Oil consumption in Pakistan jumped 19% to 20.8 million tons in 2021, a strong indication of the country's economic recovery from the COVID-impacted 2020. In addition to oil, Pakistanis also consumed nearly 4 billion cubic foot of natural gas every day. Energy is fundamental to the functioning of any economy.

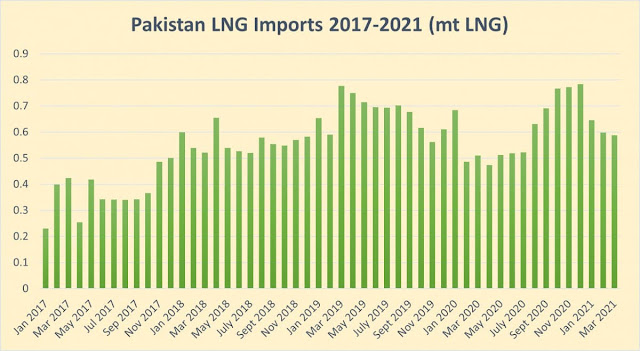

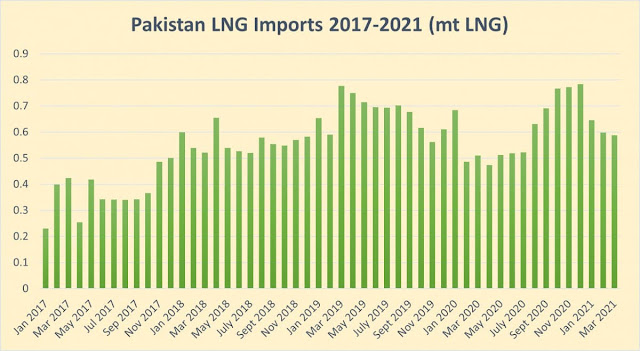

Pakistan's furnace oil consumption has been declining for several years as power producers continued to switch fuel to liquified natural gas (LNG) in recent years. However, the sudden jump in LNG prices forced them to use more furnace oil in

year 2021 than in 2020. There was also a big jump in diesel (HSD) and petrol (MS) with a rise in number of vehicles on the nation's roads.

|

| Pakistan LNG Imports 2017-2021 in million tons |

“Year 2021 proved to be remarkable for the automobile sector as there was a volumetric sales growth of 90% on a year-on-year basis to 210,048 units compared to 110,540 units in 2020,” said Arif Habib Limited analyst Arsalan Hanif.

Motorcycle sales in the first 9 months of CY 2-21 were 1.4 million units, up 37.5% vs the 2020 and 13.0% vs the 2019. Atlas Honda dominated the motorcycle market with sales up 52.2%. Soaring cement consumption, rising auto sales and double digit increase in energy consumption in Pakistan in 2021 confirm that Pakistan's recovery from the COVID-induced slump is well underway.

Barring any adverse impact of the Omicron variant of the COVID 19 virus, Pakistan's GDP is likely to grow at least 5% in the current fiscal year ending in June, 2022. The country's average economic growth of 5% a year has been faster than the global average since the 1960s. However, it has been slower than that of its peers in East Asia. It has essentially been constrained by Pakistan's recurring balance of payment (BOP) crises as explained by Thirlwall's Law. Pakistan has been forced to seek IMF bailouts 14 times in the last 70 years to deal with its BOP crises. This has happened in spite of the fact that remittances from overseas Pakistanis have grown 30X since 2000. Every time Pakistan has faced a balance of payments crisis, the result has been massive currency devaluation, high inflation and slower growth for a period of multiple years. This is exactly what Pakistan's current government led by Prime Minister Imran Khan is dealing with right now. This pain is the result of years of flat exports, soaring imports and excessive debt taken on during former Prime Minister Nawaz Sharif's PMLN government from 2013 to 2018. The best way for Pakistan to accelerate its growth beyond 5% is to boost its exports by investing in export-oriented industries, and by incentivizing higher savings and investments.

Fantastic recovery. With CPEC running full steam and exports showing recovery its a bright road ahead.

ReplyDeleteRazak vows to increase IT exports to $3.7bn in FY22

ReplyDeletehttps://profit.pakistantoday.com.pk/2022/01/07/razak-vows-to-increase-it-exports-to-3-7bn-in-fy22/

Adviser to the Prime Minister on Commerce and Investment, Abdul Razak Dawood on Friday said that there is a lot of scope to increase exports in Information Technology (IT) from non-traditional sector at present, announcing that the government has set a new target of $3.5 billion exports in this regard.

“The current annual $2.5 billion IT exports are very low. We now have an annual export target of $3.7 billion this year,” he said while addressing the Technology Roundtable to highlight Investment opportunities in the IT and Information Technology Enabled Services (ITES) sector organized by Board of Investment ( BOI).

“Today is the age of Information Technology and e-commerce, our youth can take full advantage of it,” he said, adding that Pakistan’s exports can now be boosted by focusing on some of the non-traditional sectors from the traditional export sector including textile.

Razak Dawood said that there was a need to promote export culture in the country at present and the government wanted to increase exports on priority basis.

During his address, he said that Pakistan’s economy has made significant progress reflecting a blend of stabilization and structural reforms despite being challenged at economic and geo political front and is moving on a positive growth trajectory.

He added that Micro Small and Medium Enterprises (MSMEs), that use e-Commerce platforms, are around five times more likely to export than those in the traditional economy and the policy aims to pave the way for holistic growth of e-Commerce in the country by creating an enabling environment in which enterprises have equal opportunity to grow steadily.

He stressed that the way forward for Pakistan on the economic front is to focus on exports, specifically IT related exports.

Chairman BOI said that government of Pakistan is making all out efforts to put the economy on the track of long-term and sustainable economic progress.

“IT Sector Policy of Pakistan offers a generous set of incentives to investors” he said.

He also apprised the participants on “Pakistan Regulatory Modernization Initiative” (PRMI), being led by BOI that was launched by the Honorable Prime Minister of Pakistan.

“Once rolled out, it shall transform the regulatory landscape across all tiers of government,’ he said.

He added that the IT sector also allows up to 100% foreign ownership and 100% repatriation of profits.

Secretary BOI, while highlighting IT sector specific reforms introduced in Pakistan shared that the payment limit for foreign vendors of digital services has been enhanced by SBP from $100,000 to $400,000 and the approval from SBP for payment above $100,000 has been waived off for digital services.

She further added that in order to facilitate IT businesses, 62 globally recognized companies have been notified requiring no approval from the State Bank and that the State Bank has allowed commercial banks to obtain the Cloud Outsourcing Services to meet their growing customers’ needs.

Elaborating on some incentives introduced for the Special Technology Zones, Secretary BOI mentioned income tax exemption for 10 years including on dividends and capital gains, exemption of custom duties and taxes on capital goods for 10 years, exemption from GST on import of plant, machinery, equipment and raw-materials and exemption from property tax for 10 years.

The Technology Roundtable was a successful feat in showcasing opportunities in Pakistan’s thriving IT sector and ended with a unanimous vote of re-assurance that all stakeholders will work in close collaboration with BOI to uplift the development of IT sector to ensure export led growth and quality FDI.

One of the major initiatives of the government to encourage imports of raw materials also pushed up the import bill. Oil prices have also increased substantially, which pushed up the import bill because of the high demand for energy in the domestic market. A surge was noted in imports of vehicles, machinery as well as vaccines, pushing the import bill.

ReplyDeleteIn FY21, the import bill surged by 25.8pc to $56.091bn from $44.574bn the previous year.

--------

Exports posted year-on-year growth of 24.71pc to $15.102bn in July-December 2021. In December 2021, exports saw a growth of 15.8pc to $2.740bn from $2.366bn in the same month last year. On a month-on-month basis, exports declined by 5.55pc in December.

Export proceeds went up by 18.2pc to $25.294bn in FY21 from $21.394bn over the last year.

According to the commerce ministry, the exports of fish & fish products, plastics, cement, fruits & vegetables, petroleum products, natural steatite, etc increased. In terms of market diversification, there was an increase in exports to Bangladesh, Thailand, Sri Lanka, Malaysia, Kazakhstan, South Korea, etc.

In the traditional sectors, there was an increase in the exports of men’s garments, home textiles, rice, women’s garments, jerseys & cardigans and T-shirts. However, exports of fruits & vegetables, surgical instruments, electrical & electronic equipment, tractors, pearls and precious stones decreased in December 2021 as compared to the same month last year.

https://www.dawn.com/news/1667861/trade-deficit-widens-106pc-in-july-dec

--------------

Arif Habib Limited

@ArifHabibLtd

Country posted highest ever textile exports for the month of Dec.

Dec’21: $ 1.64bn, +17% YoY, -6% MoM

1HFY22: $ 9.40bn, +26% YoY

https://twitter.com/ArifHabibLtd/status/1480415138108870656?s=20

Arif Habib Limited

ReplyDelete@ArifHabibLtd

Atlas Honda Limited (ATLH) posted highest ever bikes sales of 1,352,711 units in CY21.

https://twitter.com/ArifHabibLtd/status/1480886060506832902?s=20

--------

Arif Habib Limited

@ArifHabibLtd

Auto Sales Data

Dec’21: 27,331 units +96% YoY; +46% MoM

1HFY22: 136,000 units, +70% YoY

CY21: 237,443 units, +91% YoY

https://twitter.com/ArifHabibLtd/status/1480884776399745028?s=20

-------

Arif Habib Limited

@ArifHabibLtd

·

4h

Auto sales increased by 91% YoY to 237.4K units during CY21, 3rd highest on CY basis.

https://twitter.com/ArifHabibLtd/status/1480886761651949575?s=20

-----------

Arif Habib Limited

@ArifHabibLtd

Private sector credit witnessed massive growth in CY21 which surged by PKR 1.4trn; highest in last 10 yrs. The jump in credit offtake reflecting improvement in business confidence and investment momentum.

https://twitter.com/ArifHabibLtd/status/1480917052084957193?s=20

---------------

Arif Habib Limited

@ArifHabibLtd

Highest ever monthly sales of Suzuki Alto during Dec’21 (9,195 units, +280% MoM | +211% YoY) amid favorable Govt policies.

https://twitter.com/ArifHabibLtd/status/1480888735126413315?s=20

---------------

AL Habib Capital Markets (Pvt) Ltd

@alhabibcapital

Urea Sales up by 5% YoY to 6.34mn tons during 2021

#Pakistan #Urea

https://twitter.com/alhabibcapital/status/1480787867114917890?s=20

#Pakistan is not alone in switching #power generation from natural #gas to #oil. #US states in #NewEngland are now generating 25% of #electricity using oil due to natural gas shortage. https://www.bloomberg.com/news/articles/2022-01-04/boston-winter-draws-caribbean-lng-cargoes-in-rare-price-play?sref=DLVyDcXJ

ReplyDeletehttps://www.bloomberg.com/news/articles/2022-01-04/boston-winter-draws-caribbean-lng-cargoes-in-rare-price-play?sref=DLVyDcXJ

A third Caribbean liquefied natural gas cargo is headed for Boston, where two other await colder weather before unloading in an unprecedented bet on price spikes this winter.

GasLog Partners LP-owned Methane Lydon Volney is expected to arrive in Boston Jan. 11 with an LNG cargo from Trinidad & Tobago, according to ship tracking data compiled by Bloomberg. The tanker will join Cadiz Knutsen and Excelerate Energy’s Exemplar, which are both anchored in Massachusetts Bay and also carrying LNG cargoes from the Caribbean nation.

According to the Pakistan Economic Survey 2019–20, the installed electricity generation capacity reached 37,402 MW in 2020. The maximum total demand coming from residential and industrial estates stands at nearly 25,000 MW, whereas the transmission and distribution capacity is stalled at approximately 22,000 MW. This leads to a deficit of about 3,000 MW when the demand peaks. This additional 3,000 MW required cannot be transmitted even though the peak demand of the country is well below its installed capacity of 37,402 MW.

ReplyDeletehttps://en.wikipedia.org/wiki/Electricity_sector_in_Pakistan#:~:text=According%20to%20the%20Pakistan%20Economic,stalled%20at%20approximately%2022%2C000%20MW.

Coal accounts for 32% of total power generation in Pakistan in January 2021

ReplyDeletehttps://www.dawn.com/news/1609100

In the last five years Pakistan has aggressively pursued coal power under the multi-billion-dollar China-Pakistan Economic Corridor (CPEC) initiative as well as outside it, increasing coal-based capacity from negligible to 4,620 megawatts. With seven other coal-based projects under construction, the country expects to add 4,590 megawatts by the end of 2026.

---------------

Coal-based power generation in January rose to the seven-month high of 2,560 gigawatt hours (GWh) as total generation from different fuels increased by 3.7 per cent to 8,079 GWh from 7,794 GWh a year ago and by 2.5 per cent from 7,880 GWh from the previous month.

Coal power generation in the country peaked at 2,581 GWh in July last year before sliding back to 1,095 GWh in November. As a ratio of total generation in any given month in the last three years since the beginning of 2018, the share of coal power rose its highest of just below 32pc in January 2021. According to data, share of coal generation in the country’s total electricity output bottomed to 9.2pc in September 2018.

In the last five years Pakistan has aggressively pursued coal power under the multi-billion-dollar China-Pakistan Economic Corridor (CPEC) initiative as well as outside it, increasing coal-based capacity from negligible to 4,620 megawatts. With seven other coal-based projects under construction, the country expects to add 4,590 megawatts by the end of 2026.

Coal power has increased by above 62pc to 15,262 GWh during the first seven months of the current fiscal year from 9,395 GWh during the same period in FY19, underscoring growth in its capacity and utilisation because of fuel price considerations. Its share in overall generation during the period July-January has risen from 12.9pc in FY19 to around 20pc this year in spite of 8.7pc increase in the cost of coal-based generation year-on-year to Rs6.47 per KWh last month on global coal prices.

An Arif Habib analyst, Rao Aamir Ali, said the share of coal power during winter increases because of reduction in hydel generation and closure of gas-based plants due to the shortage of the fuel. He pointed out that the share of coal power in the country’s generation will likely double in the years to come as new plants come online over the next six years to end 2026.

Sheikh Mohammad Iqbal, a power-sector consultant based in Lahore, is glad to see the increasing share of coal power in the country’s total power generation. “I am of the firm view that maximum utilisation of the coal-based power is critical for slashing the overall cost of generation. It is good for the economy of countries like Pakistan even though some may oppose coal power because of its potential impact on the environment.

“But they should remember that the coal power technology has improved a great deal and it no longer can be regarded dirty fuel when it comes to producing electricity from it. I would say coal is much cleaner fuel for electricity generation than furnace oil.”

Arif Habib Limited

ReplyDelete@ArifHabibLtd

Trade deficit increased by 107% to USD 25.5bn during 1HFY22

Textile Exports: $ 9.4bn, +26% YoY

Petroleum Imports: $ 10.2bn, +113% YoY

Transport Imports: $ 2.3bn, +105% YoY

Agriculture and others: $ 7.9bn, +96% YoY

https://twitter.com/ArifHabibLtd/status/1483063886744018945?s=20

Arif Habib Limited

ReplyDelete@ArifHabibLtd

Historic high-power generation registered in CY21, 136,572 GWh, up by 10.6% YoY. The sharp inflection in economic activity post supportive measures by the Gov’t/SBP remained instrumental in achieving this growth.

https://twitter.com/ArifHabibLtd/status/1484519832921989122?s=20

-------------------

Arif Habib Limited

@ArifHabibLtd

*Power Generation up by 9.3% YoY during 1HFY22*

Dec’21: 8,828 GWh, +12.0% YoY

1HFY22: 74,396 GWh , +9.3% YoY

https://twitter.com/ArifHabibLtd/status/1484511672001871878?s=20

#Pakistan to burn more domestic #coal for #electricity. Work on 3rd phase of Thar Coal Block II mine is to begin this year at an estimated cost of $93 million. Annual production of lignite to grow from 3.8 million tons to 12.2 million tons by 2023. #CPEC https://asia.nikkei.com/Spotlight/Environment/Climate-Change/Pakistan-to-burn-more-domestic-coal-despite-climate-pledge

ReplyDeleteWork on the third phase of the Thar Coal Block II mine expansion is set to begin this year at an estimated cost of $93 million, according to the Sindh Engro Coal Mining Company (SECMC), a public-private enterprise operating the mine since 2019 in the southeastern district of Tharparkar. The second phase of expansion is underway with the help of China Machinery Engineering Corp. and Chinese bank loans, in addition to local financing. The series of expansions will scale up the annual production of lignite from 3.8 million tons to 12.2 million tons by 2023.

The output from the second phase of expansion will feed two 330 MW coal-fired power plants being built under the $50 billion China Pakistan Economic Corridor projects, part of Chinese President Xi Jinping's flagship Belt and Road Initiative. The power plants are expected to come on line this year.

Lignite is brown coal with low calorific value due to high moisture and low carbon content.

The expansion of the Thar coalfields is aimed at curbing coal imports to ease a staggering current-account deficit made worse by soaring international commodity prices and shipping costs. Pakistan's current-account deficit ballooned to an unprecedented $9.09 billion between July and December last year, as imports continued to outstrip exports during the post-COVID economic recovery. Pakistan had to seek a $3 billion loan and a deferred payment facility on the import of petroleum products from Saudi Arabia last year to stabilize forex reserves.

In recent years, high volatility in international oil prices, soaring LNG prices and dwindling local gas reserves have spurred public-private spending, particularly Chinese investment, in Pakistan's coal power sector. Until now, four coal-fired power plants with 4.62 GW of total installed capacity have joined the grid, while another three plants with an aggregate capacity of 1.98 GW are expected to come online over the next two years -- all under CPEC. In addition, growing demand from cement factories banking on a global construction boom has tripled coal consumption over the last five years to 21.5 million tons per annum.

Consequently, the share of coal in Pakistan's import bill for the year ended June 2021 shot to 24% from over 2% in previous years, according to data from the Pakistan Bureau of Statistics. Currently, only the power plant at Thar Coal Block II is running on indigenous coal.

A spike in coal power generation is in line with global trends, where countries including China, the U.S. and India have turned to coal to meet heightened demand following the lifting of COVID-19 restrictions.

------------

Authorities contend that the expansion of Thar Coal Block II will reduce the price of indigenous coal from $60 to $27 per ton -- making it the country's cheapest power source and leading to annual savings of $420 million. Pakistan is currently importing coal at around $200 per ton.

"We are compelled to use this cheap source of energy because we cannot keep using dollars to run power plants running on expensive furnace oil and RLNG (re-gasified liquefied natural gas)," Sindh Provincial Energy Minister Imtiaz Shaikh told Nikkei Asia. "We would like to mix 20% Thar coal [in power plants running] with imported coal. Then we will move towards converting coal to liquid and coal to gas."

The cost of operating thermal plants has become punishing due to expensive fuel and the cost of diverting scarce freshwater, which leads to underutilization of the plants, said Omar Cheema, director of London-based renewable energy consultancy Vivantive.

Arif Habib Limited

ReplyDelete@ArifHabibLtd

Power Generation up by 10.6% YoY in CY21

Dec’21: 8,828 GWh, +12.0% YoY

CY21: 136,572 GWh, +10.6% YoY

Full Report

https://arifhabib.com/r/PowerGenDec-21.pdf

https://twitter.com/ArifHabibLtd/status/1485478323979436038?s=20

Arif Habib Limited

ReplyDelete@ArifHabibLtd

Oil marketing industry sales surged by 18.9% YoY during Jan’22 to 1.80mn tons (7MFY22: 12.91mn tons, +14.5% YoY).

https://twitter.com/ArifHabibLtd/status/1488511560565854222?s=20&t=ifmoAqCf2BMw2onQ92fGFg

-------------

https://tribune.com.pk/story/2341510/oil-sales-surge-20-to-18m-tons-in-january-2022

KARACHI:

The demand for petroleum oil products remained robust despite the uptrend in prices, as wheat harvesting, power generation through oil-fired plants and building of domestic reserves in anticipation of a further hike in international prices generated strong demand in January.

Besides, healthy industrial activities and growing car numbers on roads also contributed to the rising momentum in sales of petroleum products. Overall oil sales surged almost 20% to 1.8 million tons in January 2022 compared to 1.51 million tons in the previous month of December 2021, Arif Habib Limited (AHL) reported on Tuesday. “(High-speed) diesel had a major increase in demand among petroleum products in the wake of wheat harvesting in the country,” AHL Head of Research Tahir Abbas said while talking to The Express Tribune.

Secondly, three major power plants, located in Punjab, ran on diesel due to the widening gas shortfall during winter months. Besides, some other plants ran on furnace oil and its demand picked up as well. Thirdly, oil marketing companies (OMCs) and their dealers (petrol pumps) built inventories during the month in anticipation of a hike in prices of petroleum products in the global as well as domestic markets.

The building of reserves was aimed at making additional profits on likely increase in prices in the domestic market with effect from February 1, 2022. The government, however, decided to keep oil prices unchanged, which “had earlier been expected to increase by Rs12-15 per litre,” he said. The demand for petrol also remained robust in the backdrop of a significant growth in sales of cars and SUVs.

Car sales slowed down, but still remained significant despite the fact that the government took measures to cut imports of luxury cars and restricted bank financing for cars to control the current account deficit (CAD). Sales of diesel increased 20% to 0.74 million tons in January compared to 0.62 million tons in December.

Sales of petrol rose 6.2% to 0.74 million tons in the month under review compared to 0.70 million tons in the previous month. Sales of furnace oil surged 103% to 0.26 million tons in January compared to 0.13 million tons in December 2021. Cumulatively, in the first seven months (July-January) of the current fiscal year 2021- 22, oil sales increased 14.5% to 12.91 million tons compared to 11.27 million tons in the same period of previous year. The growth in demand is mostly seasonal given that wheat harvesting takes place

Pakistan is seeking to buy liquefied natural gas (LNG) cargoes from the spot market after two long-term suppliers failed to fulfil commitments to deliver shipments in March, Bloomberg reported on Friday while citing “people with knowledge of the matter”.

ReplyDeletehttps://www.dawn.com/news/1675863/pakistan-to-tap-spot-cargoes-after-long-term-lng-suppliers-bail

Pakistan LNG Ltd has issued a tender for two cargoes to be delivered next month, the international news agency said.

Two suppliers, Eni SpA and Gunvor Group Ltd, recently informed Islamabad about their inability to deliver cargoes scheduled for March, Pakistan LNG Ltd told Bloomberg.

A global energy crunch has resulted in LNG spot prices surging to levels that are too high for cash-strapped nations like Pakistan. The South Asian nation purchased its most expensive LNG cargo ever in November after a similar cancellation, and has avoided additional purchases since then.

Pakistan is “carefully” analysing its gas shortage, and will purchase cargoes depending on the prices they receive, Pakistan LNG Ltd told the news agency. It’s looking for the cargoes to be delivered between March 2 and March 3 and from March 10 to March 11, it said. The offers are due on Feb 22.

Eni’s LNG deliveries to Pakistan were disrupted after its supplier defaulted on obligations for an unspecified reason, the Italian company told Bloomberg in an emailed statement. “Eni is evaluating all contractual remedies, including legal actions,” the company said by email.

Gunvor declined to comment, the Bloomberg report said.

The nation’s (Pakistan's) energy costs had already been increasing. They more than doubled to $12 billion in July through January from the previous seven-month period, according to government data.

ReplyDeletehttps://www.bloomberg.com/news/articles/2022-03-15/pakistan-struggling-to-buy-enough-diesel-due-to-global-crunch

Pakistan is struggling to buy diesel due to a supply shortage with more traders targeting Europe as the loss of Russian fuel flows sets in.

Pakistan State Oil Co. hasn’t been able to secure additional shipments from its main supplier Kuwait Petroleum Corp., people familiar with the matter said.

PSO has requested more diesel from KPC and bought cargoes from the spot market, a spokesman for the retailer said in an emailed response to questions. “Product is moving toward the west” and there is a need to diversify international supplies due to the challenges, the company said, without saying if it had received additional diesel.

Pakistan’s difficulties come amid a global shortage of the industrial and transport fuel that’s been exacerbated by Russia’s invasion of Ukraine. It’s putting more pressure on government finances after Prime Minister Imran Khan cut domestic fuel and electricity prices at the start of March, despite agreeing the opposite with the International Monetary Fund.

See also: An Oil Price Rally Is Bad. A Diesel Crisis Is Worse: Javier Blas

The nation’s energy costs had already been increasing. They more than doubled to $12 billion in July through January from the previous seven-month period, according to government data.

Pakistan’s Oil and Gas Regulatory Authority has proposed that PSO buy fuel for the nation’s private retailers for the next three months as the surging prices make it tough to break even, according to a document seen by Bloomberg.

Vehicle Sales in Pakistan

ReplyDeletehttps://minutemirror.com.pk/speedy-recovery-33561/

In the first eight months of the current financial year (July 2021-February 2022), the automobile industry sold cars at a record pace and car sales went up by a record 57 per cent. According to the data released by the Pakistan Automotive Manufacturers Association, 149,813 vehicles were sold in the first eight months of the current financial year as against 95,139 units in the same period of the previous financial year. The breakup of the sale data tells interesting tales: of the sold vehicles, car sales accounted for 57.5 per cent, truck sales for 82.2 per cent, jeep/pickup sales for 51.5 per cent and farm tractor sales for 6 per cent during the period. However, the sale of motorcycles and rickshaws declined by 3%. Car sales are likely to continue to rise till the end of the current financial year. The increased sale of trucks shows the revival of economic activities across the country. Farm tractors’ sale figures are also encouraging as the agriculture sector has seen an unprecedented boom, thanks to the farmer-friendly policies of the government. The figure strengthens the government’s claims of economic recovery.

This has happened at a time when car prices have increased multiple times, and the opposition has been protesting inflation. The figures of car sales have puzzled many and they may scramble the main reasons for the increase in car sales when people are worried about inflation.

According to experts, the main reason for the vehicle sale is the single-digit rate trade and macro recovery, which played a significant role in increasing auto sales in the first eight months of the current financial year. The increase in the purchase of such necessities of life, which are considered luxuries in Pakistan, is not a sign of the recovery or improvement of the economy, but the recent figures on car sales establish the fact that the purchasing power of a certain class has increased multiple times. The increasing gap between the rich and the poor makes it hard for social scientists to determine the overall rate of poverty.

These figures are, however, welcome for the automobile sector, which went through troubling times in the last three years. Several plants had to close down operations and lay off the staff. However, the life of the common man may remain the same as their purchasing power has shrunk. The government needs to take concrete steps for the welfare of the people.

Arif Habib Limited

ReplyDelete@ArifHabibLtd

Highest ever oil import bill during FY22 amid a 71% YoY jump in Arab Light prices along with 19% YoY volumetric growth.

https://twitter.com/ArifHabibLtd/status/1549436102188081153?s=20&t=T9F58BD1swNPae5vu_mvxA

---------------

Arif Habib Limited

@ArifHabibLtd

Balance of Trade FY22

Historic high trade deficit during FY22, up by 56% YoY

Exports: $ 31.79bn; +26% YoY

Imports: $ 80.18bn; +42% YoY

Trade Deficit: $ 48.38bn; +56% YoY

https://twitter.com/ArifHabibLtd/status/1549433873347579904?s=20&t=b20BZelKhp8oumsNy7N5og

-----------------

Arif Habib Limited

@ArifHabibLtd

Historic high textile exports during FY22, increased by 26% YoY to USD 19.33bn

https://twitter.com/ArifHabibLtd/status/1549430609520508931?s=20&t=q2pwBz7Am1ZetYwiNYbfCA

The ongoing global energy crisis has left countries scrambling for fuel. As wealthy buyers of liquefied natural gas (LNG) offer top dollar for every available cargo, Pakistan faces dire fuel and power shortages with little end in sight.

ReplyDeletehttps://ieefa.org/resources/ieefa-finding-right-way-forward-pakistans-energy-crisis

There will be no easy way forward. Reversing Pakistan’s dependence on imported fossil fuels by accelerating the shift to low-cost domestic renewable energy sources will be crucial for energy security and economic growth. In the meantime, Pakistan needs a coherent LNG procurement strategy that avoids locking in high prices for upcoming decades.

Ripple effects of low LNG supply

In the aftermath of Russia’s invasion of Ukraine, Europe is buying significantly more volumes of LNG to cut its dependence on Russian gas. But with almost no spare global LNG supply capacity, European buyers have pulled existing cargoes away from developing nations by offering higher prices.

Pakistan is suffering the consequences. In July, state-owned Pakistan LNG Limited (PLL) issued a tender to buy ten cargoes of LNG through September but did not receive a single bid.

This is the fourth straight tender that went unawarded. In a previous tender, PLL received only one bid from Qatar Energy at a price of US$39.80 per million British thermal unit (MMBtu). At this price, a single cargo would cost over US$131 million, but the government rejected the offer to conserve its dwindling foreign exchange reserves.

The effects have been disastrous. Power cuts are crippling household and commercial activities, while gas rationing to the textile sector has resulted in a loss of US$1 billion in export orders. Despite energy conservation efforts, many areas continue to experience load shedding of up to 14 hours, as the generation shortfall reached 8 gigawatts (GW).

LNG procurement: spot purchases vs. long-term contracts?

Some countries are shielded from extreme LNG price spikes by long-term purchase contracts. But Pakistan sources roughly half of its LNG from spot markets, increasing the country’s exposure to global price volatility.

To mitigate the situation , Pakistan has expressed openness to signing new long-term contracts, with one official claiming the country would go for an unusually long 30-year contract. The contracts will most likely be signed with Qatar and United Arab Emirates.

However, Pakistan’s experience with long-term contracts has been problematic. Term suppliers had defaulted at least 12 times over the past 11 months, most recently in July when Pakistan desperately needed fuel.

Long-term contracts—which are typically tied to a ‘slope’ or a percentage of the Brent crude oil price—are reportedly 75% more expensive than one year ago. If Pakistan signed a deal now with a 16-18% slope, and assuming current Brent crude prices of US$100, a single cargo would cost roughly US$55-61 million. At the 11-13% slope of Pakistan’s current contracts, meanwhile, a cargo would cost US$37.5-44.3 million. Although Brent crude prices will vary, it is clear that Pakistan would risk locking in higher prices by signing new long-term contracts in the current LNG environment.

Moreover, with limited global LNG supply, long-term contracts would likely not start until 2026, when significant new global supply capacity is expected online. Pakistan’s LNG needs are more immediate.

Rather than lock in high prices for the long-term, buyers in Pakistan can consider signing shorter five-year contracts with portfolio players. Industry representatives have suggested there is space in the market for shorter contracts. Although shorter terms typically come at a price premium, they may temporarily help alleviate Pakistan’s exposure to extreme spot market volatility.

The ongoing global energy crisis has left countries scrambling for fuel. As wealthy buyers of liquefied natural gas (LNG) offer top dollar for every available cargo, Pakistan faces dire fuel and power shortages with little end in sight.

ReplyDeletehttps://ieefa.org/resources/ieefa-finding-right-way-forward-pakistans-energy-crisis

Short-term contracts have to carry higher penalties in instances of non-delivery to avoid repeated supplier defaults. Coupled with the existing long-term contracts and spot purchases, short-term contracts would diversify the country’s supply portfolio, potentially allowing better price management, supply security, and flexibility.

Permanent shift away from LNG

In the longer term, cutting Pakistan’s dependence on imported fossil fuels altogether is the most affordable solution. Low-cost, domestic renewables like wind and solar can prove to be a crucial hedging mechanism against high, US dollar-denominated fossil fuel prices.

The government is beginning to recognize the unreliability and unaffordability of LNG compared to domestic renewables. Policymakers recently indicated that they would announce a new solar policy geared towards reducing LNG dependence, reducing high energy costs, and improving energy security.

Under the policy, due out August 1, 7-10 GW of residential solar systems would be deployed by the summer of 2023. In addition, the policy would allow the installation of seven utility-scale solar plants at the sites of existing thermal power plants.

This is a major step in the right direction, one that will help reduce gas and LNG demand in the power sector. We also identified other measures in a recent IEEFA report to limit LNG demand, such as reforming gas distribution company revenue regulations to reduce gas leakage, along with energy efficiency incentives.

Ultimately, there will be no one-size-fits-all solution to the current energy crisis, but a portfolio of short to long-term plans is necessary to mitigate Pakistan’s unsustainable reliance on LNG imports.

PetroChina explores #SouthAsia market, supplies first gasoil cargo to #Pakistan. A vessel loaded 324,454 barrels of #gasoil from the Jubail Refinery in #SaudiArabia on June 8 and discharged at Fauji, #Karachi in Pakistan on June 14, data from Kpler showed.http://www.spglobal.com/commodityinsights/en/market-insights/latest-news/oil/072922-petrochina-explores-south-asia-market-supplies-first-gasoil-cargo-to-pakistan

ReplyDeleteChina used to be a key gasoline supplier to Pakistan, led by PetroChina, but gasoil flows were thin as it supplied only one 40,000-mt (298,000 barrels) gasoil cargo to the South Asian country in November 2021, China's official data showed.

Pakistan was also the only destination that recorded steady growth among China's top five gasoline recipients, with flows jumping 93.8% year on year to 1.56 million mt (64,000 b/d) over the first half of 2022 despite drying up of outflows in June. According to China's official data, this made Pakistan the second-biggest destination for Chinese gasoline cargoes over the same period, behind the regional trading hub, Singapore.

----------

The company is the international trading arm of China's state-owned oil and gas giant PetroChina.

The breakthrough comes after China's suspension of oil product exports to Pakistan since late May, following the South Asian country's imposition of a 10% regulatory duty on flows effective July 1 to shut the tax-free access created by a bilateral agreement in 2019.

Earlier, gasoline imports from China were exempted from any duties under Phase-II of the China Pakistan Free Trade Agreement.

"It also suggests PetroChina's effort to develop the South Asia market by sourcing barrels outside of China when Beijing tightens oil product exports to ensure domestic supply and cut emissions," said Sun Sijia, an analyst with Platts Analytics.

Moreover, this highlights a shift in the focus of Chinese state-run oil product trading desks' business to international trades. However, they were initially built to fix outlets for Chinese oil products, trading sources said.

According to the information on the WeChat account, the cargo was shipped by the Denmark-flagged clean tanker Torm Philippines.

The vessel loaded 324,454 barrels of gasoil from the Jubail Refinery in Saudi Arabia on June 8 and was discharged at Fauji, Karachi in Pakistan on June 14, data from Kpler showed.

Beijing is keen to cut the outflow of oil products by issuing fewer export quotas to ensure domestic supplies and tackle global inflation while reducing emissions to meet the country's net-zero targets.

So far this year, China's three rounds of allocation have taken the total quota volume to 22.5 million mt for 2022, 40% lower than the 37.61 million mt awarded in the three batches of 2021, data from S&P Global Commodity Insights showed.

Pakistan's oil consumption downtrend likely to spill over to early 2023

ReplyDeletehttps://www.spglobal.com/commodityinsights/en/market-insights/latest-news/oil/010423-pakistans-oil-consumption-downtrend-likely-to-spill-over-to-early-2023

Pakistan's oil demand likely to remain soft in Q1 2023: S&P Global

Gasoline sales over July-Dec down 15% on year, diesel falls 23%

Sluggish industrial activity to keep a lid on oil products consumption

Amid oil consumption falling by 19% on the year over July-June followed by a drop in transportation fuels demand in July-September stemming from devastating floods, Pakistan saw a slower economic recovery in October-December. This exacerbated by higher oil prices owing to economic woes likely led to a contraction in oil demand in 2022 from 2021 levels, according to Shreyans Baid, a Senior South Asia oil analyst at S&P Global.

"Pakistan's oil demand is likely to remain soft at least until the first quarter of 2023 and is likely to recover in the latter part of the year. Overall, we expect the 2023 Pakistan oil demand to grow on the year, although downside risks remain," Baid said, referring to a continued slowdown in industrial activity, economic challenges, and shortage of foreign exchange reserves.

Oil sales during the first six months of the country's fiscal year were at 9.03 million mt, compared with 11.10 million mt in the same period of the previous year, data from oil marketing companies and the Oil Companies Advisory Council showed.

Yousuf Saeed, head of research at Darson Securities, said that during these months industrial activity slowed substantially, resulting in relatively lower movement of heavy transportation commercial vehicles.

Additionally, many factories were either partially or fully closed as the shortage of foreign exchange reserves was prompting the country's central bank, the State Bank of Pakistan, to be cautious in making overseas payments, restricting the ability of industries to import raw materials in time to run their operations.

The country's foreign exchange reserves held by SBP for the week ended Dec. 23, 2022, reached $5.8 billion, the lowest in almost eight and a half years, and just enough to cover five weeks of imports.

Product sales head south

Motor gasoline sales during the six-month period that ended Dec. 31, 2022, dropped 15% on the year to 3.83 million mt. At the same time, diesel and fuel oil consumption dropped 23% on the year to 3.36 million mt and 24% on the year to 1.45 million mt, respectively, according to OCAC data.

"Gasoline sales declined on account of high prices while fuel oil sales declined due to lower demand from the power sector, as authorities relied on relatively cheaper sources for electricity production during the winter season," Saeed said.

Anand Kumar, an equity research analyst at Optimus Capital Management, also held similar views, saying monthly oil consumption declined on the back of lower fuel consumption in the winter season. Diesel demand also dropped significantly as sales to the agriculture sector dropped with the ending of the crop sowing season, resulting in reduced irrigation activity.

"Oil demand is expected to remain at low levels due to the economic slowdown and an expected rise in petroleum prices, which may happen due to an anticipated rise in general sales tax or higher levies on petroleum products," he said.

"We foresee the country's oil demand for the remaining months of the fiscal year to be about 9.9 million mt, taking the overall consumption in 2022-23 to 18.9 million mt, a decline of 16.1% on a year-on-year basis," Kumar added.

On a monthly basis, motor gasoline sales in December 2022 were around 620,000 mt, down 11% from 700,000 mt of the same month in 2021, while diesel consumption fell by 15% to 520,000 mt and fuel oil by 3% to 120,000 mt over the same period, OCAC data showed.