdown in growth was being witnessed due to resumption of cross border travel in the world.

However, he held firm hope that Pakistan would record receipt of $30 billion from overseas Pakistan in full fiscal year 2021-22.

Echoing his views, Pak-Kuwait Investment Company Head of Research Samiullah Tariq stated that the month-on-month decrease was a seasonal phenomenon and increase in number of foreign flights had capped remittance flow.

During the first four months of the ongoing fiscal year (July-October 2021), remittances rose 11.9% to $10.6 billion on a year-on-year basis. The country had received $9.4 billion in the same period of previous fiscal year.

Country wise figures

According to the central bank, Pakistanis based in Saudi Arabia sent the largest amount of remittances at $655.4 million in October 2021, which was 3.25% higher than $634.8 million received in the same month last year.

The amount sent home by expatriates in UAE registered a decrease of 10% to $456 million in October 2021. Inflows from the Middle Eastern nation had amounted to $504.1 million in the same month last year.

Pakistanis in UK managed to send $346.7 million home in the month under review compared to $278.5 million in the same month last year, an increase of 24.5%.

Remittances sent home by overseas Pakistanis residing in US climbed 26.4% last month as they amounted to $231.8 million against $183.3 million in the same month last year.

Receipts from GCC countries other than Saudi Arabia and UAE inched up 4.7% to $285.6 million. The amount received from the region had stood at $272.8 million last year.

Pakistanis in European Union sent 43% higher remittances in October 2021 as the inflows amounted to $291.1 million against 203.2 million in October 2020.

https://twitter.com/ArifHabibLtd/status/1459819674980564993?s=20

Nations Lure Foreigners. After #COVID19 #Pandemic, Wealthy Nations Wage Global Battle for Migrants. Several developed countries, facing #aging #labor forces & #worker #shortages, are racing to recruit, train & integrate foreigners. #Canada #Germany #Japan https://www.nytimes.com/2021/11/23/world/asia/immigration-pandemic-labor-shortages.html?smid=tw-share

As the global economy heats up and tries to put the pandemic aside, a battle for the young and able has begun. With fast-track visas and promises of permanent residency, many of the wealthy nations driving the recovery are sending a message to skilled immigrants all over the world: Help wanted. Now.

In Germany, where officials recently warned that the country needs 400,000 new immigrants a year to fill jobs in fields ranging from academia to air-conditioning, a new Immigration Act offers accelerated work visas and six months to visit and find a job.

Canada plans to give residency to 1.2 million new immigrants by 2023. Israel recently finalized a deal to bring health care workers from Nepal. And in Australia, where mines, hospitals and pubs are all short-handed after nearly two years with a closed border, the government intends to roughly double the number of immigrants it allows into the country over the next year.

The global drive to attract foreigners with skills, especially those that fall somewhere between physical labor and a physics Ph.D., aims to smooth out a bumpy emergence from the pandemic.

Covid’s disruptions have pushed many people to retire, resign or just not return to work. But its effects run deeper. By keeping so many people in place, the pandemic has made humanity’s demographic imbalance more obvious — rapidly aging rich nations produce too few new workers, while countries with a surplus of young people often lack work for all.

New approaches to that mismatch could influence the worldwide debate over immigration. European governments remain divided on how to handle new waves of asylum seekers. In the United States, immigration policy remains mostly stuck in place, with a focus on the Mexican border, where migrant detentions have reached a record high. Still, many developed nations are building more generous, efficient and sophisticated programs to bring in foreigners and help them become a permanent part of their societies.

“Covid is an accelerator of change,” said Jean-Christophe Dumont, the head of international migration research for the Organization for Economic Cooperation and Development, or O.E.C.D. “Countries have had to realize the importance of migration and immigrants.”

The pandemic has led to several major changes in global mobility. It slowed down labor migration. It created more competition for “digital nomads” as more than 30 nations, including Barbados, Croatia and the United Arab Emirates, created programs to attract mobile technology workers. And it led to a general easing of the rules on work for foreigners who had already moved.

----------------

One of the sharpest shifts may be in Japan, where a demographic time bomb has left diapers for adults outselling diapers for babies. After offering pathways to residency for aged-care, agriculture and construction workers two years ago, a Japanese official said last week that the government was also looking to let other workers on five-year visas stay indefinitely and bring their families.

World Bank: "Remittances to South Asia likely grew around 8 percent to $159 billion in 2021....Pakistan had another year of record remittances with growth at 26 percent and levels reaching $33 billion in 2021" #Pakistan #remittances #diaspora #migration https://www.worldbank.org/en/news/press-release/2021/11/17/remittance-flows-register-robust-7-3-percent-growth-in-2021

Remittances to low- and middle-income countries are projected to have grown a strong 7.3 percent to reach $589 billion in 2021. This return to growth is more robust than earlier estimates and follows the resilience of flows in 2020 when remittances declined by only 1.7 percent despite a severe global recession due to COVID-19, according to estimates from the World Bank’s Migration and Development Brief released today.

For a second consecutive year, remittance flows to low- and middle-income countries (excluding China) are expected to surpass the sum of foreign direct investment (FDI) and overseas development assistance (ODA). This underscores the importance of remittances in providing a critical lifeline by supporting household spending on essential items such as food, health, and education during periods of economic hardship in migrants’ countries of origin.

“Remittance flows from migrants have greatly complemented government cash transfer programs to support families suffering economic hardships during the COVID-19 crisis. Facilitating the flow of remittances to provide relief to strained household budgets should be a key component of government policies to support a global recovery from the pandemic,” said Michal Rutkowski, World Bank Global Director for Social Protection and Jobs.

Factors contributing to the strong growth in remittance are migrants’ determination to support their families in times of need, aided by economic recovery in Europe and the United States which in turn was supported by the fiscal stimulus and employment support programs. In the Gulf Cooperation Council (GCC) countries and Russia, the recovery of outward remittances was also facilitated by stronger oil prices and the resulting pickup in economic activity.

Remittances registered strong growth in most regions. Flows increased by 21.6 percent in Latin America and the Caribbean, 9.7 percent in Middle East and North Africa, 8 percent in South Asia, 6.2 percent in Sub-Saharan Africa, and 5.3 percent in Europe and Central Asia. In East Asia and the Pacific, remittances fell by 4 percent - though excluding China, remittances registered a gain of 1.4 percent in the region. In Latin America and the Caribbean, growth was exceptionally strong due to economic recovery in the United States and additional factors, including migrants’ responses to natural disasters in their countries of origin and remittances sent from home countries to migrants in transit.

The cost of sending $200 across international borders continued to be too high, averaging 6.4 percent of the amount transferred in the first quarter of 2021, according to the World Bank’s Remittance Prices Worldwide Database. This is more than double the Sustainable Development Goal target of 3 percent by 2030. It is most expensive to send money to Sub-Saharan Africa (8 percent) and lowest in South Asia (4.6 percent). Data reveal that costs tend to be higher when remittances are sent through banks than through digital channels or through money transmitters offering cash-to-cash services.

“The immediate impact of the crisis on remittance flows was very deep. The surprising pace of recovery is welcome news. To keep remittances flowing, especially through digital channels, providing access to bank accounts for migrants and remittance service providers remains a key requirement. Policy responses also must continue to be inclusive of migrants especially in the areas of access to vaccines and protection from underpayment,” said Dilip Ratha, lead author of the Brief and head of KNOMAD.

#India Facing a #Population Implosion. Urban India's fertility rate is1.6, below replacement. India has "a baby factory in the north (#Bihar, #UP, #MP, #Rajasthan) and a jobs factory in the south (#TN, #Kerala, #Andhra, #Karnataka) " @dhume https://www.wsj.com/articles/india-may-face-a-population-implosion-fertility-rate-replacement-levels-children-11640289956?st=gughxhon7lk8x77&reflink=desktopwebshare_twitter via @WSJOpinion

After it gained independence in 1947, India’s soaring population—made possible by advances in medicine and disease control—seemed to doom it to poverty and hunger. Droughts in the mid-1960s raised the specter of famine. In 1966 the U.S. shipped one-fourth of its wheat output to India to avert mass starvation. Paul Ehrlich’s 1968 best-seller, “The Population Bomb,” predicted that hundreds of millions would starve and that by 1977 India could fall apart “into a large number of starving, warring minor states.”

----------

As in many countries, urbanization, rising income and female literacy, and increased contraception have led to plummeting fertility. But the biggest reason for the decline, according to Mr. Eberstadt, is hard to measure: Indian women want fewer babies.

In 1960 the average Indian woman would bear six children during her lifetime. By 2005 this had fallen to three. Urban India now has a fertility rate of 1.6, comparable to the European Union. And unlike China, whose government enforced a draconian one-child policy, India has achieved this largely without coercion. A harsh sterilization drive by Prime Minister Indira Gandhi in the mid-1970s led to her crushing electoral defeat in 1977. No Indian government tried to force the matter again.

Though India may have dodged mass famine, its massive population still poses challenges. Optimists claim the country’s skew toward youth provides a demographic dividend: a large working-age cohort to support relatively few retirees.

But such sunny prognostications present only half the picture. Thanks to uneven development, in the coming decades India will house an unprecedented experiment: hundreds of millions of college graduates living among hundreds of millions of illiterates. “The education gap in India could generate an income distribution that will make Manhattan look like Sweden,” says Mr. Eberstadt.

Regional disparities complicate things further. The relatively well-educated coastal states of the south already have fertility rates well below replacement levels. Birthrates in the poor and populous Hindi heartland have fallen too, but not nearly as sharply. Three of them—Uttar Pradesh, Bihar and Jharkhand—remain above replacement levels.

“To oversimplify, you have a baby factory in the north and a jobs factory in the south,” says Mr. Eberstadt. “But there’s a mismatch in educational attainment between a rising cohort in the north and the needs of the economy emerging in the south.” Kerala, in the south, has a literacy rate of 96%. Bihar, in the north, is 71%.

Then there’s the most sensitive question: political representation. In the relative weight of its states, India’s Parliament has remained frozen since the 1971 census. The average parliamentarian from Uttar Pradesh represents three million people, while a counterpart from Tamil Nadu represents 1.8 million. A 2019 report by Carnegie Endowment scholars Milan Vaishnav and Jamie Hintson calculated that if Parliament were reapportioned according to the likely population in 2026, the five southern states would send 26 fewer representatives to the 545-seat Parliament. The four most populous Hindi heartland states would add 31 seats.

If India is lucky, it will defuse these problems as successfully as it dealt with food shortages a generation ago. But though the population bomb failed to explode, it doesn’t mean India is safe from other ticking time bombs.

Overseas Pakistanis provided vital support for Pakistan’s economy in 2021 as they invested a significant amount of $2.9 billion in different assets through the Roshan Digital Account (RDA) over the past 14 months, which bolstered the foreign exchange reserves.

https://tribune.com.pk/story/2336078/rda-inflows-to-stay-robust

Besides, the RDA inflows aided in offsetting the negative impact of foreign divestment of around $3.5 billion from the rupee-denominated government debt securities like treasury bills and Pakistan Investment Bonds (PIBs) in the aftermath of the Covid-19 pandemic.

RDA inflows also contributed to stabilising the Pakistani rupee against the US dollar and other foreign currencies.

“Pakistani diaspora is projected to inject an additional $2 billion in the remaining seven months (December-June) of the ongoing fiscal year 2021-22,” remarked Arif Habib Limited (AHL) economist Sana Tawfik while talking to The Express Tribune.

RDA receipts are different from the remittances sent by the non-resident Pakistanis (NRPs) to their family members and friends back home.

The inflow of remittances remained larger than export earnings in 2021. Remittances are used to partially finance import payments and repay foreign debt.

Overseas Pakistanis sent record high remittances of $29.4 billion in fiscal year 2020-21. They are estimated to inflate further to an all-time high of $31.8 billion by the end of current fiscal year in June 2022, according to the research house.

Turning to the RDA, Tawfik said “we expect total inflows of over $3 billion in FY22.”

So far, overseas Pakistanis have invested a total of $2.9 billion since the launch of the scheme by the central bank in September 2020. Data breakdown suggests that they have invested $1.35 billion in the first five months (July-November) of the ongoing fiscal year.

The non-resident Pakistanis have poured a significant amount through the RDA into the Naya Pakistan Saving Certificates, which “offer lucrative returns on investment of 5-7% per annum in foreign currencies,” she said.

Pakistan has offered attractive returns on the certificates to the non-resident Pakistanis at a time when the rest of the world (especially the developed countries) is offering a nominal return of around 0.25%.

Read RDA to ‘tighten the noose’ around illegal housing units

Investments made under the RDA are unlikely to be pulled out aggressively as opposed to the foreign divestment from the rupee-denominated T-bills and PIBs after the Covid-19 outbreak.

Investors prematurely sold the government debt securities to keep cash in hand during the pandemic and their investment was also facing the risk of rupee depreciation at that time.

“The rupee is expected to recover partially against the greenback in the second half (January-June) of FY22 when the inflation reading and current account deficit are projected to improve,” she said.

The expected improvement in macroeconomic indicators along with acceleration of economic activities in the second half of FY22 are likely to encourage the overseas Pakistanis to enhance investment in a host of assets in their homeland.

They will also consider investing more after the resumption of International Monetary Fund’s (IMF) loan programme worth $6 billion.

The IMF is scheduled to take up for approval the next loan tranche of $1 billion for Pakistan on January 12, 2022. It will be followed by a Sukuk (Islamic bond) offer in the international market and other inflows from the multilateral lenders like the World Bank and Asian Development Bank (ADB).

“RDA inflows will encourage overseas Pakistanis to pour a higher amount of investment in the coming months,” she said. “Salient features of the RDA such as permission to seamlessly divest at any point in time will push them to keep investing in Pakistan.”

India will likely get old before it gets rich

By Mihir Sharma

https://www.livemint.com/economy/india-seems-likely-to-grow-old-before-it-can-become-wealthy-11639673192633.html

By the middle of this century, India will have 1.6 billion people. That’s when the country’s population will finally start to decline, ending up at perhaps a billion by 2100. While that is still around 250 million more people than China will have then, every time India’s population is projected, its peak seems to come earlier and crest lower. While India will be a young country for decades yet, it is ageing faster than expected. The latest round of India’s massive National Family Health Survey (NFHS) underscores the point. The average Indian woman is now likely to have only two children. That’s below the “replacement rate" of 2.1, at which the population would exactly replace itself over generations.

A few decades ago, this would have been considered miraculous in a country dismissed as a Malthusian nightmare. As modern health care became increasingly available after independence in 1947, population growth exploded—rising from 1.26% annually in the 1940s to 2% in the 1960s. Twenty years after independence, the demographer Sripati Chandrashekhar became India’s health minister and warned that “the greatest obstacle in the path of overall economic development is the alarming rate of population growth." The India in which I grew up was plastered with the inverted red triangle of the government’s family planning campaign.

As it turned out, increasing prosperity, decreases in infant mortality and—crucially—female education and empowerment achieved more than government propaganda ever could. In urban India, the fertility rate is now 1.6, according to the NFHS, equivalent to that of the US.

This is good news. But unalloyed good news is rare in India and this is no exception. The unexpected speed of the demographic transition has forced India to confront a new problem.

China-watchers have long debated whether that country will grow old before it gets rich. India now has to answer that same question, with far fewer resources at its disposal.

Draconian though China’s one-child policy was, those born under it received unprecedented attention from their families: Average education levels rose sharply, as did the quality of their nutrition. In India, by contrast, the NFHS shows that not only is child malnutrition high, it is not improving fast enough. In fact, in the five years after 2015-16, acute undernourishment actually worsened for children in most parts of India.

Meanwhile, India’s education system is clearly failing. Indian companies are already reporting a shortage of skilled manpower. That isn’t because schools aren’t turning out enough graduates. The Centre for Monitoring Indian Economy reports the unemployment rate for college graduates is 19.3%, almost three times higher than the national average. Universities just aren’t producing the kind of workers that companies feel they can employ. In some large-scale surveys, employers have said that less than half the college graduates entering the workforce have the cutting-edge skills they need or the ability to pick them up in the workplace.

Moreover, too few of these young people are trying to get into the workplace at all. Two-thirds of working-age Chinese are currently either employed or looking for a job, according to the International Labour Organization; at the beginning of the country’s high-growth spurt in the early 2000s, this labour force participation rate hit 80%. (The global average is close to 60%.) In India, by contrast, CMIE estimates that the country’s LPR stands at a mere 43% and that the pandemic has “lowered the LPR structurally" to 40%. One big reason: Just one in five Indian women work, which the World Bank has argued is linked to the social stigma of holding jobs outside the home.

The changing geography of remittance inflows

https://tribune.com.pk/story/2312688/the-changing-geography-of-remittance-inflows

The performance of these traditional sources of remittances mostly located in the Persian Gulf and North America ( Saudi Arabia, UAE, US, UK) pales in comparison with the growth in remittances from the younger communities sprouting in Europe and Asia Pacific. Remittances from EU countries (excluding the UK) increased by a spectacular 663.7% during the 2010-11 to 2020-21 period. Inflows from Germany and the Netherlands grew threefold, while those from Sweden grew fivefold. Growth was even higher for the three Latin countries, Spain (651%), France (957%) and Italy (1,128%). The best growth rate was achieved for Greece and Belgium, from where remittances grew 23 and 72 times, respectively. The growing diaspora in Australia and Japan too appears to send significantly more, with remittances from the two countries growing five and ninefold in the past 10 years, respectively.

In the preceding two decades, thousands of Pakistanis went to work in Europe, mainly to Southern European countries. Many of them were initially irregular workers who have since become legal residents, and can now use formal means of transferring money to their families back home. The Pakistani community in several countries in northern Europe and Australia has by contrast grown chiefly through emigration and settling down of university graduates.

As a result of these growth differentials, fast-growing remittances from Pakistani communities based in Europe and the Far East have gained importance overtime at the cost of slow-growing flows from the US. While transfers from the six Gulf states have maintained their lion’s share of Pakistan’s remittances of about 58%, those from the EU have grown threefold, from 3.1% in FY11 to 9.2% in FY21. Similarly, the relative share of remittances from Australia and Japan, which used to be negligible until recently, has collectively grown threefold in the past 10 years. Thanks to these changes in regional distribution, Europe has now become Pakistan’s second major sending region after the Persian Gulf, replacing North America, while the hitherto insignificant community in Asia Pacific is gradually coming into its own. Although Pakistan’s heavy reliance on the GCC states for its remittances has not yet waned, the increasing number of countries where Pakistani communities are getting settled and beginning to send significant amounts of money augurs well for the stability and durability of the country’s remittances.

#India population to surpass #China's in 2023. Over half of global population increase up to 2050 will be in just 8 countries: Dem Republic of #Congo, #Egypt, #Ethiopia, #India, #Nigeria, #Pakistan, #Philippines & #Tanzania. https://www.un.org/development/desa/pd/sites/www.un.org.development.desa.pd/files/wpp2022_summary_of_results.pdf

For 10 countries, the estimated net outflow of migrants exceeded 1 million over the period from

2010 through 2021. In many of these countries, the outflows were due to temporary labour

movements, such as for Pakistan (net flow of -16.5 million), India (-3.5 million), Bangladesh

(-2.9 million), Nepal (-1.6 million) and Sri Lanka (-1.0 million). In other countries, including

Syrian Arab Republic (-4.6 million), Venezuela (Bolivarian Republic of) (-4.8 million) and

Myanmar (-1.0 million), insecurity and conflict drove the outflow of migrants over this period.

• All countries, whether experiencing net inflows or outflows of migrants, should take steps to

facilitate orderly, safe, regular and responsible migration, in accordance with SDG target 10.7.

------------------

Between 2010 and 2021, 40 countries or areas have experienced a net inflow of more than

200,000 migrants; in 17 of those, the total net inflow exceeded 1 million people.

In 2020, Türkiye hosted the largest number of refugees and asylum seekers worldwide (nearly 4 million),

followed by Jordan (3 million), the State of Palestine (2 million) and Colombia (1.8 million). Other major

destination countries of refugees, asylum seekers or other persons displaced abroad were Germany,

Lebanon, Pakistan, Sudan, Uganda and the United States of America (United Nations, 2020b).

World Population Day: India will overtake China in 2023, says the UN

By Stephanie Hegarty

https://www.bbc.com/news/science-environment-62126413

India is set to become the world's most populous country next year, overtaking China with its 1.4bn people, according to UN figures.

By this November, the planet will be home to 8bn.

But population growth is not as rapid as it used to be.

It is now at its slowest rate since 1950 and is set to peak, says the UN, around the 2080s at about 10.4bn though some demographers believe that could happen even sooner.

But the population of the world is expanding unevenly.

More than half the growth we will see in the next 30 years will happen in just eight countries - the Democratic Republic of the Congo, Egypt, Ethiopia, India, Nigeria, Pakistan, the Philippines and Tanzania.

At the same time, some of the world's most developed economies are already seeing population decline as fertility rates fall below 2.1 children per woman, which is known as the "replacement rate". In 61 countries, the report says, populations will decline by at least 1% by 2050.

With one of the lowest fertility rates in the world (at 1.15 children per woman), China has announced that its population is due to start declining next year - much earlier than previously thought. That is despite the country abandoning its one child policy in 2016 and introducing incentives for couples to have two or more children.

As India's population continues to grow it will almost certainly overtake China as the country with the biggest population in the world.

Fertility rates are falling globally - even in many of the countries where the population is expanding. That is because, as previous generations expand, there are more people having children, even if individually those people are having fewer children than their parents did.

Growth is also largely thanks to developments in medicine and science which mean that more children are surviving into adulthood and more adults into old age. That pattern is likely to continue, which means that by 2050 the global average life expectancy will be around 77.2 years.

But this pattern means that the share of the global population aged 65 years or above is projected to rise from 10% this year to 16% in 2050. Again the distribution will be unequal with some countries, in East Asia and Western Europe, already seeing more extremes in ageing.

Global Village Space, Pakistan, 15 June 2021 - The recent Economic Survey launched on 10th June 2021 for the outgoing Fiscal Year 2020-21 mentioned that Pakistan is one of the largest labor exporting countries in the region. The document correctly read that overseas migrant workers are the most valuable asset of Pakistan.

Pakistan becomes the leader of manpower export in 2020 in the region

https://apmigration.ilo.org/news/pakistan-becomes-the-leader-of-manpower-export-in-2020-in-the-region

Special Assistant to the PM for Overseas Pakistanis and Human Resource Development Zulfikar Bukhari went to Twitter to talk about Pakistan’s labor export.

He said, “For a country, direly in need of foreign remittances we created 1.2 million new jobs across the world since coming into government.”

He added, “Even with global slowdown during Covid-19 we kept Pakistan in leading spot. This alone accounts for 12% of PM’s promised jobs.”

The recent Economic Survey launched on 10th June 2021 for the outgoing Fiscal Year 2020-21 mentioned that Pakistan is one of the largest labor exporting countries in the region.

The document read that overseas migrant workers are the most valuable asset of Pakistan and they are playing a key role in the socio-economic development of the country through their remittances.

It is true, as the current GDP surge to a surprising 3.94 percent is largely on the back of remittances, as claimed by Pakistan’s Finance Minister himself, who said on 10th June that he hopes that the remittances continue, as they helped stabilize the country during the pandemic.

Source: https://www.globalvillagespace.com/pakistan-becomes-the-leader-of-manpower-export-in-2020-in-the-region/

Remittances Are a Lifeline for Developing Countries With Economic Instability

https://thefintechtimes.com/remittances-are-a-lifeline-for-developing-countries-with-economic-instability/

Remittances sent worldwide have increased 64.3 per cent in the past decade, rising from $420.1billion 10 years’ ago to $653.4billion in the last year, shows research by ACE Money Transfer, the online remittance provider.

---

Global economic growth is expected to slump from 6.1 per cent last year to 3.2 per cent this year — significantly lower than the 4.1 per cent anticipated in January. This is due to rising interest rates and spiralling inflation. This slowdown in growth is expected to hit low-income countries harder.

---

Remittances also play a key role in urban areas, helping drive investment into real estate and infrastructure in developing countries.

Rashid Ashraf, CEO of ACE Money Transfer, says, “Remittances have a massive impact on people’s lives across the world. When times are tough and economies are struggling, this is when remittances are particularly important.

“Around three-quarters of remittances sent globally are used to cover essential things, like putting food on the family’s table and covering medical expenses, school fees or housing expenses. In addition, in times of crises, migrant workers tend to send more money home to cover loss of crops or family emergencies.”

Countries facing significant economic stress at present include Sri Lanka, Pakistan, Nigeria and Nepal. Remittances play a key role in supporting the economies of all mentioned countries.

Remittances key to helping Sri Lanka and Nepal’s struggling economies

Sri Lanka in particular has struggled following the pandemic, with its economy having collapsed. The country has been short of cash to pay for vital food and fuel imports and has defaulted on its debt.

Remittances are a key pillar of Sri Lanka’s economy, reaching $7.1billion in the past year, up from $6.7billion the previous year. Remittances in Sri Lanka support economic growth, reduce the burden on social security payments and help alleviate poverty. Increases in remittances could significantly aid Sri Lanka’s economic recovery.

-----

How remittances can help moderate inflation in Pakistan and Nigeria

Pakistan and Nigeria are two other countries facing economic difficulties where remittances can play a key role in their recoveries. Both countries have been struggling with the effects of surging inflation this year.

Pakistan’s currency has devalued 28 per cent compared to the US dollar so far this year, fuelling surges in the prices of vital imported goods such as fuel, cooking oil and grains.

This has made remittances to Pakistan, which have risen 26 per cent to a record $33billion in the past year, even more important. Remittances are a key source of foreign currency for Pakistan and play a significant role in supporting its currency. This is in turn can help control inflation and the price of essential goods and services in the country.

---

The role of remittances in strengthening resilient economies like the Philippines

Remittances can also play an important role in countries where the economy has remained resilient. This includes the Philippines’ economy, which has continued to show rapid expansion this year despite global headwinds.

An important stabilising factor in its economy has been remittances, which have reached a record high of $34.9billion in the past year. Remittances in the Philippines are important in supporting domestic consumer spending, which has driven the country’s economic growth.

Remittances are a crucial source of foreign capital for many developing countries. Unlike other flows of private capital, remittances have remained resilient throughout the pandemic. As economics across the world continue to recover, remittances continue to play a vital role in helping countries build resilience and drive economic growth.

Germany is hoping to combat its shortage of skilled workers with a new ‘opportunity card’.

https://www.euronews.com/travel/2022/09/06/skilled-workers-are-in-demand-as-germany-tackles-labour-shortage-with-new-points-based-vis

The ‘chancenkarte’ will use a points system to enable workers with required skills to come to Germany more easily.

It is part of a strategy proposed by Labour Minister Hubertus Heil to address the country’s labour shortages, which is due to be presented to the government this autumn.

Every year, quotas will be set depending on which industries need workers. Three out of four of the following criteria must also be met to apply for the scheme:

A degree or vocational training recognised by Germany

Three years’ professional experience

Language skills or a previous stay in Germany

Under 35 years old

Currently, most non-EU citizens need to have a job offer before they can relocate to Germany. A visa for job seekers already exists, but the 'chancenkarte' is expected to make it easier and faster for people looking to find work in Germany.

Citizens of certain countries with visa agreements can already enter Germany for 90 days visa-free but are only permitted to take up short-term employment.

The opportunity card will allow people to come and look for a job or apprenticeship while in the country rather than applying from abroad. Applicants must be able to prove they can afford to pay their living expenses in the mean time.

The exact details of the scheme are yet to be formalised.

Why does Germany need to attract skilled workers?

This year, the shortage of skilled workers in Germany has risen to an all time high. Earlier this year, the Institute for Employment Research (IAB) found 1.74 million vacant positions throughout the country.

In July, staff shortages affected almost half of all companies surveyed by Munich-based research institute IFO, forcing them to slow down their operations.

From #Singapore to #Thailand, #Asia courts talent for post-#COVID #economic boost. Battle for high-skill workers is not just an #Asian phenomenon, but a global one. #UK has launched a new system called High Potential Individual visa for university grads.

https://asia.nikkei.com/Spotlight/Asia-Insight/From-Singapore-to-Thailand-Asia-courts-talent-for-post-COVID-boost

TOKYO/SINGAPORE/BANGKOK -- During the peak of the COVID-19 pandemic, Singapore tightly closed its borders. While many countries did the same, it was a sharp shock to the system for a city-state that had thrived as a hub for travel and as a magnet for foreign workers.

As some foreign nationals left, and entries were largely halted, Singapore's population dropped by 4.1% over the year through June 2021, to 5.45 million.

The latest data released on Sept. 27, however, shows nearly as swift a turnaround, thanks to a gradual lifting of restrictions. The population rebounded by 3.4% to 5.63 million, largely driven by workers in sectors like construction and shipyards -- the unsung labor that keeps the economy going.

Now, Singapore hopes to attract more highly skilled professionals with expertise and ideas that could jolt growth in the post-COVID era. "This is an age where talent makes all the difference to a nation's success," Prime Minister Lee Hsien Loong said in his annual National Day Rally speech on Aug. 21, days before his government announced a new type of visa designed to lure such people. "We need to focus on attracting and retaining top talent, in the same way we focus on attracting and retaining investments."

The city-state is far from the only place that covets high-flyers. From Thailand to Taiwan, a competition is heating up to entice the best of the best, and to fill hiring gaps with people equipped to excel in today's pandemic-altered workplace.

Innovative sectors like digital technology and biotechnology are especially hungry for talent.

Singapore's latest carrot is called the Overseas Networks and Expertise (ONE) Pass, a new visa for high-skill professionals who earn at least 30,000 Singapore dollars ($20,800) a month. The program will allow people with these visas to stay at least five years and work at multiple organizations.

Thailand, meanwhile, began taking applications on Sept. 1 for a new visa that lets global professionals stay in the country for 10 years. The government hopes to bring in 1 million foreign nationals with the Long-Term Resident (LTR) visa, designed for those with skills in targeted sectors such as electric vehicles, biotechnology and defense.

Tourism-oriented Thailand, like Singapore, has been hit hard by travel disruptions. Both also have aging populations. While Singapore is expecting growth in the 3% to 4% range this year, the Asian Development Bank's latest outlook forecasts Thailand's growth rate at 2.9%, far below Indonesia's expected growth of 5.4%, Malaysia's 6% and Vietnam's 6.5%.

Malaysia, for its part, aims to attract wealthy investors with its new Premium Visa Program. The program, which began accepting applications on Saturday, allows people who can deposit 1 million ringgit (about $215,000) in the country and have an annual offshore income of around $100,000 to stay for up to 20 years. During that time, they can invest, run businesses and work.

As part of a broader move to bring in more human resources, Australia recently raised its annual permanent immigration cap to 195,000 for the current fiscal year, from 160,000.

Digital census process continues smoothly: PBS

https://www.pakistantoday.com.pk/2023/03/16/digital-census-process-continues-smoothly-pbs/

ISLAMABAD: The process of the 7th Population and Housing Census, being conducting digitally for the first time in the country’s history, has been going on smoothly all across the country, the Pakistan Bureau of Statistics (PBS) reported here on Thursday.

“The overall progress and speed of the census process is very encouraging and satisfactory,” PBS said in a press statement issued here.

The process includes an option for self-enumeration, which was made available from February 20, 2023, till March 10, 2023, and field operations of house listing and enumeration commenced from March 01, 2023, that will continue till April 4, 2023.

Conducting a census digitally ensures transparency, data-driven procedures, real-time monitoring of progress through geo-tagging using GIS systems, and wider acceptability of census results, said PBS press statement.

It said structures were listed from March 1st to March 10, 2023, during which all the residential and economic units were geotagged along with the classification of economic activities as per international standards.

It said, the self-enumeration portal was very well received by people who have enumerated themselves using the portal launched and this method was optional.

Currently, the final phase of the census i.e. enumeration is ongoing starting from March 12, 2023, and would continue till April 4, 2023. In this phase, the data about household members and their demographic characteristics, various Socio-Economic Indicators, as well as Housing characteristics, are being collected.

PBS technical team is analyzing and assessing the data and trends on a day-to-day basis to ensure the quality of the data and progress in identified 291 blocks all over Pakistan. Physical verification and digital monitoring are being used for quality assurance.

PBS has established 495 Census Support Centers (CSC) at the Census District level and 495 Census Support Centers (CSC) at the tehsil level where over 1,095 IT experts of NADRA and PBS team are available 24/7 for technical assistance and facilitation of field staff.

The control room has been established at the CSC level which facilitates census field staff during field operation and for this purpose, NADRA technical teams are available to redress all IT-related issues.

A call center is operating 24/7 for facilitation, assistance and suggestions through the toll-free number 0800-57574.

It said, certain quarters were spreading false and misinformation, adding information shared on the PBS website and official social media should be believed and considered.

Why are women in #China not having more babies despite gov't incentives? With rapidly #aging and declining #population and slowing #economic growth, China’s leaders are asking #women to have three children again, but it's too late. #economy #fertility https://www.marketplace.org/2023/03/17/why-are-women-in-china-not-having-more-babies/

Fewer people might mean slower growth in China, which will be felt by the U.S. and beyond.

“They’ve now become, you know, the center of the global manufacturing superhighway and are typically the largest contributor to growth every year,” said Scott Kennedy with the Center for Strategic and International Studies in Washington D.C.

Chinese officials often credit the so-called one-child policy for preventing over 400 million births, but some analysts say China’s population would have declined regardless.

“It’s just simply a rule across all countries, that as you urbanize, and as you get a more educated female population that enters the workforce, fertility numbers fall,” Kennedy said.

-------

The number of Chinese workers is already declining; according to the World Bank, in 2001, China had 10 workers to support one retiree.

“In 2020, that was down to five working folks for each retiree and by 2050 it’ll be down to two,” Kennedy said.

He believes China still has time to offset the effects of population decline, including by boosting productivity, increasing the retirement age and lifting restrictions on people from rural areas to freely settle in cities with their families.

“I don’t think the problem has become so severe that demography is destiny, and China is destined to radically slow down and its chances of becoming an economic superpower breaking out of the middle income trap have been dashed,” Kennedy said.

“[But] these are pretty significant challenges.”

------

28-year-old Joy Yu’s parents each had three siblings. As they were growing up in the 1970s, the Chinese government started to limit the number of babies born.

Government statistics show on average a woman in China went from having about three babies in the late 1970s to just one.

Four decades on, China’s leaders are asking women to have three children again, which doesn’t sit well for Yu, an only child.

“For me to give birth to three children, my future husband must be rich enough to make sure I can live well without a job. This is a big challenge,” Yu said.

Last year, China’s population dropped for the first time in six decades by 850,000. That still leaves the country with 1.41 billion people but if the decline continues, there will be multiple impacts on the economy.

China began enforcing birth limits in the late 1970s when the country was poor and there were too many mouths to feed.

In a Chinese propaganda film called the Disturbance of Gan Quan Village, the birth restrictions were justified on economic grounds.

“We should put our energy into getting rich rather than keep having children,” says one woman in the film.

She’s sitting among a group of women picking corn kernels off the cob. “Aren’t we getting poorer with each child we have,” she says. The rest of the group nods in agreement.

Chinese leaders enforced, sometimes brutally, the so-called one-child policy in 1979, just as the country was coming out of the tumultuous Cultural Revolution.

“The post-[Chairman] Mao leadership thought that economic development would be the new basis for the party’s political legitimacy and based on pseudo-scientific and demographic projections, limiting birth to one child per married heterosexual couple,” said Yun Zhou, an assistant professor of sociology at the University of Michigan.

There were exceptions. Some ethnic minority groups could have up to three children. People from rural areas could try for a second child if their first-born was not a boy. Later, if both parents had no siblings they could have two children. Starting in 2016, China raised the birth limit for everyone to two children, but there was no sustained baby bump.

Country’s brain drain situation accelerated in 2022

Official documents showed more than 765,000 educated youth leave country for employment overseas

https://tribune.com.pk/story/2390704/countrys-brain-drain-situation-accelerated-in-2022

According to the official documents from the Bureau of Emigrants, this year 765,000 young people went abroad. The documents also showed that the number of emigrants had risen after registering a fall in two consecutive years, following 625,000 emigrations in 2019.

According to the documents, those who left the country in 2022, included more than 92,000 graduates, 350,000 trained workers and the same number of untrained labourers went abroad. The documents also showed that 736,000 people went to the Gulf states.

The emigrating educated youth included 5,534 engineers, 18,000 associate electrical engineers, 2,500 doctors, 2,000 computer experts, 6,500 accountants, 2,600 agricultural experts, over 900 teachers, 12,000 computer operators, 1,600 nurses and 21,517 technicians. The group of unskilled workers comprised 213,000 drivers.

According to the data, over 730,000 youth went to the Gulf States, nearly 40,000 went to European and other Asian countries. The country-wise break down of the data showed 470,000 Pakistanis headed to Saudi Arabia for employment, 119,000 to UAE, 77,000 to Oman, 51,634 to Qatar and 2,000 to Kuwait.

Also, according to the official documents, 2,000 Pakistanis went to Iraq, 5,000 to Malaysia, 602 to China, 815 to Japan, and 136 to Turkey. The documents also revealed that 478 Pakistan went to Sudan in Africa in search of employment.

The highest number of people emigrating to a European country was 3,160 youth, going to Romania. It was followed by 2,500 to Great Britain, 677 to Spain, 566 to Germany, 497 to Greece, and 292 to Italy. The Bureau of Emigrants also registered 700 people going to the United States.

More than half of those leaving the country were from Punjab. The documents said 424,000 emigrants this year were from Punjab, 206,000 from Khyber-Pakhtunkhwa plus 38,000 from newly-merged tribal districts, 54,000 from Sindh, 27,000 from Azad Kashmir, 7,000 from Balochistan and 6,000 from Islamabad.

Dependency ratio is the ratio of children (under 15) and retirees (65 and above)) to working age (15-64 years) people in a population. Countries with high dependency ratios tend to perform poorly relative to countries with low dependency ratios in terms of economic growth.