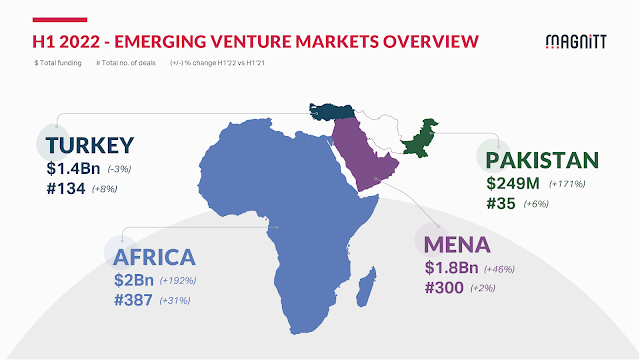

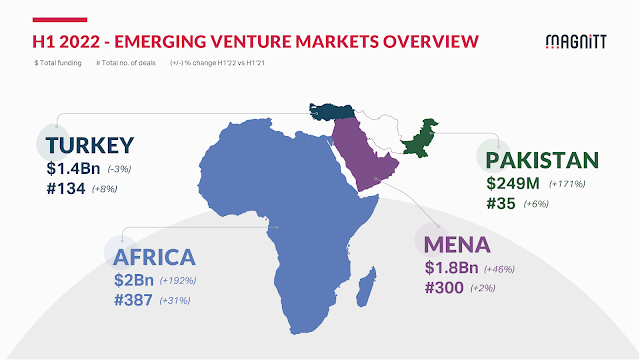

Technology startups in Pakistan received record $249 million funding during January-June 2022, up a whopping 171% from the same period last year. A total of 35 deals closed, up 6% from the first half of 2021. July 2022 saw a maiden investment from Sequoia Capital which is considered among the top venture capital firms headquartered in Silicon Valley, California. Last year was a banner year for Pakistani startups with $310 million venture capital investments.

|

Venture Capital Investments in MENAPT Region 1H/22. Source: Magnitt

|

Sequoia Capital and Kleiner Perkins co-led $17.6 million seed round in Islamabad-based fintech startup DBank this month. DBank has been founded by Tania Aidrus and Khurram Jamali, both of whom have studied the challenges the unbanked population faces closely at their previous stint at Google, where they worked on payments rails for the company’s Next Billion Users initiative, according to

Tech Crunch.

Pakistani startups set a record in 2021 with $310 million venture capital investments, more than the previous six years combined, according to

Bloomberg. The South Asian nation has seen a wave of investments from many global venture capital firms, including Sequoia Capital and Kleiner Perkins -- early investors in Google and Amazon.com Inc.

|

| Venture Capital Investments in MENAPT Region 1H/22. Source: Magnitt |

Pakistan's

technology sector is in the midst of an unprecedented boom. It is being fueled by the country's growing human capital and rising investments in technology startups. A

tweet by Swedish fund manager Mattias Martinsson captured it well when he wrote, "Have followed Pakistan for 15 years. Can't recall any time time when VC activity was anywhere near we've seen in the last few months. Impact of reforms kicking in?". New laws have made it easier to create startups and offered greater protection to investors. Digital infrastructure has expanded with over 100 million smartphones and an equal number of broadband subscriptions.

With expanding Internet infrastructure and rapidly growing user base, Pakistan is now seeing robust growth in venture money pouring into technology startups. Pakistani startups have already attracted more than $310 million in funding in FY 2021-22, more funds than all the money raised by Pakistani startups in their entire history. A recent example is Kleiner Perkins, a top Silicon Valley venture capital investment firm, that led a series A round of $17 million investment into

Pakistani start-up Tajir. The startup operates an online marketplace for small store merchants in Pakistan. The announcement came via a

tweet by Mamoon Hamid, a

Pakistani-American Managing Partner at Kleiner Perkins who led the investment. Last year, Tajir raised a $1.8 million seed round. The company's revenue has increased by 10x since its seed round. Another example is Sequoia Capital's first investment in Pakistan this month.

Pakistan's technology exports are experiencing rapid growth in double digits over the last decade. Total technology exports jumped 22% to $2.6 billion in fiscal year 2021-22, as reported by

Arif Habib Securities.

The foundation for Pakistan's digital transformation was laid with the higher education reform and telecommunications deregulation and investments starting in the year 2001 on President Musharraf's watch. With a huge increase in higher education funding, Higher Education Commission Chairman

Dr. Ata ur Rehman succeeded in establishing 51 new universities during 2002-2008. As a result, university enrollment (which had reached only 275,000 from 1947 to 2003) soared to about 800,000 in 2008. This helped build a significant human capital that drove the IT revolution in Pakistan.

Please watch the following video presentation for more details on Pakistan's technology startup ecosystem:

https://youtu.be/ePApXOM3vkQ

51 comments:

Not strange given the ever-growing percentage of Pakistanis within Pakistan that venture into that field whether by choice of education or due to the business opportunities that present itself.

This sector (as is the case of the overall private sector) is less prone to corruption and outside interference from the establishment, thus it makes it a much more interesting, safe and profitable sector to invest in within Pakistan, rather than the ineffective and corrupt public sector or sector where you need direct local involvement, say the mineral (unexplored mostly so far) sector.

Most serious long-term foreign investors would never invest in any public sector in Pakistan as things stand right now.

Do note that all of this happened during the global startup recession.

Hindoos are getting funded by their government.. we should also actively seek domestic investment and also Chinese parternships..

https://www.livemint.com/economy/india-witnesses-a-massive-15-400-rise-in-startups-in-last-6-years-11658627326219.html

Rupee depreciation is going to be a concern..Exit routes are choked..and risk vs reward is something to ponder about..

https://www.dawn.com/news/1702261

Azhar: "Rupee depreciation is going to be a concern..Exit routes are choked..and risk vs reward is something to ponder about.."

Top VCs like Sequoia Capital and Kleiner Perkins understand long-term risks and rewards of investing in emerging markets like Pakistan. They know that Pakistan, forecast to be the world's 7th largest consumer market by 2030, is a vast untapped market for them.

https://www.southasiainvestor.com/2021/12/pakistan-forecast-to-become-worlds-7th.html

ibex. Pakistan which is also a subsidiary of TRG (The Resource Group) has announced that it will add a new, state-of-the-art, 500 Seat Facility in Karachi to cater to the expansion of its export of business process outsourcing services for some of its largest US-based customers in the retail and financial services sectors.

https://propakistani.pk/2022/07/30/ibex-pakistan-adds-state-of-the-art-500-seat-facility-in-karachi-to-cater-to-its-export-expansion/

The facility is expected to be in production by end of the year and will house roughly 800 professionals entirely geared toward the export of IT-enabled services.

“Our largest customers continue to have a positive view of the quality of our human resources, particularly for back-office and call center services from Pakistan”, said Nadeem Elahi Country Manager for ibex. Pakistan, Middle East & North Africa.

He added, “We are extremely excited to continue our growth, particularly in Karachi where we continue to source top-quality people. We plan to hire over 1,000 customer services professionals in the next 3 months in Karachi in both call center, back-office, and chat services geared towards our international customers.”

“I strongly believe that in a difficult time like this for Pakistan, IT and IT enabled services can still continue to grow strongly, and play a major role in the diversification of exports of the country,” said Nadeem.

Nadeem further added, “ ibex. is offering highly attractive packages of an average over PKR 80,000 per month. The customer services industry is a great starter to any young professional’s career as it offers an excellent opportunity to build one’s personal communication and professional skills. Therefore, I strongly encourage everyone seeking a good opportunity to visit our website and apply immediately”.

Riaz bhai, What is the USD stock yields in Pakistan like over the last 10-15 years? And what would be your projection for next 10-15 years. For those going in with currency that is all matters. Being 10th largest producer and 7th largest consumer will not be be of any help as we consume more than we produce ! Size matters negatively when it comes to obesity...

If investors are coming to Pakistan because it is 7th largest consumer market, then why are investors fleeing India according to your previous article? Is the Indian market not bigger?

Anon: "If investors are coming to Pakistan because it is 7th largest consumer market, then why are investors fleeing India according to your previous article? Is the Indian market not bigger?"

Investors are looking for other large untapped markets by diversifying away from India and China where they have already invested heavily over the last several decades.

BRICS are losing their luster. Investors are much less bullish on them today than they were a decade ago.

Ex #RBI Gov R. Rajan: Turning #Muslims Into "2nd Class Citizens" Will Divide #India. Warning against majoritarianism, he cited #SriLanka as an example of what happens when politicians try to deflect a job crisis by targeting minorities. #Modi #Islamophobia https://www.ndtv.com/india-news/turning-minority-into-2nd-class-citizens-will-divide-india-raghuram-rajan-3209792

Former Reserve Bank of India Governor Raghuram Rajan on Saturday said India's future lies in strengthening liberal democracy and its institutions as it is essential for achieving economic growth.

Warning against majoritarianism, he said Sri Lanka was an example of what happens when a country's politicians try to deflect a job crisis by targeting minorities.

Speaking at the 5th conclave of All India Professionals Congress, a wing of the Congress party, in Raipur, he said any attempt to turn a large minority into "second class citizens" will divide the country.

Mr Rajan was speaking on the topic 'Why liberal democracy is needed for India's economic development'.

".What is happening to liberal democracy in this country and is it really that necessary for Indian development? ... We absolutely must strengthen it. There is a feeling among some quarters in India today that democracy holds back India ... India needs strong, even authoritarian, leadership with few checks and balances on it to grow and we seem to be drifting in this direction," Mr Rajan said.

"I believe this argument is totally wrong. It's based on an outdated model of development that emphasizes goods and capital, not people and ideas," said the former chief economist of the International Monetary Fund.

The under-performance of the country in terms of economic growth "seems to indicate the path we are going on needs rethinking," he said.

The former RBI governor further said that "our future lies in strengthening our liberal democracy and its institutions, not weakening them, and this is in fact essential for our growth."

Elaborating on why majoritarian authoritarianism must be defeated, he said any attempt to "make second class citizens of a large minority will divide the country and create internal resentment." It will also make the country vulnerable to foreign meddling, Me Rajan added.

Referring to the ongoing crisis in Sri Lanka, he said the island nation was seeing the "consequences when a country's politicians try to deflect from the inability to create jobs by attacking a minority." This does not lead to any good, he said.

Liberalism was not an entire religion and the essence of every major religion was to seek out that which is good in everyone, which, in many ways, was also the essence of liberal democracy, Mr Rajan said.

Claiming that India's slow growth was not just due to the COVID-19 pandemic, Mr Rajan said the country's underperformance predated it.

"Indeed for about a decade, probably since the onset of the global financial crisis, we haven't been doing as well as we could. The key measure of this underperformance is our inability to create the good jobs that our youth need," the former RBI governor said.

Ex #RBI Gov R. Rajan: Turning #Muslims Into "2nd Class Citizens" Will Divide #India. Warning against majoritarianism, he cited #SriLanka as an example of what happens when politicians try to deflect a job crisis by targeting minorities. #Modi #Islamophobia https://www.ndtv.com/india-news/turning-minority-into-2nd-class-citizens-will-divide-india-raghuram-rajan-3209792

Citing the strident protests against the Centre's 'Agniveer' military recruitment scheme, Mr Rajan said it suggested how hungry the youths were for jobs.

"Just a while ago you saw 12.5 million applicants for 35,000 railway jobs. It is particularly worrisome when India has a scarcity of jobs even when so many women are not working outside their homes. India's female labour force participation is among the lowest in G-20 at 20.3 percent as in 2019," he pointed out.

Talking about the "vision of growth" of the current government led by Prime Minister Narendra Modi, he said it centres around the term 'atmanirbhar' or self-reliance.

"Now, to the extent it emphasizes better connectivity, better logistics, better roads and devotes more resources to it, in some way this (atmanirbhar vision) seems the continuation of the past reformed decades. And that's good," he said.

But, the former RBI governor said, in many ways a look at what 'atmanirbhar' is trying to achieve takes one back to an early and failed past where the focus was on physical capital and not human capital, on protection and subsidies and not on liberalization, on choosing favourites to win rather than letting the most capable succeed.

Asserting that there was a misplaced sense of priorities, Mr Rajan said the nation was not spending enough on education, with tragic consequences.

"Many (children) not having been to school for two years are dropping out. Their human capital, which is their and our most important asset in the coming years, is something we are neglecting. We are failing them by not devoting enough resources to remedial education," Mr Rajan said.

#Pakistan’s #fintech #startup OneLoad secures $11 million in funding. This #investment round led by Sarmayacar and Shorooq Partners. Other investors include Gates Foundation and IFC. https://www.brecorder.com/news/40189369

The company said that "the strategic collaboration with regulated financial partners and banks has led to daily disbursements worth Rs10+ million, which created horizons of accelerated growth for numerous micro-retailers across the country."

OneLoad operates through its 40,000 agents and conducted about $100 million in transactions last year. The company wants to increase daily transaction to one million a day from the current level of up to 400,000, founder and CEO Muhammad Yar Hiraj was quoted as saying by Bloomberg.

Under digital products and payments, OneLoad offers mobile top-ups, internet packages, and media and entertainment services. Under banking access, OneLoad enables money transfers, utility bill payments, deposits and withdrawals for digital wallets, wallet account opening and biometric verification, and government-to-person (G2P) payments – in partnership with banks.

“We are excited to bring new partners to the company like Sarmayacar and Shorooq Partners,” Hiraj was quoted as saying in the PSX notice.

“Working with them brings valuable tech and venture capital expertise to the company and pushes us to continue to innovate and evolve with the regional and global markets. Our vision is to fully digitise the financial needs of the unbanked and the financially excluded masses in Pakistan," he said.

Pakistan, China aim to boost tech cooperation

Ink Letter of Intent to create world-class technology ecosystem

https://tribune.com.pk/story/2369046/pakistan-china-aim-to-boost-tech-cooperation

Shenyang Economic and Technological Development Area (Seda) of China and the Special Technology Zones Authority (STZA) of Pakistan have signed a Letter of Intent (LOI) to boost cooperation in technology sector between the two organisations.

Established in 1988, Seda is a production hub of major biotech and automobile organisations including the BMW Group, Neusoft, Pfizer, NCR and Ikea.

Speaking to a virtual ceremony, Seda’s Director of Management Committee Zhao Yongsheng highlighted the company’s successes, according to a press release issued on Monday.

Seda hosts the largest manufacturing facility of BMW in the world, while 84 Fortune 500 companies from all over the globe are operating in Seda’s hi-tech manufacturing, automotive, research and development areas.

Zhao hailed the strong relationship between China and Pakistan and pledged his organisation’s support and cooperation with the STZA in the areas of innovation, entrepreneurship, human capital development and digital economy through the integration of science, technology and economy.

Speaking on the occasion, STZA Chairman Amer Hashmi stated that due to its rapid growth, Pakistan’s technology sector offered globally competitive opportunities for Chinese partners and investors.

He highlighted that Pakistan had a unique demographic advantage, as almost 64% of its population consisted of youth, and saw great potential in working with Seda through the STZA’s dedicated China Desk to streamline cooperation with the Chinese technology sector.

He praised Pakistan’s Ambassador to China Moinul Haque and the leadership of Seda for enabling cooperation between the STZA and Seda and expressed his support for implementing the shared vision.

Shenyang Municipal People’s Republic Vice Mayor Gao Wei stated that China and Pakistan were strategic partners, with a long history of peaceful cooperation in various development sectors.

He explained that Shenyang was creating hubs for scientific, industrial and technological growth, with special focus on fintech.

He vowed to support cooperation between Seda and the STZA, saying that the technology sector represented a new avenue for potential cooperation between the two friendly nations.

Ambassador Haque highlighted the longstanding ties between the two countries and appreciated the STZA chairman and his team for their efforts to foster the knowledge economy in Pakistan.

He affirmed the commitment of Pakistan’s embassy in China to facilitating the ongoing engagements between the STZA and the technology ecosystem in China and called the LOI a step forward towards strengthening linkages and relationship between the two countries.

He hoped that both sides would increase their cooperation under a joint working group to practically implement the shared vision of creating a world-class technology ecosystem in Pakistan, creating jobs and empowering the youth through the technology-led economic transformation.

The United Arab Emirates is planning to invest $1 billion in Pakistani companies spanning various sectors, state-run news agency WAM reported Friday.

The investments will cover fields including gas, energy infrastructure, renewable energy, health care, biotechnology, agricultural technology, logistics, digital communications, e-commerce and financial services, WAM said.

https://www.bloomberg.com/news/articles/2022-08-05/uae-to-invest-1-billion-in-pakistan-from-gas-to-logistics#xj4y7vzkg

More startups to emerge

Food delivery platform CEO says young entrepreneurs will learn from crisis

Usman Hanif

https://tribune.com.pk/story/2370258/more-startups-to-emerge

Startups are a relatively young industry in Pakistan. “We have investors with little or no experience in emerging markets which operate differently than developed markets,” said Foodpanda CEO.

On the flip side, young people who have founded companies and run them have not been exposed to proper mentoring and this has resulted in glaring blindspots. As a consequence, while some people have succeeded, others have not been able to sustain themselves in the long run. Crucially, there may have been more work done on the fundamentals if entrepreneurs starting out in the industry had gained more experience, said Muntaqa Peracha.

In order to draw in more foreign investment, the government and the State Bank have relaxed rules for attracting investment in tech-based startups and are working on regulations that will permit investors to repatriate profits and capital and ease overall corporate operations, Waqas Ghani said.

Pakistani economy will undoubtedly benefit from fostering entrepreneurship in a balanced way. There is a lot of work being done on the digital banking side already and there is definitely hope that entrepreneurship will rise again, Waqas added.

“It was difficult to predict that things will change this rapidly in the startup industry. But now people have experienced and understood the worst-case scenario. At that time, no one had any idea of the worst-case scenario. As they were raising money at the time, from mid-2020 to the first quarter of 2022, everything seemed fine. Now, people know that this is the worst-case scenario and we have to prepare for it while growing at the same time,” Muntaqa Peracha said.

Non-bank finance firms disbursed over Rs6.14bn loans digitally

https://www.dawn.com/news/1673391/non-bank-finance-firms-disbursed-over-rs614bn-loans-digitally

Licensed digital lending Non-Bank Finance Companies (NBFCs) have made rapid progress and started to show disruption in Pakistan’s lending landscape and are proving to be significant in furthering the journey of financial inclusion, data shared by the Securities and Exchange Commission of Pakistan (SECP) showed on Friday.

The SECP has licensed six fintech-enabled NBFCs, which have collectively reached out to 365,239 borrowers with disbursement of over Rs6,139 million through 858,998 loans, which signifies that many borrowers have obtained more than one loan from these lenders.

The data released by the SECP shows that the average loans size of these digitally-enabled NBFCs ranges from Rs1,000 to Rs80,000 depending upon the nature of business and target market of these entities.

“These are small loans available easily for the borrowers, but since these are digital-based, the borrowers cannot default and ignore the repayment,” said a senior official of the SECP adding that the data of defaulters is shared with the State Bank of Pakistan as a result the defaulter cannot avail any other financial service.

The official added under this lending mode, the small amount request by the borrower is credited into the digital wallet of the borrower within few hours as digital processing of the loan is fast and does not require any guarantee.

Newly licensed digital lending NBFCs include Finja Lending Services Limited, SeedCred Financial Services Limited, Qisstpay BNPL Limited, Tez Financial Services Limited, Cashew Financial Services Limited and CreditFix Financial Services Limited. These NBFCs are providing financial solutions to otherwise unserved and underserved through digital means and include Nano lending, Peer-to-Peer (P2P) Lending and Buy-Now-Pay-Later models etc.

All of these licences have been issued during the last three years to NBFCs that are engaged in digital lending using innovative fintech solutions.

The first fintech-enabled NBFC licence was issued in 2019 and only 55,528 requests were honoured, disbursing Rs495 million, while by the end of 2021, the six licence holders disbursed a total of Rs6.13 billion to 365,239 borrowers.

“This is a solution to the traditional complaint that the banks were not interested in small loans, and the majority of borrowers were those who either did not possessed credit cards or wanted to spend the amount in any sector which does not deal in credit cards,” the official added.

The SECP has said that fresh applications have been received for NBFC licence from investors who intend to engage in fintech based lending.

Unfortunately their is no proper guidance in Pakistan , their are hardly any mentors or business consultants in Pakistan who can guide and help these students who are willing to have their own startups .

The reason I think startups are more successful in western countries and in developed countries is because they have mentors and business consultants from whom they can take advices , ideas and suggestions .

If you like IT, put a ring on IT

The recent fall in IT exports, Pakistan’s great new hope, is a reality check posing a number of biting questions for the industry and authorities

https://profit.pakistantoday.com.pk/2022/07/31/if-you-like-it-put-a-ring-on-it/

“What gave India the respect that they are interacting with the world today? It was their IT industry, which is why you people (Pakistani IT industry) are extra important,” Abdul Razak Dawood, the then Adviser for Commerce and Investment, said in January while praising the industry in his address to the Board of Investment (BOI) IT roundtable conference.

The optimism from back then may have fallen flat in recent times as IT exports and services for May 2022 were recorded at $189 million – decreasing by 27% compared to April 2022 and 8% from May 2021. The final numbers are still awaited, but the financial year 2021-22’s export target for the sector, around $3.7 billion, is likely to be missed by a massive $1 billion.

Many experts anticipated the end of what has been a dream run for the IT sector, primarily because of the unstable rupee and demand slowdown in the two key markets of North America and Europe.

“The post-Covid boom in the IT sector was partly because central banks across jurisdictions printed money and governments announced schemes to promote business activity. This led to demand creation, which translated into greater interest in the country’s IT sector by foreign businesses,” Asad Ghauri, President Asia-Pacific, and Group MD Europe at NetSol Technologies Inc, told Profit.

“Now, the focus is on contractionary measures, and as the funding dries up, demand is likely to plunge, resulting in a difficult next few months for the industry.” Ghauri added.

However, the industry has a consensus on the issue that these temporary jitters can do some permanent damage if the structural and policy flaws of the sector are not addressed.

IT sector treated like a stepchild?

The reservations of the industry stem from the lack of policy continuity and initiative by the government. An example is the reversal of the tax-exempt status of the sector in March 2021.

“IT industry, unlike traditional industries, operates differently. Changing the tax regime in the mid of the fiscal year, despite the original commitment till 2025, creates not only uncertainty and a state of panic about inconsistent policies but also raises questions about the understanding of the government about the gravity of the situation of how it will jeopardize the growth,” Pakistan Software House Association said in a statement on their website.

Faseeh Mangi

@FaseehMangi

PayPal founder and billionaire investor Peter Thiel invests in Pakistan's startup space for the first time

Thiel participates in PriceOye's round

It sells consumer electronics such as mobile phones and raised $8 million in seed funding

https://twitter.com/FaseehMangi/status/1564530785326997504?s=20&t=W9ka4RkZQYndO2lUjcTKdA

----------------

A Pakistani startup, which has taken inspiration from China’s JD.com and India’s Flipkart to build a managed marketplace of electronics products, said on Tuesday it has raised seed funding from scores of investors including PayPal founder Peter Thiel.

Launched in March 2020 — just two weeks before the COVID-19 pandemic ravaged the world — the Islamabad-based startup PriceOye offers a range of electronics products, including smartphones, TVs and home appliances.

Its seed funding round was led by JAM Fund, a venture capital firm by Tinder founder Justin Mateen. The institutional funding round also included participation of Beenext, DG Daiwa, Mantis VC, HOF Capital, Jet.com investor Palm Drive Capital and Atlas Ventures, among others. Angels including Thiel, Immad Akhud of Mercury Bank, and Asif Keshodia of Souq also participated in the round — alongside previous investors Fatima Gobi Ventures, SOSV, and Artistic Ventures. This is Thiel’s maiden investment in Pakistan.

PriceOye has served 45 million unique users in Pakistan in the last two years, covering 37.5% of the country’s total internet userbase, Adnan Shaffi, co-founder and CEO of the startup, told TechCrunch in an interview.

“We are the second most visited shopping website in the entire country, with over two and a half million monthly active users coming on the platform, doing research using our product recommendation engine, and then getting to know about different products,” he said.

After exiting two startups, Adan and his brother Adeel Shaffi got the idea of launching PriceOye when they were doing “a lot of island hopping” in Southeast Asia. The duo looked at several startups in Indonesia and India and found the Asian markets were seeing similar consumer internet trends play out — just at a different pace. They built a thesis that Pakistan will see similar adoption of consumer internet services in the next four to five years.

https://techcrunch.com/2022/08/29/pakistan-priceoye-pk-7-9-million-usd-seed-funding-jd-com-managed-electronics-marketplace/

Faseeh Mangi

@FaseehMangi

* Pakistani startup PostEx has acquired a logistics company to make it the nation's largest e-commerce delivery firm

* It started in 2019 by going door-to-door to small shops for business

* The combined entity will handle 50,000 orders a day https://www.bloomberg.com/news/articles/2022-08-30/postex-buys-rival-to-become-top-e-commerce-courier-in-pakistan?sref=8HTMF4ka

https://twitter.com/FaseehMangi/status/1564496822860668938?s=20&t=bm3zHr6frEJ4qFEhxINcXA

-----------

Pakistani startup PostEx, a provider of courier and financing services to online merchants, acquired logistics company Call Courier in a deal that makes it the nation’s largest e-commerce delivery firm, according to its founder.

The combined entity will be handling about 50,000 orders a day, a scale that makes it profitable, founder Muhammad Omer Khan said without disclosing a value for the deal. The acquisition gives PostEx delivery operations in 500 Pakistani cities, compared with its previous base that consisted of just the three main ones.

“While others are going on the backfoot and slowing down, we plan to become even more aggressive,” Khan, who is PostEx’s chief executive officer, said in an interview in the southern city of Karachi.

Pakistan, whose population of about 230 million makes it the world’s fifth-largest nation, is attracting interest from global investors as its online businesses gain users. The country’s startups raised more than $350 million in 2021, a record, with several global venture funds investing for the first time. PostEx raised $8.6 million last year in one of Pakistan’s largest early-stage funding rounds.

More than 90% of e-commerce deliveries in the South Asian nation are paid for in cash, resulting in long delays before the merchants receive the proceeds for the sale. PostEx offers these businesses upfront payments before deliveries are made, giving them liquidity. The financing services help PostEx stand out from the region’s other delivery companies, Khan said.

Pakistan’s e-commerce industry has lured the most investment in the recent funding rush. The majority of the population still hasn’t switched to online shopping, providing room for the sector to grow and transactions to reach $10 billion before 2025 from about $6 billion now, Khan estimates.

Khan started PostEx in 2019 with a friend, going door-to-door to small shops to convince them to allow the company to handle their deliveries. The acquisition more than triples its number of employees to 2,400.

#Pakistan #PropTech #Startup Scene a Standout Among #EmergingMarkets.A huge, young/growing population needs #housing & other #realestate services.The country’s only #unicorn — EMPG, the Emerging Power Market Property Group — came out of the proptech sector https://commercialobserver.com/2022/09/pakistan-proptech-companies/#.Yxdr9Y1KD4I.twitter

Because Pakistan’s black market is three times the size of the nation’s legitimate economy, real estate is the only industry outperforming other asset classes, said Arif.

-------

A country of 230 million people with a median age of 23, Pakistan is embracing proptech innovation as a means to more efficiently increase housing availability and other real estate services. The proptech industry in turn is providing new job opportunities for Pakistan’s growing number of highly educated young people.

Atif Bin Arif, founder and CEO of Karachi-based MyGhar, a coliving startup that provides furnished private and shared rooms with all-inclusive billing, said his decision to start the company was based on his trying to rent an apartment in Islamabad, the country’s capital. He found that Pakistan’s residential culture was a problem for a young bachelor looking to rent.

“You know, we live with our parents over here,” said Arif, who was raised in Toronto and moved back to Pakistan 10 years ago to take over his family’s travel and hospitality business. “It’s just a cultural norm that families live together and move out when they get married.”

However, Arif wasn’t married as he looked for an apartment.

“That was the first time I moved between cities as a temporary move,” he said. “As a single male, that was one of the most daunting tasks I have ever come across. If you visited 10 properties, 10 out of 10 landlords would say no to bachelors because they would think they’re going to come and ruin the place. So, culturally, that was a problem.”

It took Arif nearly two months to find a place.

“Also, it was expensive,” he added. “They would ask for three months’ deposit, three months advance rent, and one month of broker fees. It was a completely offline process. I would be going on classified websites, visiting properties, and physically exhausted. That’s where the Eureka moment happened: I am someone with resources and it’s taking me this long and it’s this daunting of a task? Imagine the average individual.”

------------

“Funds cannot be parked anywhere except [in real estate],” he said. “I realized that’s where I wanted to be. There was no dedicated housing solution. And I thought that if I can create furnished spaces that are move-in ready that people can book on a monthly basis, completely flexible and digital, we might be solving one of the most pressing needs in the housing industry in Pakistan. That’s what we’re out to build.”

The market is huge and growing. About 500,000 Pakistanis graduate college annually, and one-fifth of those move to city centers, Arif said.

Pakistan’s foreign direct investment in June 2022 was $271 million, according to CEIC. The country’s only unicorn — EMPG, the Emerging Power Market Property Group — came out of the proptech sector.

Given Pakistan’s vast market potential, its housing challenge is not the only area where proptech startups are looking to provide solutions. The workplace is being disrupted and digitized, as well.

“We provide flexible workspace solutions across coworking enterprise offices,” said Omar Shah, co-founder and CEO of Colabs, a Lahore-based proptech firm founded in 2019.

#Pakistan #PropTech #Startup Scene a Standout Among #EmergingMarkets.A huge, young/growing population needs #housing & other #realestate services.The country’s only #unicorn — EMPG, the Emerging Power Market Property Group — came out of the proptech sector https://commercialobserver.com/2022/09/pakistan-proptech-companies/#.Yxdr9Y1KD4I.twitter

Having seen the traditional Pakistan real estate market that has existed for decades — one he characterized as grossly inefficient and expensive — Shah realized it was ripe for digital disruption.

“I did this because it was the sharing economy,” he said. “The whole concept of the sharing economy is that the same spaces are used by multiple people. And as we move towards a more flexible world, people realize that these solutions are more organized and better fitted in terms of what we’re all doing.”

Colabs bills itself as the fastest-growing flexible workspace in Pakistan. It provides back-office services; HR payroll accounting, for which it is developing a SaaS platform; and an entrepreneurial division for events, workshops and training that acts as an accelerator for other startups.

Similar to MyGhar’s Arif, Shah sees great opportunity and growth for Pakistan proptech.

“I am a former investment banker and investor,” said Shah. “I spent nine years doing private equity venture capital in London and across emerging markets, including Dubai, Latin America, Turkey and Africa. I moved back three years ago to start COLABS. Today we are the top company in the country in terms of speed of growth. We are managing about 1,200 seats across multiple locations. In the next 12 months we hope to get up to 3,000 seats.”

In March, Colabs raised a $3 million seed round from venture capital firms in Pakistan and internationally, said Shah. “Our investors include Fatima Gobi Ventures, Indus Valley Capital, Shorooq Partners, Kinnow Capital, Zayn Capital, as well as angel investors.”

Also, like MyGhar, COLABS is part of a Singapore-based holding company, said Shah. “It’s very common in Pakistan to have your holding company in Singapore, or the Cayman Islands, or Delaware,” he said. “The holding company makes it easier for investors to raise money at the seed or series level by having a foreign audit.”

Although U.S. investment in Pakistan-based proptech startups remains rare, interest in the market is growing, said Zach Aarons, co-founder and partner at MetaProp, a Manhattan-based early-stage proptech startup investment firm.

“A few reasons why I’m excited about the proptech ecosystem in Pakistan is that it’s such a large and young country,” said Aarons. “It has a favorable regulatory environment for fintech and an inefficient current real estate market. Plus, it has high mobile phone penetration and very quickly growing internet access.”

In fact, over the last 18 months, U.S.-based general technology venture capital firms such as Tiger Global Management and Kleiner Perkins have begun slowly to invest in Pakistan proptech startups, said COLABS’ Shah. However, he admits that Pakistan still trails far behind other emerging proptech markets such as India, Indonesia, Singapore and Vietnam.

As a Pakistan-born immigrant to the U.S., Farhan Masood, president and CTO of Soloinsight, a leading workflow automation and security proptech company founded in 2018 and based in Chicago, has a unique perspective on what’s happening in his homeland.

“I think things are changing now,” Masood said of Pakistan. “Things have drastically changed. If you look at the amount of investments that are coming to Pakistan, proptech is the most [exciting]. Ask any Pakistani, ‘What’s your dream?’ The dream is to own a house.”

In such a huge population, home buyers and renters are met with major inefficiencies due to a lack of product as well as no established financing, government support or conventional mortgage systems, he said. “You don’t have any of that support, so the market isn’t right for a huge amount of business.”

#Pakistan #PropTech #Startup Scene a Standout Among #EmergingMarkets.A huge, young/growing population needs #housing & other #realestate services.The country’s only #unicorn — EMPG, the Emerging Power Market Property Group — came out of the proptech sector https://commercialobserver.com/2022/09/pakistan-proptech-companies/#.Yxdr9Y1KD4I.twitter

In such a huge population, home buyers and renters are met with major inefficiencies due to a lack of product as well as no established financing, government support or conventional mortgage systems, he said. “You don’t have any of that support, so the market isn’t right for a huge amount of business.”

As for Soloinsight, it is a somewhat rare Pakistan-U.S. proptech startup, Masood said.

“We started in Pakistan and moved to the United States and now focus on some of the most iconic buildings and Fortune 500 customers,” said Masood, who received the so-called “genius visa” after attending the MIT Business Acceleration Program.

“I’m actually a dropout, but I have a lot of contributions and patents around authentication, facial recognition technology, machine vision and data analytics. I’ve worked with national databases for identity management,” Masood said of his more than 23 years of working to make building infrastructures secure.

Soloinsight has 114 employees, 104 of whom are based in Lahore, with the other 10 in Chicago. The company’s leading product, CloudGate, is a visitor identity and access management (VIAM) platform that delivers security and an intuitive guest and host experience at multiple locations via the cloud. The startup has integrated its product with access control and visitor identity firms, such as Honeywell, Johnson Controls and LenelS2.

Despite the various types and degrees of ongoing chaos in Pakistan — including a parliamentary no-confidence vote in April that ousted Prime Minister Imran Khan and recent catastrophic flooding — MyGhar’s Arif is bullish on the country’s proptech potential.

“It’s a huge opportunity,” he said. “I think the fact that there’s less competition here is the opportunity, which is why we’re all here. It’s why we work day in and night out, regardless of the economic and political turmoil.”

Kalsoom Lakhani

@kalsoom82

1/ As of today, Pakistani startups have raised $322M in 2022 (YTD) via 48 deals. Just to give perspective, in 2021, we ended the year w/ startups raising $350M via 83 deals. Not bad considering (a) we still have Q+1 mo left in 2022 & (b) the global slowdown & PK's macro./

https://twitter.com/kalsoom82/status/1567288940356374531?s=20&t=KKmYHw_zgyrEwe_0F6CvPA

--------

Kalsoom Lakhani

@kalsoom82

2/Not going to sugarcoat things: int'l investor appetite on PK has slowed down A LOT, esp this quarter (we have a month left). As someone who's worked in the ecosystem way before the 2021 hype, it almost feels like that bright & shiny year never happened, BUT, because it DID/

-------------------

Kalsoom Lakhani

@kalsoom82

3/ here's some good takeaways: #1: In a market w/ v few exits (& that being the biggest ? for investors), 2022 has at least seen some notable ones - DigitalOcean acq by Cloudways for $350M, TezFinancial acquired/

---------

Kalsoom Lakhani

@kalsoom82

4/ by Zoodpay in a play to enter the PK market (our hypothesis is this will continue to occur), local players VentureDive acquired NexDegree (if u know either Atif or Imran, u know this was v v smart) & logistics player Postex acq older gen play Call Courier./

Pakistan’s embedded finance platform Neem has raised $2.5 million in a seed funding round as it works to support underbanked communities in the country.

https://techcrunch.com/2022/09/13/pakistan-embedded-financial-platform-neem-2-5-million-usd-seed-funding/

The Karachi-based startup targets communities across sectors including agriculture, MSMEs, e-commerce, logistics, healthcare and others. It offers a lending platform that its partners use to provide tailored lending products to consumers and MSMEs. Neem is also working on a banking-as-a-service (BaaS) platform, which will go live in December, that will onboard partners to embed wallets and payments and offer financial products such as insurance and savings customized to specific community’s needs.

Three-year-old Neem was founded by Nadeem Shaikh, Vladimira Briestenska and Naeem Zamindar, who previously worked as fintech entrepreneurs, operators and VCs.

“Most of the [existing] players are providing a B2C solution; we are a B2B2C solution. If you look at the embedded finance space, it is a $167 billion opportunity,” Shaikh said in an interview with TechCrunch.

Owing to COVID, the strong growth in digitization has helped Neem embed its finance services across private and public sectors.

Citing industry figures, Shaikh said about 53 million people in Pakistan are currently underbanked. Over time, the startup plans to go beyond Pakistan and support underbanked communities in other developing markets.

The seed funding, which the startup aims to use to expand its existing team of 20 people, roll out the BaaS platform and capitalize licenses, was led by Hong Kong-based SparkLabs Fintech. The funding round also saw the participation of Pakistan’s investment banking firm Arif Habib, Cordoba Logistics and Ventures, Taarah Ventures, My Asia VC, Concept Vines and Building Capital. Additionally, partners at Outrun Ventures, the founding partner at Mentors Fund and fintech veteran and ex-CEO of Seccl also participated in the seed round.

“We have strong conviction about Neem’s mission to enable financial wellness for underbanked communities, and have full confidence in the Neem leadership team to realise this vision amidst macro challenges across the globe,” said William Chu, managing partner, SparkLabs Fintech, in a prepared statement.

The startup was bootstraped before receiving the seed funding.

Pakistan sees growing culture of innovation amid tech startup boom

By Hamna Tariq and Uzair Younus

https://www.atlanticcouncil.org/in-depth-research-reports/report/pakistan-sees-growing-culture-of-innovation-amid-tech-startup-boom/

Pakistan’s startups and technology sector witnessed unprecedented growth during the COVID-19 pandemic. 2021 was a record-breaking year, with technology startups raising $350 million, while over $227 million was raised in the first half of 2022; Pakistani startups have raised $322 million in 2022 so far. Additionally, Pakistan’s information technology (IT) services sector has emerged as the largest net services exporter in the country, with IT exports more than doubling from $1.19 billion in fiscal year (FY) 2019 to $2.62 billion in FY 2022.

Another key component of the country’s technology sector is freelance work, where individuals provide technology services to global clients through platforms such as Upwork and Fiverr. This talent pool has experienced a tremendous increase in their earnings during the pandemic. While exact data for cumulative freelance earnings is not available, Pakistan is ranked as one of the largest freelance markets in the world. The national government has set a target of earning over $3 billion from this sector by 2024.

However, a tightening global macro environment coupled with increasing domestic political instability is a cause of concern for the sector, especially the domestic startup economy. To understand the risks and opportunities facing the technology ecosystem, the Atlantic Council’s Pakistan Initiative interviewed several experts within and outside Pakistan. The analysis below highlights the current state of the ecosystem and the impact of ongoing economic and political instability in Pakistan. It also outlines recommendations for key stakeholders including policymakers seeking to further globalize Pakistan’s technology sector to unlock both export earnings and foreign investment opportunities.

Bilal I Gilani

@bilalgilani

Close to 350k engineers in Pakistan ( registered with engineering council)

Largest number is electrical , followed by civil engineers

https://twitter.com/bilalgilani/status/1577366163700465664?s=20&t=WBzayqQ-JdSiEUMBO2EdXA

Pakistani startups raise $328m in first 9 months of Calendar Year 2022

Despite investor scepticism, amount raised equals 87% of total funding in 2021

https://tribune.com.pk/story/2380002/pakistani-startups-raise-328m

In spite of heightened investor scepticism stemming from geopolitical tensions and mounting fear of a global recession, the total funds raised by Pakistani startups, in the nine months of 2022, stood at $328 million. This amounts to 87% of the total funding in 2021, as per Alpha Beta Core’s Deal Tracker.

“The third quarter of 2022 has had more early-stage deals with total seed and pre-seed level rounds accounting for 90% of the total deals. The average deal size in the third quarter of 2022 clocked in at $60 million versus $7.3 million last quarter,” said Khurram Schehzad, CEO of Alpha Beta Core (ABCore).

Speaking to the Express Tribune, startup Investment Specialist, Kapeel Kumar said, “The more room for failure we leave, the more we also create room for success in its wake.”

“The one reason Pakistan is witnessing the boom is because the country is, after all, one of the few untapped frontier markets,” he noted.

“Most investments are within B2B or B2C e-commerce, fintech and logistics. This is a trend that can be observed in a lot of emerging markets as the ecosystem starts to grow,” he added.

“The total deal value in the third quarter was recorded at $48.6 million with a total of 11 deals,” said ABCore CEO Schehzad.

“The top deals closed were DBank at $17.6 million, OneLoad at $11 million, PriceOye at $7.9 million and DealCart at $4.5 million. Other notable deals this quarter were Neem and SnappRetail at $2.5 million each and Mahaana at $2.1 million,” he added.

Explaining the impact of startups shutting operations in Pakistan, Kumar said, “The closing of tech-startups in the last six months is alarming. In Pakistan, this will weigh heavily on the entire startup ecosystem, which is unfair to the many startups performing and creating employment.”

“The success of some startups is being fueled by the country’s growing human capital and rising investments in technology startups,” he added.

“We look forward to a better closing of 2022 as compared to that in 2021. Pakistani startups still have much better survival rates (both in terms of size and numbers) than the rest of the region or the world,” Kumar commented.

“Owing to our massive population, we have an incredible potential of growth within us,” said Noman Ahmed, CEO of SI Global Solutions.

He highlighted that “Fintech and e-commerce alike have brought in a significant chunk of this funding. The need of the hour is to create consistency and compliance, and support may be needed in order to sail through this passage to enable startups to continually thrive ahead. With this new found funding, we must collectively focus on bringing Pakistan at par with the Western world. There’s absolutely no doubt that Pakistan is positively brimming with talent.”

“As leading professionals in the tech world, it is upto us to revolutionise Pakistan’s technological landscape by nurturing, guiding and shaping this pool of talent. It is imperative that this work begins at the university level. Final projects and thesis submissions should focus on creativity and new ideas that may be brought to life with support from the startups on ground. We must rise to the challenge and work on expanding our horizons within the tech world,” urged the SI Global CEO.

Kalsoom Lakhani

@kalsoom82

1/It's the end of Q3, so u know what that means -- time for the

@Invest2Innovate

deal flow roundup! In Q3 2022, startups in #Pakistan raised $65.5M via 15 deals, bringing our YTD total to $340M. In Q3 2021 in comp, startups raised $177M via 22 deals, so *yes* the slowdown is/

https://twitter.com/kalsoom82/status/1575858711532568576?s=20&t=CYlehpFCO0i_J49VS1pc7A

-----------

Kalsoom Lakhani

@kalsoom82

2/ is very much upon us (OR it was just a REALLY slow summer -- every VC I know, except us apparently 😂, went on holiday/took a pause). Most significant deals in Q3 was

@dbankpk

(co-founded by

@taidrus

&

@kjamali

), which raised $17.6M from

@kleinerperkins

&

@sequoia

& was/

-------------

Kalsoom Lakhani

@kalsoom82

3/ Sequoia's FIRST check in PK. Revolving Games also raised $13.2M, which was also exciting given their shift into Web3 & making blockchain games & One Load raised $11M from

@Sarmayacar

&

@ShorooqPartners

&

@gatesfoundation

. Fintech had the best quarter, which makes sense given/

----------

Kalsoom Lakhani

@kalsoom82

4/ the macreconomic conditions shrinking consumer behavior & floods impacting certain sectors over others. Fintech raised 58% of funding in Q3 (vs e-commerce, 19%). The most interesting dev in Q3 was ACQUISITIONS: most significant being Digital Ocean's acq of Cloudways for $350M/

--------------------

Kalsoom Lakhani

@kalsoom82

5/ tho our sense is local/regional consolidation will continue in the current environment in the future, which is a positive trend for the PK market as a whole (exits! yay!). Comp PK to Egypt & Bangladesh (thx

@__racha

&

@LightCastleBD

for their data), 2022 YTD in Egypt is $382M/

--------------

Kalsoom Lakhani

@kalsoom82

6/ (PK was $340M as a reminder) & Bangladesh Is $94M -- the slowdown is felt everywhere, but we're not doing THAT bad at least. You can read our full analysis here (& kudos to

@ShifraKhan

on our team for this AWESOME work):

---------------

https://insightsi2i.substack.com/p/4-q3-2022-roundup

Investors, including HBL, participate in Finja’s Series A2 Funding Round

Finja, Pakistan’s largest dual-licensed SME digital lending platform, announced fresh capital injection as part of its $10 Million Series A2 financing round, with participation from notable investors including Sturgeon Capital and HBL.

https://www.globalvillagespace.com/investors-including-hbl-participate-in-finjas-series-a2-funding-round/

Finja, Pakistan’s largest dual-licensed SME digital lending platform, announced fresh capital injection as part of its $10 Million Series A2 financing round, with participation from notable investors including Sturgeon Capital and HBL. This investment round is multi-dimensional and includes equity, debt, and off-balance sheet capital. This is HBL’s second investment in Finja after its initial participation in the company’s Series A1 round.

With this injection, Finja has the capacity to finance more than $50 million over the next 12 months to catalyze the potential of Pakistan’s SME sector. This has set the stage to further scale Finja’s existing digital co-lending program to support its overall vision of empowering Micro, Small and Medium Enterprises (MSMEs) and their supply chains with digital credit.

This financing is a significant step towards more fully utilizing Finja’s credit engine, which continues to prove its scalability and accuracy, cementing Finja as the sustainable choice for SMEs throughout Pakistan.

Qasif Shahid, Co-Founder Finja remarked, “The future of the financial services industry lies in collaboration between fintechs and banks. Moving away from vertical silos to open banking systems and embedded finance. This puts Finja in a winning position as it ramps up our capability to offer small and micro businesses digital products.” He further added, “With this new injection and our laser focus on optimizing our organization, we will now be turbo charging digital lending to SMEs through our association with HBL”

Finja today has emerged as one of the leading digital lending platforms in the country clocking a total lending throughput of PKR 7 Billion at the back of extending approximately 150,000 loans to 35,000 Karyana stores in 30+ cities. Finja also works closely with FMCG distributors and helps them to buy supplies upstream on credit and also provides purpose built working capital lending lines to SMEs scored through Finja’s proprietary AI/ML algorithms.

Kamran Zuberi, CEO Finja Lending Services, remarked that Finja is the first financial services entity to package capital in small amounts of PKR 50,000 and for periods of 7, 14 and 30 days to Karyana stores for availing credit to buy supplies and improve their sales. “We score these retailers from data that we get from our partnerships with multiple FMCG principles, hundreds of distributors and new-age market aggregators that operate mobile apps for small retailers to order supplies from.”

Waada Buys Rival to Become Pakistan’s Top Insurance-Tech Startup

Pakistan’s insurance penetration is 0.7%, trailing neighbors

Nation to see further consolidation as funding slows: investor

---------------

Waada becomes largest technology led insurance start-up in Pakistan - 24/7 News

https://www.insurancejournal.com/news/international/2022/11/07/693869.htm

Pakistani online insurance startup Waada acquired a local rival to create the South Asian nation’s largest player in the field, seeking to benefit from growth in the burgeoning market.

The Karachi-based company took over MicroEnsure Pakistan, a unit of MIC Global operating in South Asia and Africa, in an all-stock deal, according to a statement Friday. The brands combined have 1.5 million active customers, Waada said, without disclosing the deal value. Waada also said it’s closed a seed round of $1.3 million from local angel investors and foreign venture capital firms.

Pakistani online insurance startup Waada acquired a local rival to create the South Asian nation’s largest player in the field, seeking to benefit from growth in the burgeoning market.

The Karachi-based company took over MicroEnsure Pakistan, a unit of MIC Global operating in South Asia and Africa, in an all-stock deal, according to a statement Friday. The brands combined have 1.5 million active customers, Waada said, without disclosing the deal value. Waada also said it’s closed a seed round of $1.3 million from local angel investors and foreign venture capital firms.

----------

https://247news.com.pk/waada-becomes-largest-technology-led-insurance-start-up-in-pakistan/

Waada, The Insurance start-up has announce that the company has become the largest player among all technology-led start-ups in the country’s insurance segment after acquiring its rival company MicroEnsure Pakistan.

The Announcement was made on the startup’s Social media handle LinkedIn, In the announcement, it has been confirmed that deal has been locked however, company has not disclosed the details of the deal yet.

Separately, the company also announced a $1.3 million seed funding round. According to international news agency, the all-stock deal will bring the number of active customers of Wada to 1.5 million. “Waada aims to add customers using online sign-ups and has a goal to distribute 10m policies in three to five years,” it said.

Pakistan:Insurance market grows by nearly 22% in 2021

https://www.asiainsurancereview.com/News/View-NewsLetter-Article?id=82438&Type=eDaily

The insurance industry posted gross annual premium of PKR432bn ($1.9bn) in 2021, 21.7% higher than the PKR355bn chalked up in 2020, according to data compiled by the Securities and Exchange Commission of Pakistan (SECP).

---------

Other News

Pakistan:Insurance market sees GWP jump by 24% in 2021

Pakistan:Adamjee's improved underwriting results lead to more balanced split of earnings

Thailand:Insurance industry growth predicted to be flat in 2023

Hong Kong Insurance Awards 2022 winners feted

Taiwan:Cathay Financial Holdings to raise at least US$1.4bn

HEC grants $525,000 to 15 startup businesses to boost entrepreneurship

Muhammad Faisal Kaleem

https://dailytimes.com.pk/1031680/hec-grants-525000-to-15-startup-businesses-to-boost-entrepreneurship/

The Higher Education Commis-sion (HEC) has granted $525,000 to fifteen start-ups under the Innovator Seed Fund (ISF) program with the purpose to enhance the entrepreneurship, Daily Times has learnt.

As per available information 15 start-ups have won grants of up to $35,000 each in the Pitching competition. Initially, as many as 26 entrepreneurial teams shortlisted out of 186 applicants who have participated in the competition.

Chairman HEC Dr. Mukhtar Ahmed applauded the talent and potential of university students, graduates and researchers with regard to presenting solutions to local challenges.

He, however, underlined that Pakistan definitely faces problems, yet it is certain that problems bring opportunities with them, adding that various achievements of Pakistani academia and industry in the spheres of technology and innovation, he stressed that the young generation was blessed with the capabilities to sort out solutions to the challenges facing the country.

While recalling the start-up program, Dr Ahmed highlighted that Pakistan’s start-ups saw a record-breaking year of fund-raising in 2021 with over $350 million in funding. He noted that with collective and persistent efforts, this fledgling ecosystem can flourish further and safeguard Pakistani entrepreneurs through regulatory, networking, and funding opportunities.

During the pitching ceremony earlier, Dr. Shaista Sohail said Pakistan currently has the largest number of young people ever in its history, which makes it one of the youngest countries in the world. “This huge generation of young people can be the biggest asset of the country, if we are able to reap its potential by empowering and uplifting them.” She stressed the need for providing the youth the right kind of education and skills as well as the opportunities to fulfil their roles as responsible, productive citizens, and drivers of economic growth.

She noted that in many countries, startups and entrepreneurship play a very important role in job creation. She further observed that Pakistan’s startup ecosystem is still in its embryonic stage compared to other nations of the world. “There is a dire need to propel our efforts towards promotion of technology and innovation-based Startups in the country and to boost the overall Startup ecosystem,” she emphasised.

The grant winning start-ups included ezGeyser, mimAR Studios, Funkshan Tech Pvt. Ltd., and truID Technologies Pvt. Ltd. from National University of Sciences & Technology (NUST); Savvy Engineers Pvt. Ltd. and Arm Rehab Technologies from International Islamic University Islamabad (IIUI); Avero Life Sciences from Institute of Management Sciences, Peshawar; Wonder Women from University of the Punjab; Orko Pvt. Ltd., Boltay Huroof, and Poter Pakistan from NED University of Engineering & Technology (UET), Karachi; VisionRD and Oxbridge Innovative Solutions Pvt. Ltd. from Bahria University Islamabad; 110 Innovate from IBA-Sukkur; and Shahruh Technologies Pvt. Ltd. from UET, Lahore.

Mobile banking doubles, internet banking grows by 51.7% in FY2021-22

As internet banking, POS, and eCommerce transactions post strong growth, the digital payments ecosystem is picking up steam

https://profit.pakistantoday.com.pk/2022/12/23/mobile-banking-doubles-internet-banking-grows-by-51-7-in-fy2021-22/

https://www.sbp.org.pk/PS/PDF/FiscalYear-2021-22.pdf

The overall number of payment cards, however, decreased during the year, from 45.9 million in 2020-21 to 42.4 million in 2021-22.

Bring in the fintech

According to the State Bank’s annual report, the four fully licensed EMIs (electronic money institution); Sadapay, Nayapay, Finja and CMPECC, combined had 262,558 total active accounts and 514,961 payment cards issued to their customers. Last year’s numbers on EMIs were not available for a comparison on how these numbers have grown.

The SBP has in the past has often emphasised on the potential fintech can play to boost digital payments and financial inclusion.

During his speech at the Institute of Banking Pakistan Annual Award Ceremony, Jameel Ahmad, Governor SBP stressed on the need for banks to revisit their traditional approach to service delivery and adapt quickly as digitalization shifts the balance of power from banks to tech savvy entities, hinting at the growing trend in fintech.

“Leveraging digital technology is essential not only to promote financial inclusion, but also to ensure that the industry keeps pace with emerging global trends,” opined Ahmed.

Speaking on the importance of technology, Ahmad quotes M-Pesa, a Kenyan fintech. “An often-cited success story is that of M-Pesa in Kenya, where it single-handedly drove mobile financial services availability and successfully raised financial services access in Kenya. “

Ahmad pointed out that a number of factors already exist in Pakistan that can help drive digital financial innovation and proliferation of a tech-based financial ecosystem. He pointed out that the nation has a fully functional digital ID system, ubiquity of mobile devices, penetration of mobile and broadband services, availability of faster payment rails, remote account opening process, and facilitative regulatory environment for enabling the entry of non-bank entities into the financial arena.

The Central Banker also points out that while fintech has brought competition, it also presents the sector with an opportunity to create synergies and mutually beneficial partnerships.

“Banks and Fintechs can partner with each other to provide innovative products for customers that are otherwise not viable on a standalone basis. For banks, such partnerships can help with penetration in untapped segments like retail businesses and Micro and Small Medium Enterprises, yielding beneficial outcomes for all stakeholders,” he said.

Encouraging the banks that are yet to make consistent and sustained moves toward technological transformation, Ahmad told them to make use of the digital bank frameworks and the instant payment system, RAAST, to position themselves for the future.

Jazz and Huawei Successfully Accomplished Nationwide Rollout for FDD Massive MIMO in Pakistan

https://www.lightreading.com/jazz-and-huawei-successfully-accomplished-nationwide-rollout-for-fdd-massive-mimo/a/d-id/782496

Jazz and Huawei have commercially deployed FDD (Frequency Division Duplexing) Massive MIMO (Multiple Input and Multiple Output) solution based on 5G technology in a large scale. The solution has been developed and tailored to the needs of boosting network capacity and user experience.

This customized solution has been the first launch of Jazz and Huawei, supporting Jazz leap into the 4.9G domain. This innovative solution has tremendously enhanced the network capacities along with superior 4G experience for the valued subscribers. The average network traffic increased by around 30% and the average single user speed increased by around 170%.

Jazz’s Chief Technology Officer, Khalid Shehzad said, “We see that our customers are increasingly using high-bandwidth applications which resultantly puts pressure on existing network capabilities. Massive MIMO essentially allows us the freedom to provide more data at greater speeds, enabling our customers to use the enhanced services on their existing 4G devices. Network speeds will be faster than ever, which will significantly improve the end-user experience. Jazz is committed to developing an ecosystem that supports the government’s Digital Pakistan vision and the evolving technology needs of individuals and businesses.”

Huawei provides the industry's unique intelligent beam scheduling and intelligent beamforming technology which are native for 5G. Massive MIMO improves the capability of the handsets to transmit more efficiently. Currently Huawei FDD Massive MIMO has been deployed in more than 70 networks and over 20,000 units have been shipped. The level of collaboration between Jazz and Huawei goes beyond to more domains. For example, the first 400G transmission, the first core network cloudification, the first large-scale commercial use of VoLTE, and the first 3G sunset city. In Pakistan, Jazz maintains a leading position in network performance and innovations, and it leads the development of the entire ICT industry.

Pakistan’s Agriculture-focused Fintech Digit++ Obtains Approval from State Bank

https://www.crowdfundinsider.com/2022/12/200398-pakistans-agriculture-focused-fintech-digit-obtains-approval-from-state-bank/

The State Bank of Pakistan (SBP), the nation’s central bank, has reportedly granted approval to the test launch of the country’s very first agriculture-focused Fintech platform, Digitt+ (providing an Electronic Money Institution or EMI permit).

Digitt+ is supported by Akhtar Fuiou Technologies (AFT), the firm revealed this past Friday.

According to the firm, the aim of this agri-Fintech app is to fully digitize the agricultural ecosystem, enable greater financial inclusion for local farmers and unbanked consumers via its tech, partnership, relationship with agri-businesses and FMCGs operating in Pakistan.

As reported by local sources, Digitt+ has teamed up with FuiouPay, an international payment solutions provider, in order to offer a market-based alternative to the traditional banking system.

As explained in the announcement, FuiouPay provides holistic enabling solutions via their 75 intellectual property licenses and proprietary software solutions.

Qasim Akhtar Khan, Founder and Chief Strategy Officer at Digitt+, noted that the firm will offer financial technology solutions to farmers residing in the country, who will have the option to open bank accounts and also gain access to credit and digital financial services – including easy bill payments, digital commerce, investments as well as fund transfers.

As noted in the update, the approval from the State Bank of Pakistan is a key milestone.

This ongoing initiative has the potential to address persistent food security issues, significantly improve yields and enhance human welfare in Pakistan, directly affecting local farmers and merchants, he stated.

Notably, Pakistan has been a significant agriculture powerhouse for many years. Agriculture employs around 50% of the nation’s workforce and also contributes approximately 25% to the GDP.

While this is considerable, the industry doesn’t have adequate access to financial services from the banking sector.

Ahmed Saleemi, CEO of Digitt+ explained that using tech to create digital financial products focusing on micro services to build a platform that should support the delivery of these solutions for the retail Agri market and corporate sector can be achieved via the provision of business tools.

Kalsoom Lakhani

@kalsoom82

1/Happy New Year! It's 2nd to last day of 2022, so that means time for the Q4 roundup of #Pakistan startup ecosystem funding, put together by our

@Invest2Innovate

Insights team. This was a ~slow~ quarter w/ startups in Q4 raising $14.9M, bringing our 2022 YTD total to $355M./

https://twitter.com/kalsoom82/status/1608898809987489795?s=20&t=0dUvaRSsLXyYKaRMrRQCRw

-----------------

2/ The good news: our 2022 YTD number just *barely* surpassed our 2021 YTD number ($354M vs $355M), BUT it still did (woo!). The bad news: pace of funding slowed down significantly towards end of year -- in Q4 we raised just 8.6% what we did in Q1. This is both push & pull/

--------------------

3/ a LOT of startups held off on raising at the end of the year in Pakistan & may open rounds early Q1 2023 (I know this qualitatively as a PK-focused VC who speaks to our portfolio companies often, this isn't a data-driven observation) & so too, a lot of VCs slowed down pace/

----------------

4/ towards the end of 2022, (us included!). My good friend

@faisal_aftab

rightly predicts macro uncertainty will continue in 2023 so buckle down, but I do believe good companies w/ good economics will continue to raise in 2023 (tho vals will go down & it will take longer./

-------------

5/ On Monday, our Insights team will put out a pretty epic EOY roundup for ur viewing pleasure, so stay tuned! You can read our roundup & subscribe for more: https://insightsi2i.substack.com/p/7-q4-2022-roundup

All raw data can be found here:

https://www.insightsi2i.com/

Health Startups to transform under AKU-AP's Incubation Programme

https://www.aku.edu/news/Pages/News_Details.aspx?nid=NEWS-002903

National Health Incubator (NHI) is a first of its kind healthcare focused incubation programme designed to enable the development, deployment, and commercialization of select innovative and technology-driven solutions. It is run by Accelerate Prosperity (AP), a global initiative of the Aga Khan Development Network (AKDN) in partnership with Aga Khan University (AKU).

Accelerate Prosperity is a global initiative of the Aga Khan Development Network in Central and South Asia which offers creative financial solutions and pre and post investment technical assistance to help start and grow innovative startups and small and growing businesses.

The Aga Khan University is a pioneering institution of higher education that works to improve quality of life in the developing world and beyond. The University operates programmes in campuses in Pakistan, Afghanistan, Kenya, Tanzania, Uganda and the United Kingdom, and treats more than 2 million patients annually at 7 hospitals across more than 350 medical centres globally.

The NHI 2022 Demo Day took place on December 1, 2022 at Aga Khan University, Karachi with the on-ground support and facilitation of Critical Creative Innovative Thinking (CCIT) Forum – a unique innovation and incubation hub at AKU. A total of 19 health tech startups pitched their businesses at the Demo Day to get one-on-one feedback and secure financing from AP and external investors. The event provided an opportunity for AKU and AKDN leadership, entrepreneurs, investors and ecosystem partners to network, exchange industry knowledge, and build market linkages. The partnership between AP and AKU has been vital to the success of NHI and aims to fuel much-needed innovation in the entrepreneurial and startup ecosystem in Pakistan.

The incubated entrepreneurs went through months of rigorous one-on-one tailored business advisory and training to refine their business and financial models and were prepared to secure investment on the Demo Day. Entrepreneurs were also provided one-on-one mentoring sessions with leading sector experts to help them better understand industry dynamics and depth.

Incubated businesses represented tele-health, mental health, wellness and lifestyle transformation, and health-tech subsectors within the broader healthcare sector. Leading investors and ecosystem partners from Sarmayacar, I2I Ventures, Indus Valley Capital, TPL eVentures, Rayn, Neem, Insitor Partners, AlphaBetaCore amongst others were present at the event. The innovative and impactful business pitches kept the investors thoroughly engaged.

Nadeem Shaikh, Founder at Neem - An Embedded Finance Platform - said “It’s impressive each time I come to pitch days and get to witness the sheer amount of talent, innovative ideas aspiring, and new entrepreneurs are thinking about and the scale at which they’re thinking about is amazing.”

Dr. Carl Amrhein, Provost & Vice President, Academic at Aga Khan University said “We feel that fostering partnerships such as NHI will pave the way for the changing the entrepreneurial landscape in Pakistan. I commend the entire NHI team who worked so hard with entrepreneurs to get them investment ready and prepared for the Demo Day.”

Rohma Labeeb, Country Director at Accelerate Prosperity Pakistan said, “Over 60% of healthcare spend in Pakistan is by the private sector, which opens unlimited opportunities for businesses to come at the forefront to bring in efficiencies, quality and scale.”

Freelancers earn $400 million in FY22

https://tribune.com.pk/story/2372834/freelancers-earn-400-million-in-fy22

The contribution of the freelancers accounted for 14.77% of the total information and communication technologies (ICT) export remittances of $2.616 billion recorded by the country during FY22.

The app (Sehat Kahani) was brought into the (Pakistani) federal government's 'Digital Pakistan' drive and used in 65 intensive care units (ICUs) across Pakistan under a project with UNDP, Health Services Academy and the federal and provincial governments. This allowed health workers to access critical care consultation through a Virtual Critical Care Specialist (VCCS).

https://www.gavi.org/vaccineswork/sehat-kahani-showing-pakistan-digital-health-services-can-change-lives-both

n connection with that project, and in collaboration with WHO and the federal government of Pakistan, six clinics were launched in hard-to-reach areas of Pakistan during the COVID-19 pandemic, and a specific focus on sexual and reproductive healthcare services was also added to this project.

"Around 1,500 doctors across Baluchistan, KPK, and Punjab were trained in sexual reproductive services, primary healthcare, and telemedicine," says Dr Saeed.

"Telehealth services have the potential to bridge the gap between patients and physicians in Pakistan. However, poor education, illiteracy in rural areas, lack of resources, poor internet connectivity, excessive loadshedding, etc., have limited the accessibility of qualified doctors to reach to the population in remote areas," says Dr Zahid.

-----------

Sehat Kahani, established in 2017, is a leading initiative in this regard. Its founder, Dr Sara Saeed, is a medical doctor whose mission is to help shore up Pakistan's fragile healthcare system by bridging the gap between patients and physicians through digitalisation.

"As per recent statistics, around 210 million people in Pakistan don't have access to basic healthcare facilities. To address this, Sehat Kahani connects a vast network of predominantly female doctors to patients in far-flung areas of Pakistan," says Dr Saeed. She and cofounder Dr Iffat Zafar Agha managed to raise seed funding of US$ 500,000 in 2018, followed by a pre-series of $1 million in March 2021.

In 2019, the app launched with about 60 doctors. Today, Sehat Kahani comprises a large network of more than 7,000 doctors.

Ninety percent of those 7,000 doctors are women. Approximately 50% of them are home-based female doctors who have returned to practice after leaving when they got married and had children.

State Bank of Pakistan issues NOCs to five applicants for establishing digital bank

https://www.brecorder.com/news/40220082

Central bank expects after commencement of operations, digital banks will promote financial inclusion by providing affordable/cost effective digital financial services to unserved and underserved segments

The State Bank of Pakistan (SBP) on Friday said that it has issued no-objection certificates (NOC) to five applicants for establishing digital banks in the country.

The following are the ones issued the NOC:

I) Easy Paisa DB (Telenor Pakistan B.V & Ali Pay Holding Ltd.),

II) Hugo Bank (Getz Bros & Co., Atlas Consolidated Pte. Ltd. and M & P Pakistan Pvt. Ltd.);